Tenaya Therapeutics (NASDAQ:TNYA - Free Report) had its price objective cut by Chardan Capital from $20.00 to $18.00 in a report issued on Thursday morning,Benzinga reports. They currently have a buy rating on the stock.

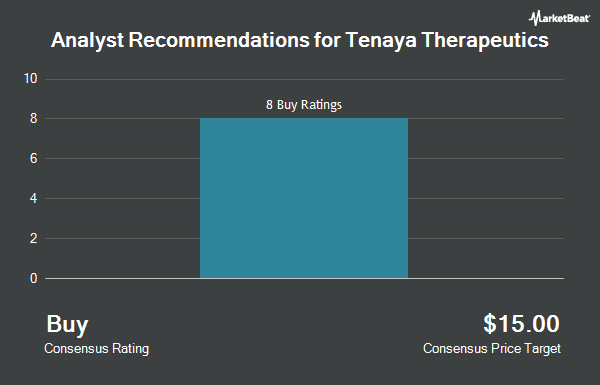

Several other equities research analysts have also weighed in on TNYA. Leerink Partners reissued an "outperform" rating on shares of Tenaya Therapeutics in a research note on Friday, October 18th. HC Wainwright reissued a "buy" rating and issued a $18.00 price target on shares of Tenaya Therapeutics in a research report on Friday, October 18th. Canaccord Genuity Group restated a "buy" rating and issued a $16.00 target price on shares of Tenaya Therapeutics in a research note on Friday, October 18th. Finally, Piper Sandler restated an "overweight" rating on shares of Tenaya Therapeutics in a research note on Friday, October 18th. Seven analysts have rated the stock with a buy rating, According to data from MarketBeat, Tenaya Therapeutics currently has an average rating of "Buy" and an average target price of $14.75.

Get Our Latest Report on TNYA

Tenaya Therapeutics Price Performance

NASDAQ:TNYA traded up $0.27 during midday trading on Thursday, reaching $2.50. 6,746,334 shares of the company traded hands, compared to its average volume of 719,340. The company has a fifty day moving average price of $2.05 and a 200 day moving average price of $3.06. The firm has a market capitalization of $197.22 million, a price-to-earnings ratio of -1.76 and a beta of 2.34. Tenaya Therapeutics has a twelve month low of $1.61 and a twelve month high of $7.01.

Tenaya Therapeutics (NASDAQ:TNYA - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported ($0.34) EPS for the quarter, topping analysts' consensus estimates of ($0.40) by $0.06. On average, equities research analysts forecast that Tenaya Therapeutics will post -1.52 earnings per share for the current fiscal year.

Insider Buying and Selling at Tenaya Therapeutics

In related news, CEO Faraz Ali sold 9,748 shares of the business's stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $2.89, for a total transaction of $28,171.72. Following the completion of the sale, the chief executive officer now directly owns 188,331 shares of the company's stock, valued at $544,276.59. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. In the last 90 days, insiders sold 19,539 shares of company stock worth $56,468. 32.76% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Tenaya Therapeutics

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vanguard Group Inc. raised its stake in shares of Tenaya Therapeutics by 16.4% during the 1st quarter. Vanguard Group Inc. now owns 2,862,916 shares of the company's stock worth $14,973,000 after purchasing an additional 403,472 shares in the last quarter. Jacobs Levy Equity Management Inc. lifted its holdings in shares of Tenaya Therapeutics by 90.8% during the first quarter. Jacobs Levy Equity Management Inc. now owns 168,565 shares of the company's stock worth $882,000 after buying an additional 80,212 shares in the last quarter. RA Capital Management L.P. raised its stake in Tenaya Therapeutics by 4.5% in the 1st quarter. RA Capital Management L.P. now owns 5,755,050 shares of the company's stock worth $30,099,000 after purchasing an additional 247,703 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in shares of Tenaya Therapeutics by 12.3% in the second quarter. Bank of New York Mellon Corp now owns 237,597 shares of the company's stock valued at $737,000 after buying an additional 26,103 shares during the period. Finally, Panagora Asset Management Inc. acquired a new stake in shares of Tenaya Therapeutics during the 2nd quarter worth $164,000. 90.54% of the stock is owned by institutional investors and hedge funds.

About Tenaya Therapeutics

(

Get Free Report)

Tenaya Therapeutics, Inc, a biotechnology company, discovers, develops, and delivers therapies for heart disease in the United States. It develops its products through gene editing, cellular regeneration, and gene addition. The company is developing TN-201, a gene therapy for myosin binding protein C3-associated hypertrophic cardiomyopathy which is in phase 1 clinical trial; TN-301, a small molecule for heart failure with preserved ejection fraction which is in phase 1 clinical trial; and TN-401, a gene therapy for plakophilin 2-associated arrhythmogenic right ventricular cardiomyopathy which is in preclinical stage.

See Also

Before you consider Tenaya Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenaya Therapeutics wasn't on the list.

While Tenaya Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.