Teachers Retirement System of The State of Kentucky raised its stake in ePlus inc. (NASDAQ:PLUS - Free Report) by 198.3% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 26,072 shares of the software maker's stock after purchasing an additional 17,332 shares during the period. Teachers Retirement System of The State of Kentucky owned approximately 0.10% of ePlus worth $2,563,000 as of its most recent SEC filing.

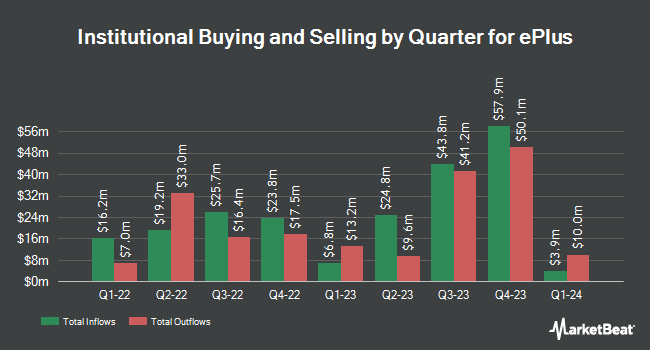

A number of other institutional investors have also added to or reduced their stakes in PLUS. Quest Partners LLC lifted its holdings in shares of ePlus by 175.7% during the 2nd quarter. Quest Partners LLC now owns 10,902 shares of the software maker's stock worth $803,000 after acquiring an additional 6,948 shares during the period. WCM Investment Management LLC lifted its stake in ePlus by 3.3% during the third quarter. WCM Investment Management LLC now owns 479,731 shares of the software maker's stock worth $47,407,000 after purchasing an additional 15,294 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in ePlus by 1.8% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 60,467 shares of the software maker's stock valued at $5,946,000 after purchasing an additional 1,078 shares in the last quarter. Argent Capital Management LLC grew its stake in shares of ePlus by 60.9% in the 2nd quarter. Argent Capital Management LLC now owns 12,683 shares of the software maker's stock valued at $934,000 after purchasing an additional 4,802 shares during the period. Finally, Millennium Management LLC raised its holdings in shares of ePlus by 4,036.0% in the 2nd quarter. Millennium Management LLC now owns 251,430 shares of the software maker's stock worth $18,525,000 after buying an additional 245,351 shares in the last quarter. 93.80% of the stock is owned by institutional investors and hedge funds.

ePlus Price Performance

PLUS stock traded up $0.92 during trading on Monday, hitting $78.06. 190,269 shares of the stock traded hands, compared to its average volume of 187,237. The stock has a market cap of $2.09 billion, a price-to-earnings ratio of 19.14, a P/E/G ratio of 1.82 and a beta of 1.08. ePlus inc. has a one year low of $56.33 and a one year high of $106.98. The company has a current ratio of 1.85, a quick ratio of 1.71 and a debt-to-equity ratio of 0.01. The company has a 50 day simple moving average of $89.31 and a 200 day simple moving average of $86.41.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered ePlus from a "buy" rating to a "hold" rating in a research note on Friday, November 15th.

Check Out Our Latest Stock Report on ePlus

About ePlus

(

Free Report)

ePlus inc., together with its subsidiaries, provides information technology (IT) solutions that enable organizations to optimize their IT environment and supply chain processes in the United States and internationally. It operates through two segments, Technology and Financing. The Technology segment offers hardware, perpetual and subscription software, maintenance, software assurance, and internally provided and outsourced services; managed services or infrastructure and cloud; and enhanced maintenance support, service desk, storage-as-a-service, cloud hosted and managed, and managed security services; and professional, staff augmentation, cloud consulting, consulting, and security services.

See Also

Before you consider ePlus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ePlus wasn't on the list.

While ePlus currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.