Teachers Retirement System of The State of Kentucky reduced its stake in Honeywell International Inc. (NASDAQ:HON - Free Report) by 6.7% in the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 49,241 shares of the conglomerate's stock after selling 3,551 shares during the quarter. Teachers Retirement System of The State of Kentucky's holdings in Honeywell International were worth $10,179,000 at the end of the most recent reporting period.

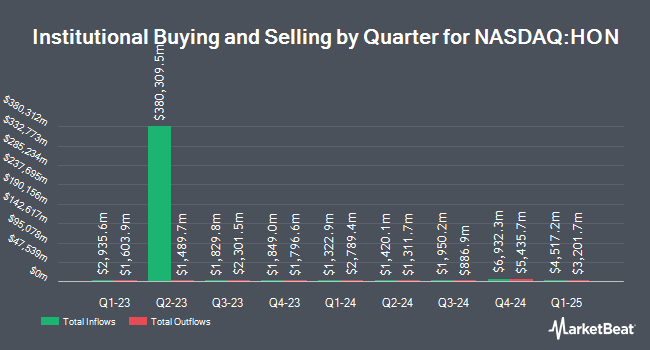

A number of other large investors also recently modified their holdings of HON. Capital Wealth Planning LLC acquired a new position in shares of Honeywell International during the second quarter worth approximately $392,478,000. Wellington Management Group LLP lifted its holdings in shares of Honeywell International by 8.4% during the third quarter. Wellington Management Group LLP now owns 17,826,700 shares of the conglomerate's stock worth $3,684,957,000 after buying an additional 1,376,479 shares during the last quarter. International Assets Investment Management LLC increased its position in shares of Honeywell International by 24,683.3% during the third quarter. International Assets Investment Management LLC now owns 948,704 shares of the conglomerate's stock valued at $1,961,070,000 after purchasing an additional 944,876 shares during the period. Mizuho Securities USA LLC increased its position in shares of Honeywell International by 1,147.0% during the third quarter. Mizuho Securities USA LLC now owns 626,071 shares of the conglomerate's stock valued at $129,415,000 after purchasing an additional 575,865 shares during the period. Finally, Geode Capital Management LLC increased its position in shares of Honeywell International by 4.0% during the third quarter. Geode Capital Management LLC now owns 14,360,730 shares of the conglomerate's stock valued at $2,959,535,000 after purchasing an additional 547,998 shares during the period. 75.91% of the stock is currently owned by institutional investors and hedge funds.

Honeywell International Price Performance

Shares of HON stock traded down $1.37 during trading hours on Thursday, hitting $227.69. 2,715,567 shares of the company's stock were exchanged, compared to its average volume of 3,143,331. The stock's 50-day moving average is $220.08 and its 200-day moving average is $211.36. The company has a debt-to-equity ratio of 1.44, a current ratio of 1.44 and a quick ratio of 1.12. The stock has a market cap of $148.05 billion, a price-to-earnings ratio of 26.49, a price-to-earnings-growth ratio of 2.82 and a beta of 1.05. Honeywell International Inc. has a 52 week low of $189.66 and a 52 week high of $242.77.

Honeywell International Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, December 6th. Stockholders of record on Friday, November 15th were issued a dividend of $1.13 per share. This represents a $4.52 annualized dividend and a dividend yield of 1.99%. The ex-dividend date was Friday, November 15th. This is a boost from Honeywell International's previous quarterly dividend of $1.08. Honeywell International's dividend payout ratio is presently 52.19%.

Analyst Upgrades and Downgrades

HON has been the topic of a number of research reports. Wolfe Research cut Honeywell International from an "outperform" rating to a "peer perform" rating in a research report on Monday, October 28th. Baird R W cut Honeywell International from a "strong-buy" rating to a "hold" rating in a research report on Friday, October 25th. StockNews.com cut Honeywell International from a "buy" rating to a "hold" rating in a research report on Monday. Morgan Stanley initiated coverage on Honeywell International in a research report on Friday, September 6th. They set an "equal weight" rating and a $210.00 price objective on the stock. Finally, Bank of America boosted their price objective on Honeywell International from $220.00 to $240.00 and gave the company a "neutral" rating in a research report on Thursday, November 14th. Ten investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $248.77.

Read Our Latest Analysis on HON

Honeywell International Company Profile

(

Free Report)

Honeywell International Inc engages in the aerospace technologies, building automation, energy and sustainable solutions, and industrial automation businesses in the United States, Europe, and internationally. The company's Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; and thermal systems, as well as wireless connectivity services.

Featured Articles

Before you consider Honeywell International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honeywell International wasn't on the list.

While Honeywell International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.