Telemark Asset Management LLC cut its stake in TechTarget, Inc. (NASDAQ:TTGT - Free Report) by 16.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 150,000 shares of the information services provider's stock after selling 30,000 shares during the period. Telemark Asset Management LLC owned 0.51% of TechTarget worth $3,668,000 as of its most recent SEC filing.

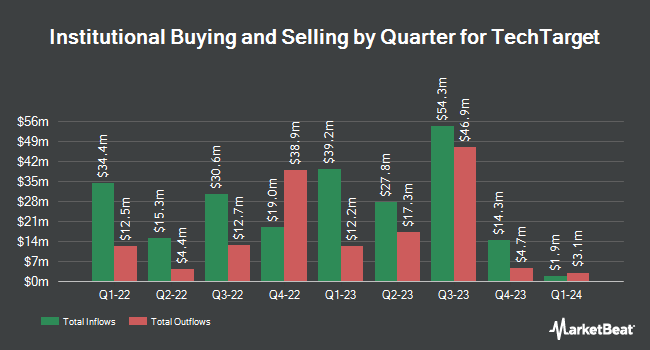

A number of other hedge funds also recently added to or reduced their stakes in TTGT. Earnest Partners LLC grew its holdings in TechTarget by 6.3% in the 2nd quarter. Earnest Partners LLC now owns 495,701 shares of the information services provider's stock worth $15,451,000 after buying an additional 29,375 shares in the last quarter. LMR Partners LLP bought a new position in shares of TechTarget in the third quarter worth $526,000. Impax Asset Management Group plc increased its holdings in shares of TechTarget by 24.9% during the third quarter. Impax Asset Management Group plc now owns 351,387 shares of the information services provider's stock valued at $8,591,000 after purchasing an additional 70,000 shares during the period. Harbor Capital Advisors Inc. raised its stake in shares of TechTarget by 152.7% during the third quarter. Harbor Capital Advisors Inc. now owns 160,370 shares of the information services provider's stock valued at $3,921,000 after purchasing an additional 96,896 shares in the last quarter. Finally, Sei Investments Co. raised its stake in shares of TechTarget by 4.6% during the first quarter. Sei Investments Co. now owns 32,853 shares of the information services provider's stock valued at $1,087,000 after purchasing an additional 1,432 shares in the last quarter. 93.52% of the stock is currently owned by institutional investors.

TechTarget Price Performance

Shares of NASDAQ:TTGT traded up $1.49 on Friday, reaching $32.44. 180,920 shares of the company traded hands, compared to its average volume of 129,701. The stock has a market capitalization of $948.55 million, a PE ratio of -73.69, a P/E/G ratio of 28.11 and a beta of 1.03. The company has a debt-to-equity ratio of 1.65, a current ratio of 10.49 and a quick ratio of 10.49. The company's 50 day moving average is $27.17 and its 200-day moving average is $28.71. TechTarget, Inc. has a fifty-two week low of $22.82 and a fifty-two week high of $41.93.

TechTarget (NASDAQ:TTGT - Get Free Report) last announced its earnings results on Tuesday, November 12th. The information services provider reported $0.42 EPS for the quarter, beating the consensus estimate of $0.37 by $0.05. The business had revenue of $58.47 million during the quarter, compared to the consensus estimate of $58.14 million. TechTarget had a positive return on equity of 5.44% and a negative net margin of 5.34%. TechTarget's revenue was up 2.4% compared to the same quarter last year. During the same period in the prior year, the business posted $0.13 earnings per share. As a group, analysts anticipate that TechTarget, Inc. will post 0.61 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities analysts recently issued reports on the stock. Craig Hallum increased their target price on shares of TechTarget from $36.00 to $40.00 and gave the company a "buy" rating in a research report on Wednesday, November 13th. Raymond James lowered their price objective on shares of TechTarget from $39.00 to $34.00 and set an "outperform" rating on the stock in a research note on Monday, August 12th. KeyCorp cut their target price on TechTarget from $38.00 to $37.00 and set an "overweight" rating for the company in a research report on Thursday, November 14th. Finally, Needham & Company LLC reiterated a "buy" rating and set a $40.00 price target on shares of TechTarget in a research report on Wednesday, November 13th. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $38.17.

View Our Latest Report on TTGT

About TechTarget

(

Free Report)

TechTarget, Inc, together with its subsidiaries, provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally. The company's service enables technology vendors to identify, reach, and influence corporate information technology (IT) decision-makers actively researching specific IT purchases; and customized marketing programs that integrate demand generation, brand advertising techniques, and content curation and creation.

Featured Articles

Before you consider TechTarget, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechTarget wasn't on the list.

While TechTarget currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.