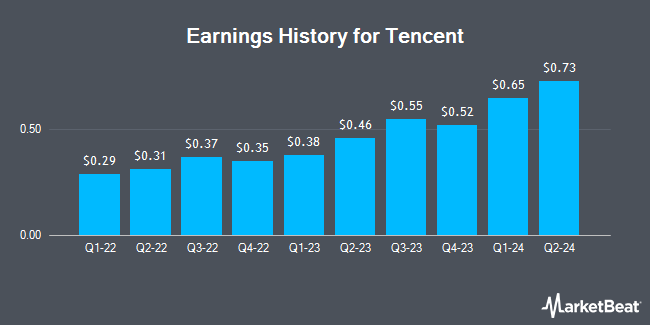

Tencent (OTCMKTS:TCEHY - Get Free Report) is anticipated to post its quarterly earnings results on Wednesday, March 19th. Analysts expect the company to announce earnings of $0.77 per share and revenue of $23.29 billion for the quarter. Parties interested in listening to the company's conference call can do so using this link.

Tencent Stock Up 2.4 %

Shares of Tencent stock opened at $67.00 on Wednesday. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.35 and a quick ratio of 1.33. The stock has a market cap of $614.98 billion, a price-to-earnings ratio of 35.26 and a beta of 0.16. The firm's 50-day moving average is $56.19 and its two-hundred day moving average is $53.83. Tencent has a 1 year low of $36.08 and a 1 year high of $69.99.

Tencent Company Profile

(

Get Free Report)

Tencent Holdings Limited, an investment holding company, offers value-added services (VAS), online advertising, fintech, and business services in the People's Republic of China and internationally. It operates through VAS, Online Advertising, FinTech and Business Services, and Others segments. The company's consumers business provides communication and services, such as instant messaging and social network; digital content including online games, videos, live streaming, news, music, and literature; fintech services, which includes mobile payment, wealth management, loans, and securities trading; and various tools, such as network security management, browser, navigation, application management, email, etc.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tencent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent wasn't on the list.

While Tencent currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.