StockNews.com began coverage on shares of TE Connectivity (NYSE:TEL - Free Report) in a research report report published on Saturday. The brokerage issued a buy rating on the electronics maker's stock.

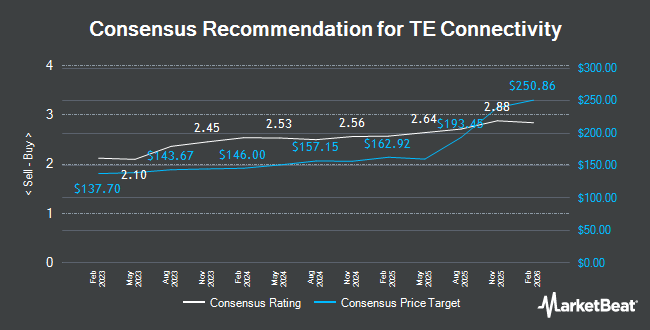

A number of other analysts have also recently commented on the company. Hsbc Global Res cut TE Connectivity from a "hold" rating to a "moderate sell" rating in a research report on Thursday, October 31st. Wolfe Research upgraded shares of TE Connectivity from a "peer perform" rating to an "outperform" rating in a report on Thursday, September 5th. Robert W. Baird lifted their price objective on shares of TE Connectivity from $162.00 to $170.00 and gave the company an "outperform" rating in a research note on Thursday, July 25th. The Goldman Sachs Group cut their price objective on shares of TE Connectivity from $189.00 to $179.00 and set a "buy" rating on the stock in a research note on Tuesday, October 1st. Finally, Vertical Research began coverage on shares of TE Connectivity in a report on Tuesday, July 23rd. They issued a "hold" rating and a $155.00 price target on the stock. One analyst has rated the stock with a sell rating, six have given a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $159.55.

Check Out Our Latest Report on TEL

TE Connectivity Stock Down 3.2 %

Shares of TEL stock traded down $4.90 during trading hours on Friday, reaching $148.35. 1,722,590 shares of the company's stock were exchanged, compared to its average volume of 1,829,200. TE Connectivity has a 1 year low of $128.52 and a 1 year high of $159.98. The company has a current ratio of 1.61, a quick ratio of 1.08 and a debt-to-equity ratio of 0.27. The stock has a market cap of $44.38 billion, a PE ratio of 14.44, a PEG ratio of 2.10 and a beta of 1.33. The stock's fifty day moving average price is $148.50 and its two-hundred day moving average price is $149.24.

TE Connectivity (NYSE:TEL - Get Free Report) last released its earnings results on Wednesday, October 30th. The electronics maker reported $1.95 earnings per share for the quarter, hitting the consensus estimate of $1.95. The company had revenue of $4.07 billion for the quarter, compared to the consensus estimate of $4 billion. TE Connectivity had a net margin of 20.15% and a return on equity of 18.48%. TE Connectivity's revenue was up .8% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.78 EPS. Research analysts predict that TE Connectivity will post 8.13 EPS for the current year.

TE Connectivity declared that its Board of Directors has initiated a share repurchase program on Wednesday, October 30th that allows the company to buyback $2.50 billion in outstanding shares. This buyback authorization allows the electronics maker to reacquire up to 5.4% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's management believes its stock is undervalued.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Versant Capital Management Inc boosted its holdings in TE Connectivity by 209.8% in the 2nd quarter. Versant Capital Management Inc now owns 189 shares of the electronics maker's stock worth $28,000 after buying an additional 128 shares during the last quarter. Olistico Wealth LLC purchased a new stake in shares of TE Connectivity during the second quarter worth approximately $30,000. Armstrong Advisory Group Inc. raised its stake in TE Connectivity by 208.3% in the 3rd quarter. Armstrong Advisory Group Inc. now owns 222 shares of the electronics maker's stock valued at $34,000 after purchasing an additional 150 shares during the last quarter. Bank & Trust Co purchased a new position in TE Connectivity in the 2nd quarter valued at $35,000. Finally, Wolff Wiese Magana LLC boosted its stake in TE Connectivity by 2,450.0% during the 3rd quarter. Wolff Wiese Magana LLC now owns 255 shares of the electronics maker's stock worth $39,000 after purchasing an additional 245 shares during the last quarter. Hedge funds and other institutional investors own 91.43% of the company's stock.

About TE Connectivity

(

Get Free Report)

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the AsiaPacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions.

See Also

Before you consider TE Connectivity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TE Connectivity wasn't on the list.

While TE Connectivity currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.