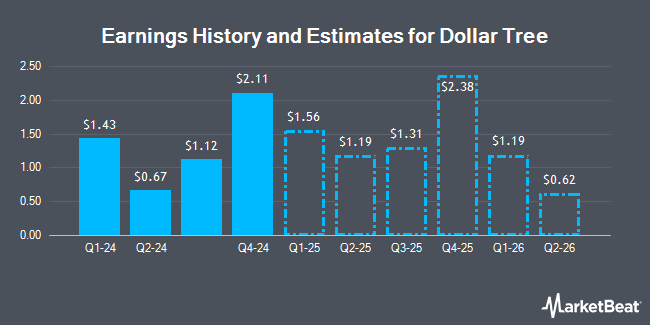

Dollar Tree, Inc. (NASDAQ:DLTR - Free Report) - Equities research analysts at Telsey Advisory Group lowered their FY2025 EPS estimates for Dollar Tree in a report issued on Tuesday, November 5th. Telsey Advisory Group analyst J. Feldman now forecasts that the company will post earnings of $5.41 per share for the year, down from their previous forecast of $5.45. Telsey Advisory Group has a "Market Perform" rating and a $75.00 price objective on the stock. The consensus estimate for Dollar Tree's current full-year earnings is $5.33 per share. Telsey Advisory Group also issued estimates for Dollar Tree's Q4 2025 earnings at $2.25 EPS, Q1 2026 earnings at $1.61 EPS, Q2 2026 earnings at $0.70 EPS, Q3 2026 earnings at $1.21 EPS, Q4 2026 earnings at $2.57 EPS and FY2026 earnings at $6.08 EPS.

Other equities analysts have also recently issued research reports about the stock. Truist Financial decreased their price objective on shares of Dollar Tree from $140.00 to $79.00 and set a "buy" rating on the stock in a research report on Thursday, September 5th. Melius Research initiated coverage on shares of Dollar Tree in a research report on Monday, September 23rd. They set a "hold" rating and a $70.00 price target on the stock. Piper Sandler reduced their price target on shares of Dollar Tree from $112.00 to $67.00 and set a "neutral" rating on the stock in a research report on Thursday, September 5th. StockNews.com cut shares of Dollar Tree from a "hold" rating to a "sell" rating in a research report on Friday, September 6th. Finally, Wells Fargo & Company reduced their price target on shares of Dollar Tree from $130.00 to $100.00 and set an "overweight" rating on the stock in a research report on Thursday, September 5th. One analyst has rated the stock with a sell rating, fourteen have given a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $88.11.

Get Our Latest Research Report on Dollar Tree

Dollar Tree Trading Down 6.5 %

Shares of DLTR stock traded down $4.36 during mid-day trading on Wednesday, reaching $62.41. The stock had a trading volume of 9,807,761 shares, compared to its average volume of 3,283,009. The stock's 50-day moving average price is $69.76 and its two-hundred day moving average price is $95.00. Dollar Tree has a 52-week low of $60.52 and a 52-week high of $151.21. The firm has a market capitalization of $13.42 billion, a PE ratio of -12.79, a price-to-earnings-growth ratio of 2.82 and a beta of 0.87. The company has a current ratio of 1.02, a quick ratio of 0.17 and a debt-to-equity ratio of 0.33.

Dollar Tree (NASDAQ:DLTR - Get Free Report) last released its quarterly earnings data on Wednesday, September 4th. The company reported $0.67 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.04 by ($0.37). Dollar Tree had a negative net margin of 3.44% and a positive return on equity of 15.77%. The firm had revenue of $7.37 billion during the quarter, compared to analysts' expectations of $7.49 billion. During the same quarter in the previous year, the firm posted $0.91 EPS. Dollar Tree's revenue was up .7% compared to the same quarter last year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Mount Yale Investment Advisors LLC raised its position in Dollar Tree by 4.9% in the first quarter. Mount Yale Investment Advisors LLC now owns 1,985 shares of the company's stock worth $264,000 after acquiring an additional 93 shares during the period. EverSource Wealth Advisors LLC raised its position in Dollar Tree by 29.3% in the first quarter. EverSource Wealth Advisors LLC now owns 486 shares of the company's stock worth $65,000 after acquiring an additional 110 shares during the period. Valeo Financial Advisors LLC raised its position in Dollar Tree by 2.1% in the second quarter. Valeo Financial Advisors LLC now owns 5,650 shares of the company's stock worth $603,000 after acquiring an additional 116 shares during the period. Raymond James Trust N.A. raised its position in Dollar Tree by 2.5% in the second quarter. Raymond James Trust N.A. now owns 4,996 shares of the company's stock worth $533,000 after acquiring an additional 124 shares during the period. Finally, Burney Co. raised its position in Dollar Tree by 1.4% in the first quarter. Burney Co. now owns 9,598 shares of the company's stock worth $1,278,000 after acquiring an additional 131 shares during the period. Institutional investors own 97.40% of the company's stock.

Insider Activity at Dollar Tree

In related news, Director Daniel J. Heinrich acquired 2,200 shares of the stock in a transaction that occurred on Friday, September 6th. The shares were bought at an average price of $68.27 per share, for a total transaction of $150,194.00. Following the completion of the transaction, the director now directly owns 9,823 shares in the company, valued at approximately $670,616.21. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. 6.80% of the stock is owned by insiders.

About Dollar Tree

(

Get Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Recommended Stories

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.