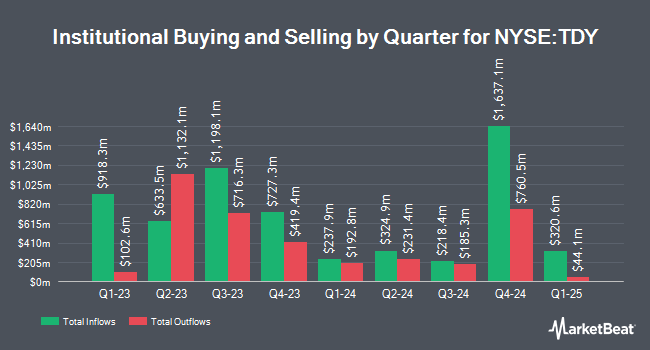

ARK Investment Management LLC decreased its holdings in Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 2.0% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 29,887 shares of the scientific and technical instruments company's stock after selling 599 shares during the period. ARK Investment Management LLC owned about 0.06% of Teledyne Technologies worth $13,871,000 as of its most recent SEC filing.

A number of other large investors also recently made changes to their positions in the business. Crestwood Advisors Group LLC increased its holdings in Teledyne Technologies by 18.7% in the fourth quarter. Crestwood Advisors Group LLC now owns 597 shares of the scientific and technical instruments company's stock worth $277,000 after buying an additional 94 shares during the last quarter. World Equity Group Inc. bought a new stake in Teledyne Technologies during the fourth quarter worth approximately $222,000. Fjarde AP Fonden Fourth Swedish National Pension Fund boosted its position in Teledyne Technologies by 46.9% during the fourth quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund now owns 20,039 shares of the scientific and technical instruments company's stock worth $9,301,000 after purchasing an additional 6,400 shares during the period. Cohen Capital Management Inc. boosted its position in Teledyne Technologies by 58.5% during the fourth quarter. Cohen Capital Management Inc. now owns 11,952 shares of the scientific and technical instruments company's stock worth $5,547,000 after purchasing an additional 4,412 shares during the period. Finally, Bradley Foster & Sargent Inc. CT boosted its position in Teledyne Technologies by 1.4% during the fourth quarter. Bradley Foster & Sargent Inc. CT now owns 4,130 shares of the scientific and technical instruments company's stock worth $1,917,000 after purchasing an additional 59 shares during the period. Institutional investors and hedge funds own 91.58% of the company's stock.

Teledyne Technologies Stock Performance

Shares of TDY traded up $14.74 during mid-day trading on Friday, hitting $515.60. The company's stock had a trading volume of 443,451 shares, compared to its average volume of 249,204. Teledyne Technologies Incorporated has a one year low of $355.41 and a one year high of $522.50. The company has a debt-to-equity ratio of 0.28, a quick ratio of 1.61 and a current ratio of 2.33. The firm has a market capitalization of $24.15 billion, a PE ratio of 29.92, a price-to-earnings-growth ratio of 3.14 and a beta of 1.03. The stock's 50-day moving average is $488.76 and its two-hundred day moving average is $464.15.

Teledyne Technologies (NYSE:TDY - Get Free Report) last posted its quarterly earnings data on Wednesday, January 22nd. The scientific and technical instruments company reported $5.52 earnings per share for the quarter, beating the consensus estimate of $5.23 by $0.29. The company had revenue of $1.50 billion during the quarter, compared to analysts' expectations of $1.45 billion. Teledyne Technologies had a return on equity of 9.94% and a net margin of 14.45%. Teledyne Technologies's revenue for the quarter was up 5.4% compared to the same quarter last year. During the same period in the prior year, the business earned $5.44 earnings per share. As a group, sell-side analysts anticipate that Teledyne Technologies Incorporated will post 21.55 EPS for the current year.

Insider Buying and Selling

In related news, COO George C. Bobb III sold 6,308 shares of the firm's stock in a transaction on Friday, January 24th. The stock was sold at an average price of $507.77, for a total value of $3,203,013.16. Following the completion of the transaction, the chief operating officer now directly owns 10,482 shares of the company's stock, valued at $5,322,445.14. This trade represents a 37.57 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Michael T. Smith sold 2,025 shares of the stock in a transaction on Thursday, December 12th. The stock was sold at an average price of $478.25, for a total value of $968,456.25. Following the transaction, the director now owns 54,935 shares of the company's stock, valued at $26,272,663.75. This represents a 3.56 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 32,190 shares of company stock valued at $16,386,864 over the last ninety days. 1.88% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

TDY has been the subject of a number of recent analyst reports. Bank of America raised Teledyne Technologies from a "neutral" rating to a "buy" rating and upped their target price for the stock from $450.00 to $550.00 in a research report on Friday, November 8th. Needham & Company LLC reaffirmed a "buy" rating and set a $585.00 target price on shares of Teledyne Technologies in a research report on Wednesday, February 5th. Finally, UBS Group initiated coverage on Teledyne Technologies in a research report on Tuesday, December 10th. They issued a "buy" rating and a $585.00 price objective for the company. Six research analysts have rated the stock with a buy rating, According to MarketBeat.com, Teledyne Technologies presently has a consensus rating of "Buy" and an average price target of $538.00.

View Our Latest Stock Analysis on TDY

Teledyne Technologies Profile

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Further Reading

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.