Tenere Capital LLC boosted its stake in shares of Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 28.8% during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 170,323 shares of the semiconductor company's stock after buying an additional 38,055 shares during the period. Marvell Technology makes up approximately 3.3% of Tenere Capital LLC's holdings, making the stock its 17th largest holding. Tenere Capital LLC's holdings in Marvell Technology were worth $12,284,000 at the end of the most recent reporting period.

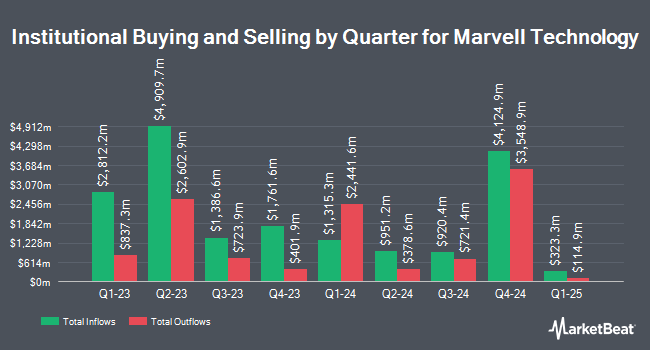

Several other hedge funds and other institutional investors also recently bought and sold shares of MRVL. State Street Corp grew its position in Marvell Technology by 0.3% in the 3rd quarter. State Street Corp now owns 19,943,655 shares of the semiconductor company's stock valued at $1,438,336,000 after acquiring an additional 68,893 shares during the last quarter. Ameriprise Financial Inc. grew its position in shares of Marvell Technology by 24.1% during the 2nd quarter. Ameriprise Financial Inc. now owns 11,623,872 shares of the semiconductor company's stock worth $812,509,000 after buying an additional 2,254,610 shares in the last quarter. Wellington Management Group LLP grew its position in shares of Marvell Technology by 4.3% during the 3rd quarter. Wellington Management Group LLP now owns 8,694,320 shares of the semiconductor company's stock worth $627,034,000 after buying an additional 359,005 shares in the last quarter. Van ECK Associates Corp grew its position in shares of Marvell Technology by 26.6% during the 3rd quarter. Van ECK Associates Corp now owns 7,471,823 shares of the semiconductor company's stock worth $538,868,000 after buying an additional 1,570,050 shares in the last quarter. Finally, Clearbridge Investments LLC grew its position in shares of Marvell Technology by 3.0% during the 2nd quarter. Clearbridge Investments LLC now owns 5,189,682 shares of the semiconductor company's stock worth $362,759,000 after buying an additional 150,109 shares in the last quarter. Hedge funds and other institutional investors own 83.51% of the company's stock.

Marvell Technology Stock Up 0.1 %

Shares of MRVL traded up $0.14 during midday trading on Friday, reaching $113.51. 13,771,877 shares of the company were exchanged, compared to its average volume of 12,026,631. The stock has a 50-day moving average price of $86.09 and a 200-day moving average price of $75.60. The company has a market cap of $98.22 billion, a price-to-earnings ratio of -66.77, a P/E/G ratio of 5.11 and a beta of 1.46. Marvell Technology, Inc. has a 1-year low of $50.56 and a 1-year high of $119.88. The company has a current ratio of 1.79, a quick ratio of 1.26 and a debt-to-equity ratio of 0.28.

Marvell Technology Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Friday, October 11th were paid a $0.06 dividend. This represents a $0.24 annualized dividend and a dividend yield of 0.21%. The ex-dividend date of this dividend was Friday, October 11th. Marvell Technology's dividend payout ratio (DPR) is -14.12%.

Wall Street Analysts Forecast Growth

MRVL has been the subject of a number of research analyst reports. Rosenblatt Securities increased their price target on Marvell Technology from $120.00 to $140.00 and gave the company a "buy" rating in a research note on Wednesday. Bank of America increased their price target on Marvell Technology from $108.00 to $125.00 and gave the company a "buy" rating in a research note on Wednesday. JPMorgan Chase & Co. increased their price target on Marvell Technology from $90.00 to $130.00 and gave the company an "overweight" rating in a research note on Wednesday. Loop Capital increased their price target on Marvell Technology from $95.00 to $110.00 and gave the company a "hold" rating in a research note on Wednesday. Finally, Oppenheimer increased their price target on Marvell Technology from $110.00 to $125.00 and gave the company an "outperform" rating in a research note on Wednesday. Three analysts have rated the stock with a hold rating and twenty-four have assigned a buy rating to the stock. According to data from MarketBeat.com, Marvell Technology currently has an average rating of "Moderate Buy" and an average target price of $119.04.

Get Our Latest Research Report on MRVL

Insider Buying and Selling

In other news, Director Ford Tamer sold 92,000 shares of the company's stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $74.16, for a total transaction of $6,822,720.00. Following the completion of the transaction, the director now directly owns 351,193 shares of the company's stock, valued at approximately $26,044,472.88. This represents a 20.76 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO Willem A. Meintjes sold 1,500 shares of the business's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $89.14, for a total value of $133,710.00. Following the transaction, the chief financial officer now owns 114,211 shares of the company's stock, valued at approximately $10,180,768.54. This represents a 1.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 267,000 shares of company stock worth $20,899,260. 0.33% of the stock is currently owned by corporate insiders.

About Marvell Technology

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

See Also

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.