Dollar General (NYSE:DG - Get Free Report)'s stock had its "market perform" rating reiterated by analysts at Telsey Advisory Group in a report issued on Thursday,Benzinga reports. They presently have a $85.00 price objective on the stock. Telsey Advisory Group's price objective would indicate a potential upside of 5.61% from the company's previous close. Telsey Advisory Group also issued estimates for Dollar General's Q4 2025 earnings at $1.55 EPS and Q4 2026 earnings at $1.63 EPS.

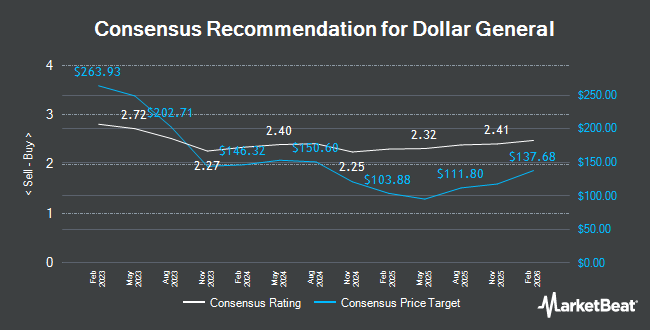

A number of other equities analysts also recently commented on DG. Gordon Haskett downgraded Dollar General from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, January 28th. The Goldman Sachs Group lowered their price target on Dollar General from $104.00 to $93.00 and set a "buy" rating on the stock in a research report on Thursday, January 23rd. Truist Financial cut their price objective on Dollar General from $94.00 to $83.00 and set a "hold" rating for the company in a report on Friday, December 6th. Morgan Stanley lowered their target price on Dollar General from $100.00 to $80.00 and set an "equal weight" rating on the stock in a report on Tuesday, January 21st. Finally, HSBC dropped their price target on shares of Dollar General from $100.00 to $88.00 and set a "hold" rating on the stock in a research report on Friday, November 15th. One analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and eight have given a buy rating to the company. According to data from MarketBeat.com, Dollar General presently has an average rating of "Hold" and an average target price of $95.09.

Get Our Latest Stock Report on Dollar General

Dollar General Stock Up 7.5 %

Shares of DG traded up $5.63 during midday trading on Thursday, hitting $80.48. The company had a trading volume of 1,771,208 shares, compared to its average volume of 3,594,026. The stock has a market cap of $17.70 billion, a price-to-earnings ratio of 13.21, a PEG ratio of 2.18 and a beta of 0.44. The company's 50 day moving average price is $73.52 and its 200 day moving average price is $78.69. The company has a quick ratio of 0.15, a current ratio of 1.15 and a debt-to-equity ratio of 0.78. Dollar General has a 52 week low of $66.43 and a 52 week high of $168.07.

Dollar General (NYSE:DG - Get Free Report) last announced its quarterly earnings data on Thursday, March 13th. The company reported $1.68 earnings per share for the quarter, beating the consensus estimate of $1.50 by $0.18. Dollar General had a return on equity of 18.85% and a net margin of 3.33%. On average, equities research analysts predict that Dollar General will post 5.75 EPS for the current year.

Insider Transactions at Dollar General

In other news, Director Michael M. Calbert sold 6,000 shares of the stock in a transaction on Tuesday, December 31st. The shares were sold at an average price of $75.27, for a total value of $451,620.00. Following the completion of the transaction, the director now owns 120,322 shares in the company, valued at approximately $9,056,636.94. This represents a 4.75 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Emily C. Taylor sold 4,740 shares of Dollar General stock in a transaction dated Friday, December 13th. The shares were sold at an average price of $77.44, for a total transaction of $367,065.60. Following the sale, the executive vice president now owns 15,575 shares in the company, valued at approximately $1,206,128. This trade represents a 23.33 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.49% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Dollar General

A number of institutional investors have recently added to or reduced their stakes in the stock. Metis Global Partners LLC boosted its stake in Dollar General by 2.0% in the 3rd quarter. Metis Global Partners LLC now owns 7,042 shares of the company's stock valued at $596,000 after buying an additional 135 shares in the last quarter. Studio Investment Management LLC lifted its holdings in shares of Dollar General by 16.4% during the fourth quarter. Studio Investment Management LLC now owns 989 shares of the company's stock valued at $75,000 after acquiring an additional 139 shares during the period. Deseret Mutual Benefit Administrators boosted its stake in shares of Dollar General by 8.7% in the 4th quarter. Deseret Mutual Benefit Administrators now owns 1,884 shares of the company's stock valued at $143,000 after purchasing an additional 150 shares in the last quarter. Empirical Finance LLC increased its position in shares of Dollar General by 2.0% during the 3rd quarter. Empirical Finance LLC now owns 7,768 shares of the company's stock worth $657,000 after purchasing an additional 153 shares in the last quarter. Finally, Bruce G. Allen Investments LLC lifted its holdings in Dollar General by 20.3% during the 4th quarter. Bruce G. Allen Investments LLC now owns 953 shares of the company's stock valued at $72,000 after purchasing an additional 161 shares during the last quarter. 91.77% of the stock is owned by institutional investors and hedge funds.

About Dollar General

(

Get Free Report)

Dollar General Corporation, a discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States. It offers consumable products, including paper and cleaning products, such as paper towels, bath tissues, paper dinnerware, trash and storage bags, disinfectants, and laundry products; packaged food comprising cereals, pasta, canned soups, fruits and vegetables, condiments, spices, sugar, and flour; and perishables that include milk, eggs, bread, refrigerated and frozen food, beer, and wine.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dollar General, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar General wasn't on the list.

While Dollar General currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.