Amundi boosted its holdings in Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 11.9% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 124,874 shares of the scientific and technical instruments company's stock after purchasing an additional 13,244 shares during the quarter. Amundi owned approximately 0.27% of Teledyne Technologies worth $57,687,000 as of its most recent filing with the Securities and Exchange Commission.

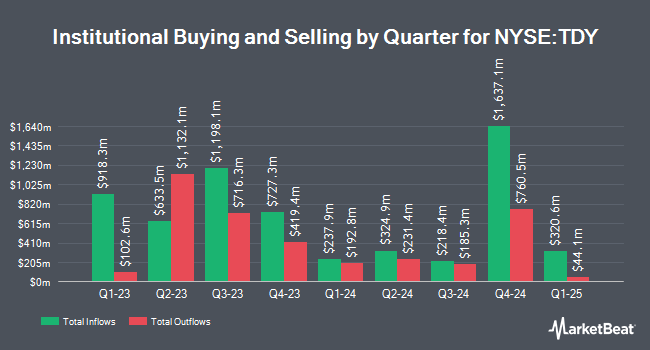

Several other institutional investors have also recently added to or reduced their stakes in the business. State Street Corp increased its stake in Teledyne Technologies by 1.9% in the third quarter. State Street Corp now owns 2,040,896 shares of the scientific and technical instruments company's stock valued at $893,219,000 after purchasing an additional 37,884 shares during the last quarter. Janus Henderson Group PLC increased its stake in Teledyne Technologies by 0.6% in the third quarter. Janus Henderson Group PLC now owns 1,709,475 shares of the scientific and technical instruments company's stock valued at $748,167,000 after purchasing an additional 9,368 shares during the last quarter. Geode Capital Management LLC grew its position in Teledyne Technologies by 2.4% during the third quarter. Geode Capital Management LLC now owns 1,192,019 shares of the scientific and technical instruments company's stock valued at $520,335,000 after acquiring an additional 28,224 shares during the period. JPMorgan Chase & Co. grew its position in Teledyne Technologies by 6.0% during the third quarter. JPMorgan Chase & Co. now owns 1,150,065 shares of the scientific and technical instruments company's stock valued at $503,338,000 after acquiring an additional 64,617 shares during the period. Finally, Allspring Global Investments Holdings LLC grew its position in Teledyne Technologies by 10.5% during the fourth quarter. Allspring Global Investments Holdings LLC now owns 318,712 shares of the scientific and technical instruments company's stock valued at $145,974,000 after acquiring an additional 30,157 shares during the period. 91.58% of the stock is currently owned by institutional investors and hedge funds.

Teledyne Technologies Price Performance

Shares of NYSE TDY opened at $489.12 on Wednesday. Teledyne Technologies Incorporated has a 1-year low of $355.41 and a 1-year high of $522.50. The business has a 50-day moving average of $491.68 and a 200-day moving average of $468.57. The company has a debt-to-equity ratio of 0.28, a current ratio of 2.33 and a quick ratio of 1.61. The company has a market capitalization of $22.91 billion, a price-to-earnings ratio of 28.39, a PEG ratio of 3.14 and a beta of 1.03.

Teledyne Technologies (NYSE:TDY - Get Free Report) last issued its earnings results on Wednesday, January 22nd. The scientific and technical instruments company reported $5.52 earnings per share for the quarter, topping the consensus estimate of $5.23 by $0.29. Teledyne Technologies had a return on equity of 9.94% and a net margin of 14.45%. The company had revenue of $1.50 billion during the quarter, compared to the consensus estimate of $1.45 billion. During the same quarter in the prior year, the business earned $5.44 earnings per share. The company's revenue was up 5.4% compared to the same quarter last year. On average, equities analysts anticipate that Teledyne Technologies Incorporated will post 21.55 EPS for the current fiscal year.

Insider Transactions at Teledyne Technologies

In other news, Director Michael T. Smith sold 2,025 shares of the company's stock in a transaction dated Thursday, December 12th. The stock was sold at an average price of $478.25, for a total value of $968,456.25. Following the completion of the sale, the director now owns 54,935 shares of the company's stock, valued at $26,272,663.75. This represents a 3.56 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP Melanie Susan Cibik sold 706 shares of the company's stock in a transaction dated Monday, March 3rd. The stock was sold at an average price of $519.96, for a total value of $367,091.76. Following the completion of the sale, the executive vice president now directly owns 26,529 shares of the company's stock, valued at $13,794,018.84. The trade was a 2.59 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 36,596 shares of company stock valued at $18,678,177 over the last quarter. Company insiders own 2.14% of the company's stock.

Wall Street Analysts Forecast Growth

TDY has been the subject of a number of research reports. Needham & Company LLC reissued a "buy" rating and set a $585.00 price target on shares of Teledyne Technologies in a research report on Wednesday, February 5th. UBS Group initiated coverage on Teledyne Technologies in a research report on Tuesday, December 10th. They set a "buy" rating and a $585.00 price target for the company. Six analysts have rated the stock with a buy rating, According to data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $538.00.

View Our Latest Report on TDY

Teledyne Technologies Company Profile

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.