TELUS (TSE:T - Get Free Report) NYSE: TU had its price target reduced by equities research analysts at TD Securities from C$26.00 to C$25.00 in a research note issued on Tuesday,BayStreet.CA reports. The brokerage presently has a "buy" rating on the stock. TD Securities' target price points to a potential upside of 13.69% from the stock's current price.

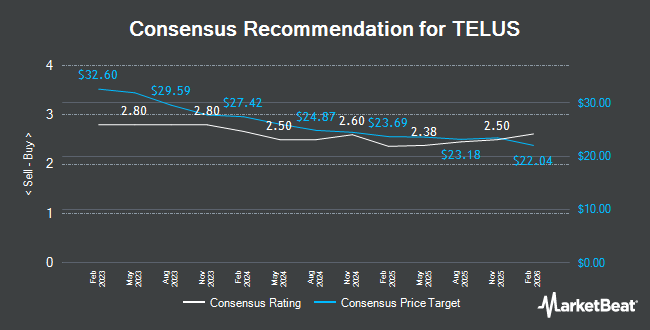

Several other equities research analysts have also issued reports on T. Cormark lowered their target price on shares of TELUS from C$26.00 to C$25.00 in a report on Monday, November 11th. Barclays lowered their target price on shares of TELUS from C$24.00 to C$23.00 in a research note on Wednesday, October 9th. Royal Bank of Canada cut their target price on shares of TELUS from C$26.00 to C$25.00 and set an "outperform" rating for the company in a report on Tuesday, August 6th. Scotiabank cut their price target on shares of TELUS from C$24.00 to C$23.25 in a report on Tuesday, November 26th. Finally, BMO Capital Markets upped their target price on shares of TELUS from C$24.00 to C$25.00 in a report on Thursday, September 5th. One analyst has rated the stock with a sell rating, two have issued a hold rating and seven have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of C$24.40.

Check Out Our Latest Report on T

TELUS Stock Up 0.4 %

TSE:T traded up C$0.09 on Tuesday, hitting C$21.99. The stock had a trading volume of 1,908,082 shares, compared to its average volume of 3,332,732. The firm's fifty day simple moving average is C$22.05 and its two-hundred day simple moving average is C$22.00. The company has a debt-to-equity ratio of 171.58, a quick ratio of 0.52 and a current ratio of 0.66. TELUS has a 1 year low of C$20.04 and a 1 year high of C$25.94. The stock has a market cap of C$32.55 billion, a P/E ratio of 41.49, a price-to-earnings-growth ratio of 1.65 and a beta of 0.72.

Insiders Place Their Bets

In other news, Director Victor George Dodig bought 100,000 shares of the company's stock in a transaction on Thursday, November 14th. The shares were purchased at an average price of C$21.38 per share, with a total value of C$2,138,000.00. Company insiders own 0.02% of the company's stock.

About TELUS

(

Get Free Report)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.