Teachers Retirement System of The State of Kentucky boosted its position in shares of Wayfair Inc. (NYSE:W - Free Report) by 16.5% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 147,436 shares of the company's stock after purchasing an additional 20,884 shares during the period. Teachers Retirement System of The State of Kentucky owned about 0.12% of Wayfair worth $8,283,000 at the end of the most recent reporting period.

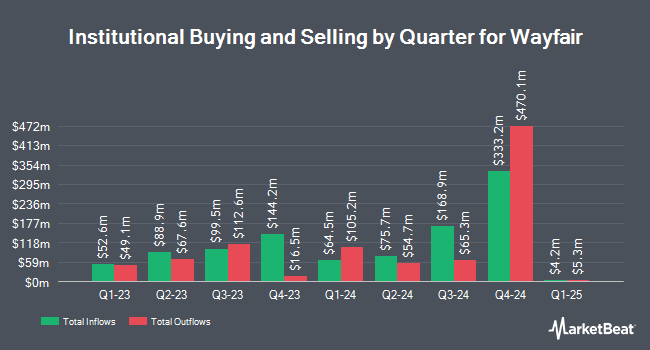

Several other hedge funds and other institutional investors have also recently modified their holdings of W. Capital Performance Advisors LLP acquired a new position in Wayfair during the third quarter worth $29,000. Point72 Asia Singapore Pte. Ltd. acquired a new position in shares of Wayfair during the 3rd quarter worth about $44,000. Brooklyn Investment Group acquired a new position in shares of Wayfair during the 3rd quarter worth about $50,000. International Assets Investment Management LLC bought a new position in shares of Wayfair in the 2nd quarter valued at about $58,000. Finally, Northwest & Ethical Investments L.P. acquired a new position in Wayfair during the third quarter valued at approximately $67,000. Institutional investors and hedge funds own 89.67% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on the company. Needham & Company LLC restated a "buy" rating and issued a $60.00 price objective on shares of Wayfair in a research note on Friday, November 1st. Truist Financial reduced their price target on shares of Wayfair from $60.00 to $55.00 and set a "buy" rating on the stock in a research report on Monday, November 4th. Mizuho decreased their target price on Wayfair from $65.00 to $60.00 and set an "outperform" rating on the stock in a research report on Monday, November 4th. Royal Bank of Canada lowered their price target on shares of Wayfair from $53.00 to $50.00 and set a "sector perform" rating for the company in a report on Monday, November 4th. Finally, Loop Capital lifted their price target on Wayfair from $45.00 to $55.00 and gave the company a "hold" rating in a research note on Thursday, September 26th. One research analyst has rated the stock with a sell rating, twelve have assigned a hold rating, thirteen have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Wayfair currently has a consensus rating of "Moderate Buy" and an average price target of $60.28.

Check Out Our Latest Report on W

Wayfair Stock Performance

Shares of W stock traded down $0.97 during trading hours on Friday, hitting $52.29. 4,029,212 shares of the company were exchanged, compared to its average volume of 4,413,043. Wayfair Inc. has a fifty-two week low of $37.35 and a fifty-two week high of $76.18. The company has a 50 day simple moving average of $47.00 and a two-hundred day simple moving average of $49.12. The firm has a market cap of $6.55 billion, a P/E ratio of -11.65 and a beta of 3.44.

Wayfair (NYSE:W - Get Free Report) last issued its earnings results on Friday, November 1st. The company reported $0.22 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.13 by $0.09. The company had revenue of $2.88 billion for the quarter, compared to the consensus estimate of $2.87 billion. During the same period in the prior year, the company earned ($1.38) earnings per share. The firm's revenue was down 2.0% compared to the same quarter last year. As a group, sell-side analysts expect that Wayfair Inc. will post -2.91 EPS for the current fiscal year.

Insider Activity at Wayfair

In other Wayfair news, COO Thomas Netzer sold 1,011 shares of the firm's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $49.42, for a total value of $49,963.62. Following the transaction, the chief operating officer now directly owns 151,802 shares of the company's stock, valued at approximately $7,502,054.84. This trade represents a 0.66 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Jon Blotner sold 4,600 shares of the business's stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $53.60, for a total transaction of $246,560.00. Following the sale, the insider now directly owns 52,078 shares of the company's stock, valued at approximately $2,791,380.80. The trade was a 8.12 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 97,868 shares of company stock valued at $4,866,748 in the last three months. Corporate insiders own 26.81% of the company's stock.

Wayfair Company Profile

(

Free Report)

Wayfair Inc provides e-commerce business in the United States and internationally. The company offers approximately thirty million products for the home sector. It offers online selections of furniture, décor, housewares, and home improvement products through its sites consisting of Wayfair, Joss & Main, AllModern, Birch Lane, Perigold, and Wayfair Professional.

See Also

Before you consider Wayfair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wayfair wasn't on the list.

While Wayfair currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.