GSA Capital Partners LLP trimmed its holdings in TechnipFMC plc (NYSE:FTI - Free Report) by 72.9% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 16,041 shares of the oil and gas company's stock after selling 43,070 shares during the quarter. GSA Capital Partners LLP's holdings in TechnipFMC were worth $421,000 as of its most recent filing with the Securities and Exchange Commission.

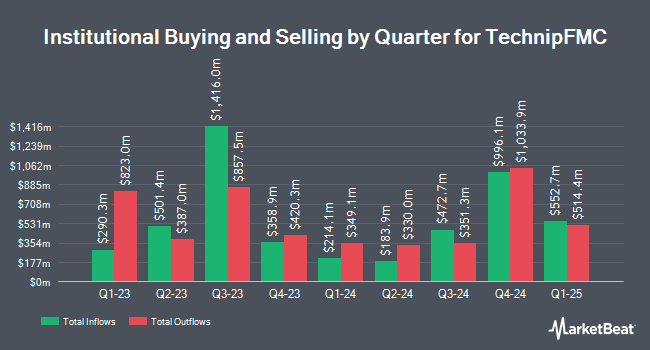

Several other large investors also recently made changes to their positions in the business. Price T Rowe Associates Inc. MD grew its holdings in shares of TechnipFMC by 8.7% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 40,594,774 shares of the oil and gas company's stock worth $1,019,337,000 after acquiring an additional 3,259,348 shares during the last quarter. Anomaly Capital Management LP increased its stake in TechnipFMC by 50.3% in the 2nd quarter. Anomaly Capital Management LP now owns 3,419,833 shares of the oil and gas company's stock worth $89,429,000 after purchasing an additional 1,144,087 shares in the last quarter. Hardman Johnston Global Advisors LLC raised its holdings in TechnipFMC by 13.5% during the 3rd quarter. Hardman Johnston Global Advisors LLC now owns 9,015,711 shares of the oil and gas company's stock worth $236,482,000 after buying an additional 1,071,103 shares during the period. AQR Capital Management LLC lifted its stake in TechnipFMC by 391.5% during the second quarter. AQR Capital Management LLC now owns 1,036,797 shares of the oil and gas company's stock valued at $27,112,000 after buying an additional 825,842 shares in the last quarter. Finally, Yaupon Capital Management LP boosted its holdings in shares of TechnipFMC by 4,931.0% in the first quarter. Yaupon Capital Management LP now owns 805,305 shares of the oil and gas company's stock worth $20,221,000 after buying an additional 789,298 shares during the period. Institutional investors own 96.58% of the company's stock.

TechnipFMC Stock Performance

Shares of FTI opened at $29.02 on Thursday. The firm has a market cap of $12.35 billion, a price-to-earnings ratio of 19.09 and a beta of 1.51. The company's fifty day moving average is $26.84 and its 200-day moving average is $26.42. The company has a quick ratio of 0.89, a current ratio of 1.14 and a debt-to-equity ratio of 0.22. TechnipFMC plc has a 12 month low of $18.33 and a 12 month high of $29.85.

TechnipFMC (NYSE:FTI - Get Free Report) last posted its earnings results on Thursday, October 24th. The oil and gas company reported $0.64 earnings per share for the quarter, beating the consensus estimate of $0.39 by $0.25. The company had revenue of $2.35 billion for the quarter, compared to analyst estimates of $2.35 billion. TechnipFMC had a return on equity of 20.11% and a net margin of 7.63%. The business's revenue was up 14.2% compared to the same quarter last year. During the same period last year, the company earned $0.21 earnings per share. Equities analysts expect that TechnipFMC plc will post 1.55 EPS for the current fiscal year.

TechnipFMC announced that its board has initiated a stock buyback program on Wednesday, October 23rd that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the oil and gas company to repurchase up to 9.2% of its shares through open market purchases. Shares buyback programs are often an indication that the company's management believes its shares are undervalued.

TechnipFMC Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Shareholders of record on Tuesday, November 19th will be issued a dividend of $0.05 per share. The ex-dividend date is Tuesday, November 19th. This represents a $0.20 annualized dividend and a yield of 0.69%. TechnipFMC's dividend payout ratio (DPR) is presently 13.16%.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on the stock. Royal Bank of Canada assumed coverage on shares of TechnipFMC in a research report on Monday. They issued an "outperform" rating and a $37.00 price target for the company. StockNews.com raised TechnipFMC from a "hold" rating to a "buy" rating in a research report on Friday, November 1st. TD Cowen upped their price target on TechnipFMC from $35.00 to $37.00 and gave the company a "buy" rating in a research report on Friday, October 25th. Bank of America raised their price objective on TechnipFMC from $30.00 to $31.00 and gave the stock a "buy" rating in a research report on Monday, October 14th. Finally, BMO Capital Markets lifted their target price on TechnipFMC from $32.00 to $33.00 and gave the company a "market perform" rating in a research note on Thursday, October 10th. One research analyst has rated the stock with a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Buy" and a consensus price target of $33.91.

Get Our Latest Stock Analysis on FTI

TechnipFMC Profile

(

Free Report)

TechnipFMC plc engages in the energy projects, technologies, and systems and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally. It operates through two segments: Subsea and Surface Technologies. The Subsea segment engages in the design, engineering, procurement, manufacturing, fabrication, installation, and life of field services for subsea systems, subsea field infrastructure, and subsea pipe systems used in oil and gas production and transportation.

Recommended Stories

Before you consider TechnipFMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechnipFMC wasn't on the list.

While TechnipFMC currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.