TELUS International (Cda) (NYSE:TIXT - Free Report) had its target price upped by TD Securities from $3.75 to $4.00 in a research report released on Friday morning,BayStreet.CA reports. The firm currently has a hold rating on the stock.

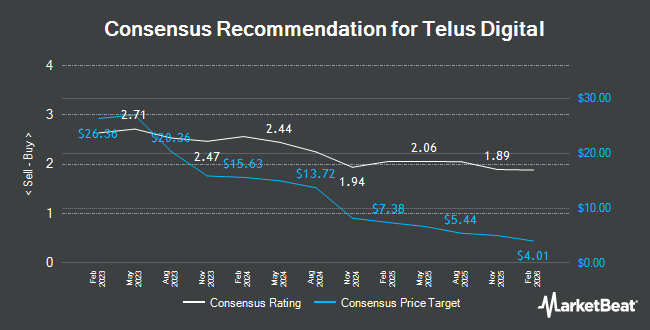

Several other equities analysts have also weighed in on TIXT. Stifel Nicolaus initiated coverage on shares of TELUS International (Cda) in a report on Thursday, January 16th. They set a "buy" rating and a $5.00 target price for the company. Stifel Canada upgraded shares of TELUS International (Cda) to a "strong-buy" rating in a research report on Wednesday, January 15th. Two equities research analysts have rated the stock with a sell rating, thirteen have issued a hold rating, two have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $7.21.

View Our Latest Stock Report on TELUS International (Cda)

TELUS International (Cda) Stock Performance

NYSE:TIXT traded up $0.15 during mid-day trading on Friday, hitting $3.89. The company's stock had a trading volume of 614,404 shares, compared to its average volume of 502,490. The business's fifty day moving average is $3.74 and its two-hundred day moving average is $3.69. The stock has a market cap of $1.07 billion, a price-to-earnings ratio of -77.70, a PEG ratio of 1.40 and a beta of 0.67. The company has a debt-to-equity ratio of 0.72, a current ratio of 1.02 and a quick ratio of 1.02. TELUS International has a 1 year low of $2.83 and a 1 year high of $11.51.

TELUS International (Cda) (NYSE:TIXT - Get Free Report) last issued its earnings results on Thursday, February 13th. The company reported ($0.04) EPS for the quarter, missing analysts' consensus estimates of ($0.01) by ($0.03). The company had revenue of $691.00 million during the quarter, compared to analysts' expectations of $672.44 million. TELUS International (Cda) had a return on equity of 9.67% and a net margin of 1.17%. Analysts anticipate that TELUS International will post 0.43 EPS for the current fiscal year.

Hedge Funds Weigh In On TELUS International (Cda)

A number of hedge funds have recently made changes to their positions in the company. Aquatic Capital Management LLC purchased a new stake in shares of TELUS International (Cda) during the fourth quarter worth approximately $37,000. Two Sigma Securities LLC purchased a new position in TELUS International (Cda) in the 4th quarter valued at $42,000. Bayesian Capital Management LP acquired a new stake in TELUS International (Cda) during the 4th quarter worth $45,000. Virtu Financial LLC purchased a new stake in shares of TELUS International (Cda) during the third quarter worth $54,000. Finally, Walleye Capital LLC acquired a new stake in shares of TELUS International (Cda) in the third quarter valued at about $60,000. Institutional investors and hedge funds own 59.55% of the company's stock.

TELUS International (Cda) Company Profile

(

Get Free Report)

TELUS International (Cda) Inc design, builds, and delivers digital solutions for customer experience (CX) in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally. The company provides digital experience solutions, such as AI and bots, omnichannel CX, enterprise mobility solutions, cloud contact center, big data analytics, platform transformation, and UX/UI design; and customer experience solutions, including work anywhere/work from home, contact center outsourcing, technical support, sales growth and customer retention, healthcare/patient experience, and debt collection.

Featured Articles

Before you consider TELUS International (Cda), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS International (Cda) wasn't on the list.

While TELUS International (Cda) currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.