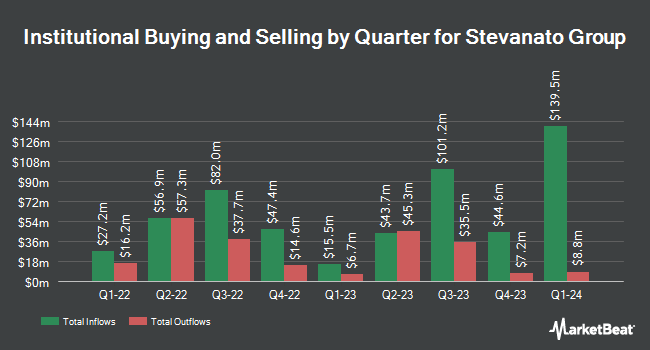

Teacher Retirement System of Texas increased its position in Stevanato Group S.p.A. (NYSE:STVN - Free Report) by 56.3% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,250,000 shares of the company's stock after acquiring an additional 450,000 shares during the period. Teacher Retirement System of Texas owned approximately 0.41% of Stevanato Group worth $27,238,000 as of its most recent SEC filing.

Several other hedge funds have also recently bought and sold shares of the company. Hardy Reed LLC boosted its position in Stevanato Group by 8.2% during the third quarter. Hardy Reed LLC now owns 11,077 shares of the company's stock worth $222,000 after purchasing an additional 840 shares in the last quarter. First Bank & Trust raised its stake in shares of Stevanato Group by 7.3% during the 4th quarter. First Bank & Trust now owns 15,145 shares of the company's stock worth $330,000 after buying an additional 1,036 shares during the last quarter. Truist Financial Corp boosted its position in shares of Stevanato Group by 4.2% in the 4th quarter. Truist Financial Corp now owns 26,900 shares of the company's stock worth $586,000 after buying an additional 1,073 shares in the last quarter. Oppenheimer Asset Management Inc. grew its position in shares of Stevanato Group by 9.7% in the fourth quarter. Oppenheimer Asset Management Inc. now owns 12,874 shares of the company's stock valued at $281,000 after purchasing an additional 1,141 shares during the last quarter. Finally, US Bancorp DE grew its holdings in Stevanato Group by 17.9% during the 4th quarter. US Bancorp DE now owns 8,527 shares of the company's stock valued at $186,000 after buying an additional 1,295 shares during the last quarter.

Stevanato Group Trading Down 0.5 %

Stevanato Group stock traded down €0.11 ($0.12) during midday trading on Wednesday, reaching €21.00 ($22.58). The stock had a trading volume of 448,070 shares, compared to its average volume of 349,422. The stock's 50-day simple moving average is €21.03 and its 200 day simple moving average is €20.59. Stevanato Group S.p.A. has a twelve month low of €16.56 ($17.81) and a twelve month high of €33.49 ($36.01). The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.21 and a current ratio of 1.81. The stock has a market capitalization of $6.36 billion, a PE ratio of 44.68, a price-to-earnings-growth ratio of 7.18 and a beta of 0.60.

Stevanato Group (NYSE:STVN - Get Free Report) last issued its earnings results on Thursday, March 6th. The company reported €0.20 ($0.22) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of €0.20 ($0.22). The business had revenue of €352.68 million during the quarter, compared to analysts' expectations of €346.26 million. Stevanato Group had a return on equity of 9.86% and a net margin of 10.47%. Analysts expect that Stevanato Group S.p.A. will post 0.5 EPS for the current year.

Wall Street Analysts Forecast Growth

STVN has been the subject of a number of recent research reports. Bank of America lifted their price objective on Stevanato Group from $24.00 to $26.00 and gave the stock a "buy" rating in a research report on Friday, December 13th. Morgan Stanley reissued an "equal weight" rating and set a $23.00 price target (down previously from $24.00) on shares of Stevanato Group in a research note on Tuesday, December 3rd. Wolfe Research assumed coverage on Stevanato Group in a research report on Friday, December 13th. They issued an "outperform" rating and a $28.00 price objective for the company. William Blair reiterated an "outperform" rating on shares of Stevanato Group in a research report on Friday, March 7th. Finally, UBS Group decreased their price target on Stevanato Group from $24.00 to $23.50 and set a "neutral" rating on the stock in a research note on Friday, March 7th. Two research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of €25.70 ($27.63).

Get Our Latest Research Report on Stevanato Group

Stevanato Group Company Profile

(

Free Report)

Stevanato Group S.p.A. engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific. The company operates in two segments, Biopharmaceutical and Diagnostic Solutions; and Engineering.

Featured Articles

Before you consider Stevanato Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stevanato Group wasn't on the list.

While Stevanato Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.