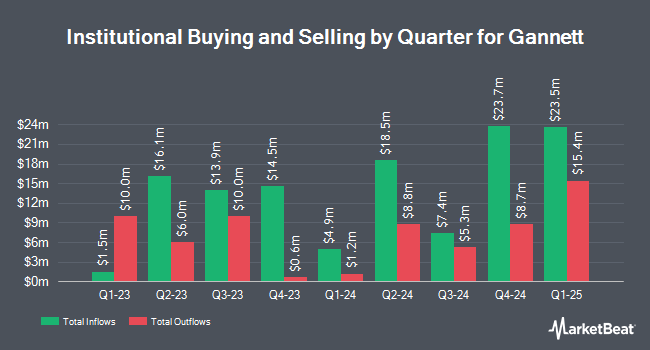

Teacher Retirement System of Texas boosted its holdings in Gannett Co., Inc. (NYSE:GCI - Free Report) by 446.8% in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 307,778 shares of the company's stock after purchasing an additional 251,496 shares during the quarter. Teacher Retirement System of Texas owned about 0.21% of Gannett worth $1,557,000 at the end of the most recent quarter.

Several other institutional investors have also recently added to or reduced their stakes in the business. Zurcher Kantonalbank Zurich Cantonalbank bought a new stake in shares of Gannett in the 3rd quarter valued at $45,000. PEAK6 Investments LLC acquired a new stake in Gannett in the third quarter worth $57,000. Ieq Capital LLC bought a new stake in Gannett in the fourth quarter valued at $54,000. Xponance Inc. acquired a new position in shares of Gannett during the fourth quarter valued at about $56,000. Finally, Paloma Partners Management Co bought a new position in shares of Gannett during the 3rd quarter worth about $66,000. 76.71% of the stock is owned by institutional investors and hedge funds.

Gannett Stock Up 7.6 %

NYSE GCI traded up $0.23 during mid-day trading on Wednesday, hitting $3.25. The company's stock had a trading volume of 1,605,389 shares, compared to its average volume of 1,366,715. The company has a current ratio of 0.78, a quick ratio of 0.74 and a debt-to-equity ratio of 6.59. The company's 50 day simple moving average is $3.94 and its 200 day simple moving average is $4.81. Gannett Co., Inc. has a twelve month low of $2.24 and a twelve month high of $5.93. The firm has a market capitalization of $478.95 million, a price-to-earnings ratio of -6.02 and a beta of 2.21.

Gannett (NYSE:GCI - Get Free Report) last posted its earnings results on Thursday, February 20th. The company reported $0.07 EPS for the quarter, topping the consensus estimate of ($0.03) by $0.10. Gannett had a negative net margin of 1.05% and a positive return on equity of 11.40%. The company had revenue of $621.28 million during the quarter, compared to the consensus estimate of $635.09 million.

Wall Street Analysts Forecast Growth

Separately, JMP Securities reaffirmed a "market outperform" rating and issued a $6.00 target price on shares of Gannett in a research report on Monday, January 27th.

Read Our Latest Stock Analysis on Gannett

Gannett Profile

(

Free Report)

Gannett Co, Inc operates as a media and marketing solutions company in the United States. It operates through three segments: Domestic Gannett Media, Newsquest, and Digital Marketing Solutions. The company's print offerings includes home delivery on a subscription basis; single copy; non-daily publications, such as shoppers and niche publications.

Read More

Before you consider Gannett, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gannett wasn't on the list.

While Gannett currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.