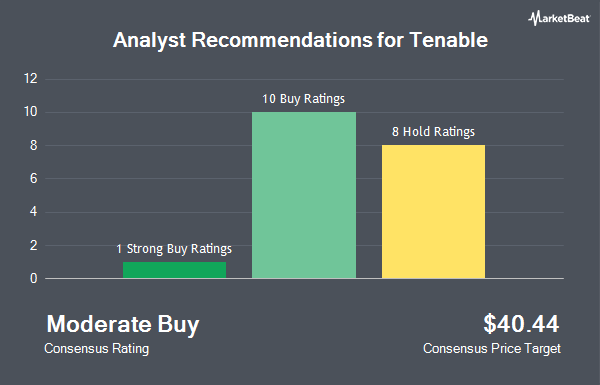

Tenable Holdings, Inc. (NASDAQ:TENB - Get Free Report) has earned an average recommendation of "Moderate Buy" from the seventeen ratings firms that are presently covering the company, MarketBeat Ratings reports. Five analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the company. The average 1-year price target among brokerages that have issued ratings on the stock in the last year is $50.81.

TENB has been the topic of several recent analyst reports. Jefferies Financial Group initiated coverage on shares of Tenable in a report on Wednesday, October 16th. They issued a "hold" rating and a $45.00 target price on the stock. Robert W. Baird dropped their price objective on shares of Tenable from $53.00 to $50.00 and set an "outperform" rating on the stock in a report on Friday, October 25th. Baird R W upgraded shares of Tenable to a "strong-buy" rating in a report on Monday, July 15th. DA Davidson lowered shares of Tenable from a "buy" rating to a "neutral" rating and dropped their price objective for the company from $56.00 to $40.00 in a report on Thursday, August 1st. Finally, Barclays dropped their price objective on shares of Tenable from $49.00 to $45.00 and set an "equal weight" rating on the stock in a report on Thursday, October 31st.

View Our Latest Research Report on TENB

Tenable Trading Down 0.9 %

TENB stock traded down $0.38 during midday trading on Monday, hitting $41.43. The stock had a trading volume of 1,211,018 shares, compared to its average volume of 927,885. The firm has a market cap of $4.98 billion, a P/E ratio of -81.24 and a beta of 0.83. The company has a current ratio of 1.28, a quick ratio of 1.21 and a debt-to-equity ratio of 0.88. Tenable has a 1-year low of $35.25 and a 1-year high of $53.50. The business has a fifty day moving average price of $40.66 and a two-hundred day moving average price of $41.99.

Insider Transactions at Tenable

In other Tenable news, COO Mark C. Thurmond sold 3,383 shares of the company's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $41.66, for a total value of $140,935.78. Following the completion of the sale, the chief operating officer now directly owns 34,079 shares of the company's stock, valued at approximately $1,419,731.14. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. In other Tenable news, CEO Amit Yoran sold 5,673 shares of the company's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $41.75, for a total value of $236,847.75. Following the completion of the sale, the chief executive officer now directly owns 39,309 shares of the company's stock, valued at approximately $1,641,150.75. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, COO Mark C. Thurmond sold 3,383 shares of the company's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $41.66, for a total transaction of $140,935.78. Following the completion of the sale, the chief operating officer now directly owns 34,079 shares of the company's stock, valued at $1,419,731.14. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 12,469 shares of company stock valued at $520,276 over the last three months. Corporate insiders own 4.30% of the company's stock.

Institutional Investors Weigh In On Tenable

A number of institutional investors have recently added to or reduced their stakes in the company. Tidal Investments LLC boosted its stake in Tenable by 157.8% in the first quarter. Tidal Investments LLC now owns 23,268 shares of the company's stock valued at $1,150,000 after acquiring an additional 14,244 shares during the last quarter. CANADA LIFE ASSURANCE Co boosted its stake in Tenable by 21.0% in the first quarter. CANADA LIFE ASSURANCE Co now owns 352,468 shares of the company's stock valued at $17,408,000 after acquiring an additional 61,080 shares during the last quarter. ProShare Advisors LLC boosted its stake in Tenable by 10.1% in the first quarter. ProShare Advisors LLC now owns 21,283 shares of the company's stock valued at $1,052,000 after acquiring an additional 1,961 shares during the last quarter. Blair William & Co. IL boosted its stake in Tenable by 9.5% in the first quarter. Blair William & Co. IL now owns 295,886 shares of the company's stock valued at $14,626,000 after acquiring an additional 25,760 shares during the last quarter. Finally, Bayesian Capital Management LP purchased a new position in Tenable in the first quarter valued at about $1,310,000. 89.06% of the stock is owned by institutional investors.

About Tenable

(

Get Free ReportTenable Holdings, Inc provides cyber exposure solutions for in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. Its platforms include Tenable Vulnerability Management, a cloud-delivered software as a service that provides organizations with a risk-based view of traditional and modern attack surfaces; Tenable Cloud Security, a cloud-native cloud security solutions for security teams to continuously assess the security posture; Tenable Identity Exposure, a solution to secure Active Directory environments; Tenable Web App Scanning, which provides scanning for modern web applications; Tenable Lumin Exposure View, a measurement tool; Tenable Attack Surface Management, an external attack surface management solution; Tenable Security Center, an on-premises solution that provides a risk-based view of an organization's IT, security and compliance posture; and Tenable OT Security, an operational technology security solution which provides threat detection, asset tracking, vulnerability management, and configuration control capabilities.

See Also

Before you consider Tenable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenable wasn't on the list.

While Tenable currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.