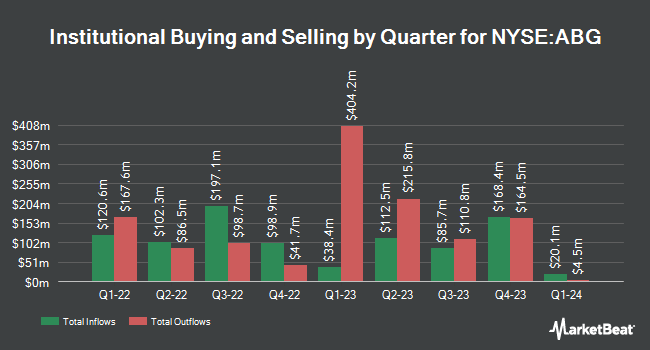

Teacher Retirement System of Texas purchased a new stake in shares of Asbury Automotive Group, Inc. (NYSE:ABG - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The firm purchased 8,370 shares of the company's stock, valued at approximately $2,034,000.

Other hedge funds and other institutional investors also recently modified their holdings of the company. Madison Investment Advisors LLC purchased a new stake in Asbury Automotive Group in the fourth quarter valued at approximately $82,426,000. Rockefeller Capital Management L.P. purchased a new stake in shares of Asbury Automotive Group during the 3rd quarter valued at $14,219,000. Proficio Capital Partners LLC purchased a new stake in shares of Asbury Automotive Group during the 4th quarter valued at $5,316,000. Stifel Financial Corp lifted its holdings in shares of Asbury Automotive Group by 1,990.9% during the 3rd quarter. Stifel Financial Corp now owns 19,926 shares of the company's stock worth $4,754,000 after acquiring an additional 18,973 shares during the last quarter. Finally, Barclays PLC grew its position in Asbury Automotive Group by 94.9% in the third quarter. Barclays PLC now owns 38,644 shares of the company's stock worth $9,220,000 after acquiring an additional 18,821 shares in the last quarter.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on the company. Stephens raised their price target on Asbury Automotive Group from $220.00 to $260.00 and gave the company an "equal weight" rating in a research report on Tuesday, February 11th. JPMorgan Chase & Co. decreased their price objective on Asbury Automotive Group from $290.00 to $250.00 and set a "neutral" rating on the stock in a report on Thursday. Finally, Craig Hallum downgraded Asbury Automotive Group from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, February 18th. Six research analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $263.00.

Get Our Latest Analysis on ABG

Asbury Automotive Group Trading Up 1.2 %

Shares of ABG traded up $2.61 during trading hours on Monday, hitting $220.78. The company had a trading volume of 522,575 shares, compared to its average volume of 191,030. Asbury Automotive Group, Inc. has a 52-week low of $206.62 and a 52-week high of $312.56. The company has a quick ratio of 0.41, a current ratio of 1.20 and a debt-to-equity ratio of 0.98. The stock's 50 day moving average price is $265.96 and its 200 day moving average price is $250.86. The firm has a market cap of $4.34 billion, a P/E ratio of 10.26 and a beta of 1.22.

Insiders Place Their Bets

In other news, COO Daniel Clara sold 1,217 shares of the firm's stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $296.64, for a total value of $361,010.88. Following the transaction, the chief operating officer now owns 3,747 shares in the company, valued at approximately $1,111,510.08. This trade represents a 24.52 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.53% of the company's stock.

Asbury Automotive Group Company Profile

(

Free Report)

Asbury Automotive Group, Inc, together with its subsidiaries, operates as an automotive retailer in the United States. It offers a range of automotive products and services, including new and used vehicles; and vehicle repair and maintenance services, replacement parts, and collision repair services.

Read More

Before you consider Asbury Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asbury Automotive Group wasn't on the list.

While Asbury Automotive Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.