Healthcare of Ontario Pension Plan Trust Fund reduced its holdings in Teck Resources Limited (NYSE:TECK - Free Report) TSE: TECK by 49.7% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 13,526 shares of the basic materials company's stock after selling 13,356 shares during the quarter. Healthcare of Ontario Pension Plan Trust Fund's holdings in Teck Resources were worth $707,000 as of its most recent filing with the SEC.

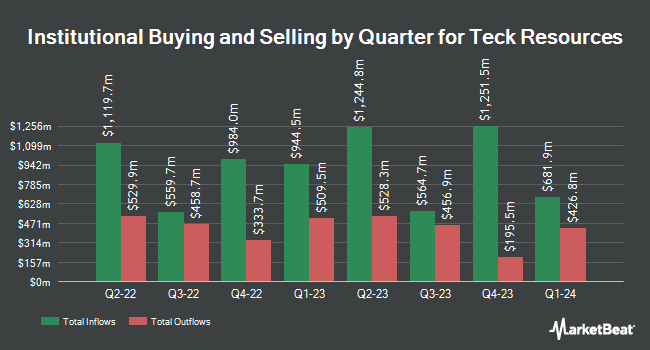

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Headlands Technologies LLC bought a new stake in shares of Teck Resources in the 2nd quarter worth approximately $38,000. Eastern Bank bought a new position in Teck Resources during the third quarter worth about $39,000. Bruce G. Allen Investments LLC lifted its stake in Teck Resources by 77.4% during the third quarter. Bruce G. Allen Investments LLC now owns 878 shares of the basic materials company's stock worth $46,000 after purchasing an additional 383 shares during the period. Blue Trust Inc. grew its stake in shares of Teck Resources by 583.1% in the 2nd quarter. Blue Trust Inc. now owns 1,052 shares of the basic materials company's stock valued at $48,000 after purchasing an additional 898 shares during the period. Finally, Massmutual Trust Co. FSB ADV lifted its position in shares of Teck Resources by 69.7% during the 3rd quarter. Massmutual Trust Co. FSB ADV now owns 996 shares of the basic materials company's stock worth $52,000 after buying an additional 409 shares during the period. Institutional investors and hedge funds own 78.06% of the company's stock.

Teck Resources Stock Down 0.0 %

TECK traded down $0.01 on Tuesday, hitting $46.12. 3,551,182 shares of the company were exchanged, compared to its average volume of 3,357,822. The company has a debt-to-equity ratio of 0.16, a quick ratio of 2.35 and a current ratio of 2.92. The stock's fifty day moving average is $48.71 and its 200-day moving average is $48.34. The company has a market cap of $23.63 billion, a PE ratio of 69.85 and a beta of 1.03. Teck Resources Limited has a 12 month low of $36.50 and a 12 month high of $55.13.

Teck Resources (NYSE:TECK - Get Free Report) TSE: TECK last issued its earnings results on Thursday, October 24th. The basic materials company reported $0.60 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.36 by $0.24. Teck Resources had a net margin of 3.32% and a return on equity of 6.37%. The company had revenue of $2.86 billion for the quarter, compared to analysts' expectations of $2.09 billion. During the same period in the prior year, the firm earned $0.57 EPS. Teck Resources's quarterly revenue was down 20.6% compared to the same quarter last year. Equities research analysts predict that Teck Resources Limited will post 1.82 EPS for the current fiscal year.

Teck Resources Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be paid a dividend of $0.0895 per share. This represents a $0.36 dividend on an annualized basis and a dividend yield of 0.78%. The ex-dividend date is Friday, December 13th. Teck Resources's dividend payout ratio is presently 56.06%.

Analyst Upgrades and Downgrades

TECK has been the topic of a number of analyst reports. Citigroup upgraded Teck Resources to a "hold" rating in a research note on Wednesday, October 2nd. Deutsche Bank Aktiengesellschaft downgraded shares of Teck Resources from a "buy" rating to a "hold" rating and set a $50.00 target price on the stock. in a research report on Friday, October 25th. UBS Group cut shares of Teck Resources from a "buy" rating to a "neutral" rating in a report on Monday, November 11th. StockNews.com upgraded Teck Resources from a "sell" rating to a "hold" rating in a report on Thursday, October 24th. Finally, Scotiabank lifted their price target on shares of Teck Resources from $78.00 to $79.00 and gave the company a "sector outperform" rating in a research note on Tuesday, October 8th. Five analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $65.29.

Read Our Latest Report on Teck Resources

Teck Resources Company Profile

(

Free Report)

Teck Resources Limited engages in exploring for, acquiring, developing, and producing natural resources in Asia, Europe, and North America. The company operates through Steelmaking Coal, Copper, Zinc, and Energy segments. Its principal products include copper, zinc, steelmaking coal, and blended bitumen.

Featured Stories

Before you consider Teck Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teck Resources wasn't on the list.

While Teck Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.