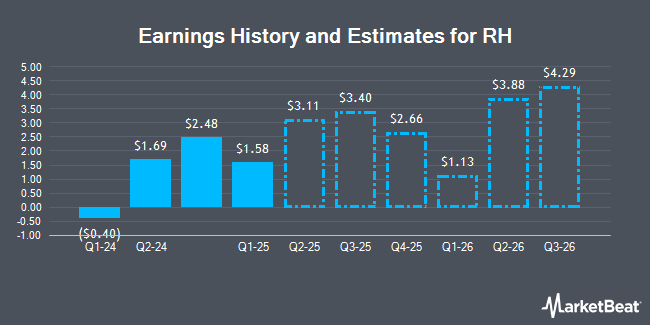

RH (NYSE:RH - Free Report) - Telsey Advisory Group boosted their Q3 2026 earnings per share estimates for RH in a research note issued on Thursday, December 19th. Telsey Advisory Group analyst C. Fernandez now expects that the company will earn $4.50 per share for the quarter, up from their previous estimate of $4.44. Telsey Advisory Group has a "Outperform" rating and a $500.00 price target on the stock. The consensus estimate for RH's current full-year earnings is $5.63 per share.

RH has been the topic of a number of other reports. Bank of America boosted their price target on shares of RH from $310.00 to $359.00 and gave the stock a "buy" rating in a research note on Friday, September 13th. Morgan Stanley increased their target price on shares of RH from $310.00 to $435.00 and gave the stock an "equal weight" rating in a report on Friday, December 13th. BNP Paribas reissued an "underperform" rating and issued a $253.00 price target on shares of RH in a research report on Wednesday, November 13th. StockNews.com raised RH from a "sell" rating to a "hold" rating in a research report on Friday, December 13th. Finally, Barclays decreased their target price on RH from $340.00 to $320.00 and set an "equal weight" rating for the company in a report on Monday, September 16th. Two research analysts have rated the stock with a sell rating, six have given a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, RH has an average rating of "Hold" and a consensus target price of $402.40.

Read Our Latest Stock Report on RH

RH Price Performance

Shares of RH stock traded up $10.24 on Friday, hitting $398.26. The stock had a trading volume of 763,426 shares, compared to its average volume of 727,881. The company's 50 day moving average price is $354.37 and its 200-day moving average price is $301.53. RH has a 1 year low of $212.43 and a 1 year high of $457.26. The firm has a market capitalization of $7.41 billion, a P/E ratio of 114.44, a P/E/G ratio of 2.73 and a beta of 2.44.

RH (NYSE:RH - Get Free Report) last posted its quarterly earnings data on Thursday, December 12th. The company reported $2.48 earnings per share for the quarter, missing analysts' consensus estimates of $2.67 by ($0.19). RH had a negative return on equity of 32.76% and a net margin of 2.25%. The company had revenue of $811.73 million for the quarter, compared to analysts' expectations of $812.19 million. During the same period in the previous year, the business posted ($0.42) EPS. The business's revenue for the quarter was up 8.1% on a year-over-year basis.

Institutional Trading of RH

Several hedge funds have recently modified their holdings of RH. Anomaly Capital Management LP lifted its stake in shares of RH by 503.6% in the second quarter. Anomaly Capital Management LP now owns 349,227 shares of the company's stock valued at $85,365,000 after purchasing an additional 291,368 shares during the period. Dimensional Fund Advisors LP lifted its position in shares of RH by 18.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 270,993 shares of the company's stock valued at $66,239,000 after acquiring an additional 41,242 shares during the period. Allspring Global Investments Holdings LLC boosted its stake in shares of RH by 8.2% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 245,810 shares of the company's stock worth $82,206,000 after acquiring an additional 18,563 shares in the last quarter. Charles Schwab Investment Management Inc. grew its holdings in shares of RH by 26.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 184,834 shares of the company's stock worth $61,814,000 after acquiring an additional 38,572 shares during the period. Finally, Marshall Wace LLP raised its holdings in RH by 58.6% during the second quarter. Marshall Wace LLP now owns 174,324 shares of the company's stock worth $42,612,000 after purchasing an additional 64,423 shares during the last quarter. 90.17% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other news, Director Keith Belling sold 500 shares of RH stock in a transaction on Tuesday, December 17th. The shares were sold at an average price of $415.00, for a total value of $207,500.00. Following the transaction, the director now directly owns 5,470 shares of the company's stock, valued at $2,270,050. The trade was a 8.38 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Edward T. Lee sold 2,000 shares of the business's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $353.57, for a total transaction of $707,140.00. The disclosure for this sale can be found here. Company insiders own 28.10% of the company's stock.

About RH

(

Get Free Report)

RH, together with its subsidiaries, operates as a retailer in the home furnishings market. The company offers products in various categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, baby, child, and teen furnishings. It provides its products through rh.com, rhbabyandchild.com, rhteen.com, rhmodern.com, and waterworks.com online channels, as well as operates RH Galleries, RH outlet stores, RH Guesthouse, and Waterworks showrooms in the United States, Canada, the United Kingdom, and Germany.

Featured Articles

Before you consider RH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RH wasn't on the list.

While RH currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.