Teacher Retirement System of Texas trimmed its holdings in IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) by 30.9% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 27,037 shares of the company's stock after selling 12,099 shares during the period. Teacher Retirement System of Texas' holdings in IDEXX Laboratories were worth $11,178,000 as of its most recent filing with the Securities and Exchange Commission.

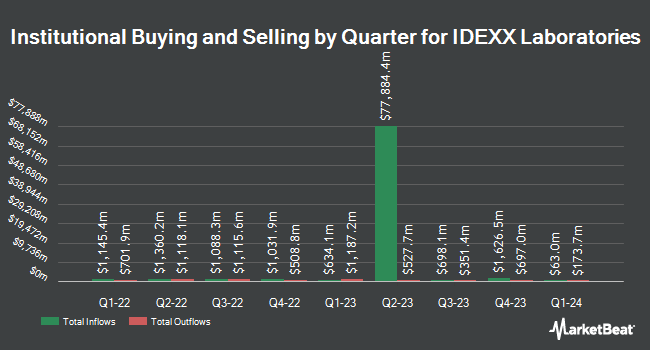

Other institutional investors have also made changes to their positions in the company. Harvest Fund Management Co. Ltd lifted its position in IDEXX Laboratories by 27.1% during the fourth quarter. Harvest Fund Management Co. Ltd now owns 4,819 shares of the company's stock worth $1,947,000 after purchasing an additional 1,028 shares during the period. Vinva Investment Management Ltd raised its position in shares of IDEXX Laboratories by 408.4% in the 4th quarter. Vinva Investment Management Ltd now owns 17,638 shares of the company's stock valued at $7,280,000 after buying an additional 14,169 shares in the last quarter. Xponance Inc. lifted its holdings in shares of IDEXX Laboratories by 22.0% during the 4th quarter. Xponance Inc. now owns 22,978 shares of the company's stock worth $9,500,000 after acquiring an additional 4,139 shares during the period. Intech Investment Management LLC boosted its position in shares of IDEXX Laboratories by 165.2% during the 4th quarter. Intech Investment Management LLC now owns 6,421 shares of the company's stock worth $2,655,000 after acquiring an additional 4,000 shares in the last quarter. Finally, Generali Asset Management SPA SGR bought a new position in IDEXX Laboratories in the fourth quarter valued at approximately $4,581,000. 87.84% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other news, EVP George Fennell sold 9,986 shares of the company's stock in a transaction on Monday, February 10th. The shares were sold at an average price of $462.53, for a total value of $4,618,824.58. Following the sale, the executive vice president now directly owns 8,176 shares of the company's stock, valued at approximately $3,781,645.28. This represents a 54.98 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, Director M Anne Szostak sold 3,000 shares of the stock in a transaction on Friday, February 7th. The stock was sold at an average price of $465.94, for a total transaction of $1,397,820.00. Following the sale, the director now owns 3,061 shares of the company's stock, valued at approximately $1,426,242.34. This trade represents a 49.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.11% of the stock is currently owned by insiders.

IDEXX Laboratories Trading Up 0.0 %

IDXX traded up $0.05 during trading on Wednesday, reaching $417.71. 760,693 shares of the company's stock were exchanged, compared to its average volume of 555,046. The company has a current ratio of 1.31, a quick ratio of 0.95 and a debt-to-equity ratio of 0.28. IDEXX Laboratories, Inc. has a one year low of $398.50 and a one year high of $548.88. The firm has a fifty day moving average price of $437.36 and a two-hundred day moving average price of $444.05. The stock has a market capitalization of $33.86 billion, a PE ratio of 39.15, a price-to-earnings-growth ratio of 3.41 and a beta of 1.39.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on the company. Morgan Stanley reduced their target price on IDEXX Laboratories from $559.00 to $550.00 and set an "overweight" rating on the stock in a report on Wednesday, January 29th. Leerink Partnrs raised IDEXX Laboratories to a "strong-buy" rating in a research note on Monday, December 2nd. StockNews.com downgraded IDEXX Laboratories from a "buy" rating to a "hold" rating in a research note on Tuesday. Bank of America raised their price target on shares of IDEXX Laboratories from $475.00 to $535.00 and gave the company a "neutral" rating in a research note on Tuesday, February 4th. Finally, Leerink Partners began coverage on shares of IDEXX Laboratories in a report on Monday, December 2nd. They set an "outperform" rating and a $500.00 price target on the stock. Four analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, IDEXX Laboratories currently has a consensus rating of "Moderate Buy" and a consensus price target of $533.75.

View Our Latest Stock Analysis on IDEXX Laboratories

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Featured Articles

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.