Teachers Retirement System of The State of Kentucky lowered its position in shares of Stellantis (NYSE:STLA - Free Report) by 41.5% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 409,000 shares of the company's stock after selling 289,900 shares during the quarter. Teachers Retirement System of The State of Kentucky's holdings in Stellantis were worth $5,746,000 as of its most recent SEC filing.

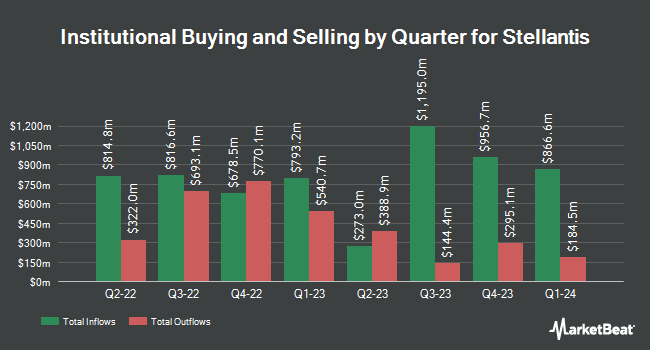

A number of other hedge funds have also modified their holdings of the company. Mediolanum International Funds Ltd lifted its stake in shares of Stellantis by 17.4% during the 3rd quarter. Mediolanum International Funds Ltd now owns 670,893 shares of the company's stock valued at $9,426,000 after buying an additional 99,388 shares in the last quarter. FMR LLC lifted its position in shares of Stellantis by 4.9% in the third quarter. FMR LLC now owns 3,137,594 shares of the company's stock valued at $44,083,000 after acquiring an additional 145,583 shares in the last quarter. Sound Income Strategies LLC lifted its position in shares of Stellantis by 47.1% in the third quarter. Sound Income Strategies LLC now owns 280,010 shares of the company's stock valued at $3,934,000 after acquiring an additional 89,594 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of Stellantis by 10.8% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,980,732 shares of the company's stock worth $27,429,000 after acquiring an additional 193,653 shares during the period. Finally, AM Squared Ltd purchased a new stake in shares of Stellantis during the third quarter worth about $641,000. 59.48% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on STLA. Barclays downgraded Stellantis from an "overweight" rating to an "equal weight" rating in a research note on Thursday, October 3rd. Royal Bank of Canada reiterated a "sector perform" rating on shares of Stellantis in a research note on Friday, October 4th. Wolfe Research restated a "peer perform" rating on shares of Stellantis in a research report on Thursday, September 5th. Finally, Evercore ISI assumed coverage on Stellantis in a research report on Monday, November 11th. They issued an "inline" rating on the stock. Eight analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $27.34.

View Our Latest Analysis on Stellantis

Stellantis Stock Up 1.7 %

NYSE STLA traded up $0.23 during trading hours on Friday, hitting $13.94. 9,557,028 shares of the company were exchanged, compared to its average volume of 7,201,572. The company has a current ratio of 1.14, a quick ratio of 0.85 and a debt-to-equity ratio of 0.26. The stock has a 50-day moving average price of $13.30 and a 200 day moving average price of $16.33. Stellantis has a 52 week low of $12.12 and a 52 week high of $29.51.

Stellantis Company Profile

(

Free Report)

Stellantis N.V. engages in the design, engineering, manufacturing, distribution, and sale of automobiles and light commercial vehicles, engines, transmission systems, metallurgical products, mobility services, and production systems worldwide. It provides luxury and premium vehicles; sport utility vehicles; American and European brand vehicles; and parts and services, as well as retail and dealer financing, leasing, and rental services.

Recommended Stories

Before you consider Stellantis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stellantis wasn't on the list.

While Stellantis currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.