Teachers Retirement System of The State of Kentucky cut its position in shares of The Goodyear Tire & Rubber Company (NASDAQ:GT - Free Report) by 56.9% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 96,548 shares of the company's stock after selling 127,610 shares during the period. Teachers Retirement System of The State of Kentucky's holdings in Goodyear Tire & Rubber were worth $855,000 at the end of the most recent quarter.

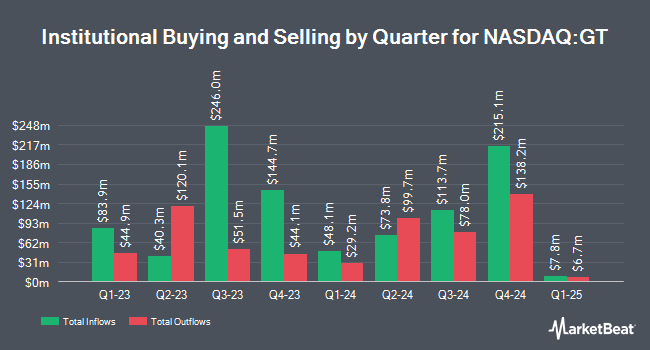

Several other hedge funds also recently added to or reduced their stakes in the company. Bank of New York Mellon Corp lifted its position in shares of Goodyear Tire & Rubber by 2.7% during the second quarter. Bank of New York Mellon Corp now owns 2,715,149 shares of the company's stock worth $30,817,000 after purchasing an additional 71,410 shares during the last quarter. Edgestream Partners L.P. lifted its holdings in Goodyear Tire & Rubber by 1,011.8% during the 2nd quarter. Edgestream Partners L.P. now owns 634,077 shares of the company's stock valued at $7,197,000 after buying an additional 577,045 shares in the last quarter. FMR LLC boosted its position in Goodyear Tire & Rubber by 28.1% in the 3rd quarter. FMR LLC now owns 842,822 shares of the company's stock valued at $7,459,000 after buying an additional 184,770 shares during the period. SG Americas Securities LLC grew its stake in Goodyear Tire & Rubber by 1,843.6% in the 3rd quarter. SG Americas Securities LLC now owns 474,980 shares of the company's stock worth $4,204,000 after acquiring an additional 450,542 shares in the last quarter. Finally, Hsbc Holdings PLC increased its position in shares of Goodyear Tire & Rubber by 196.8% during the second quarter. Hsbc Holdings PLC now owns 335,967 shares of the company's stock worth $3,768,000 after acquiring an additional 222,767 shares during the period. 84.19% of the stock is currently owned by institutional investors.

Goodyear Tire & Rubber Stock Down 3.0 %

NASDAQ GT traded down $0.27 during midday trading on Thursday, hitting $8.59. 6,590,207 shares of the company traded hands, compared to its average volume of 4,319,455. The Goodyear Tire & Rubber Company has a 52 week low of $7.27 and a 52 week high of $14.97. The company's 50-day simple moving average is $9.32 and its 200-day simple moving average is $9.66. The company has a market cap of $2.45 billion, a PE ratio of -8.26 and a beta of 1.77. The company has a debt-to-equity ratio of 1.51, a current ratio of 1.14 and a quick ratio of 0.65.

Goodyear Tire & Rubber (NASDAQ:GT - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The company reported $0.37 earnings per share for the quarter, beating analysts' consensus estimates of $0.25 by $0.12. The company had revenue of $4.82 billion for the quarter, compared to the consensus estimate of $4.96 billion. Goodyear Tire & Rubber had a positive return on equity of 6.66% and a negative net margin of 1.56%. The firm's revenue for the quarter was down 6.2% compared to the same quarter last year. During the same quarter last year, the company earned $0.36 earnings per share. As a group, equities research analysts forecast that The Goodyear Tire & Rubber Company will post 1.09 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities analysts have recently commented on GT shares. Wolfe Research lowered Goodyear Tire & Rubber from an "outperform" rating to a "peer perform" rating in a research note on Thursday, September 5th. StockNews.com downgraded shares of Goodyear Tire & Rubber from a "buy" rating to a "hold" rating in a research report on Wednesday, November 13th.

Read Our Latest Research Report on Goodyear Tire & Rubber

Goodyear Tire & Rubber Profile

(

Free Report)

The Goodyear Tire & Rubber Company, together with its subsidiaries, develops, manufactures, distributes, and sells tires and related products and services worldwide. It offers various lines of rubber tires for automobiles, trucks, buses, aircraft, motorcycles, earthmoving and mining equipment, farm implements, industrial equipment, and other applications under the Goodyear, Cooper, Dunlop, Kelly, Mastercraft, Roadmaster, Debica, Sava, Fulda, Mickey Thompson, Avon, and Remington brands and various house brands, as well as under the private-label brands.

Further Reading

Before you consider Goodyear Tire & Rubber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goodyear Tire & Rubber wasn't on the list.

While Goodyear Tire & Rubber currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.