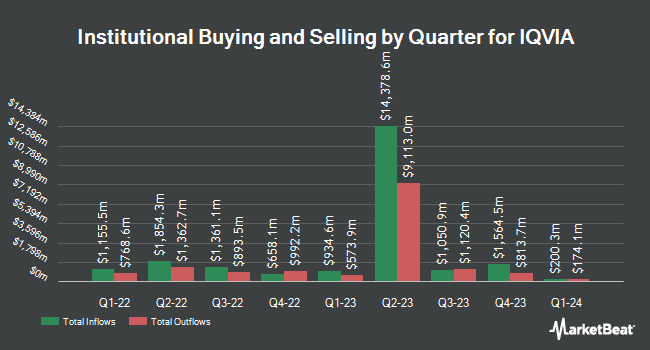

Tenere Capital LLC acquired a new stake in shares of IQVIA Holdings Inc. (NYSE:IQV - Free Report) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 62,859 shares of the medical research company's stock, valued at approximately $14,896,000. IQVIA comprises about 4.0% of Tenere Capital LLC's portfolio, making the stock its 11th largest holding.

A number of other hedge funds also recently modified their holdings of the business. Opal Wealth Advisors LLC bought a new position in shares of IQVIA during the second quarter worth $27,000. Capital Performance Advisors LLP bought a new position in shares of IQVIA in the third quarter worth $27,000. Park Place Capital Corp bought a new position in shares of IQVIA in the third quarter worth $28,000. Itau Unibanco Holding S.A. acquired a new stake in IQVIA in the second quarter valued at about $29,000. Finally, International Assets Investment Management LLC acquired a new stake in shares of IQVIA during the second quarter valued at about $32,000. Hedge funds and other institutional investors own 89.62% of the company's stock.

Analyst Upgrades and Downgrades

IQV has been the subject of several recent research reports. TD Cowen decreased their price objective on IQVIA from $270.00 to $255.00 and set a "buy" rating for the company in a report on Friday, November 1st. Truist Financial reduced their price objective on IQVIA from $286.00 to $265.00 and set a "buy" rating for the company in a research report on Monday, November 4th. The Goldman Sachs Group lowered their target price on IQVIA from $280.00 to $250.00 and set a "buy" rating on the stock in a research report on Friday, November 1st. Redburn Atlantic initiated coverage on IQVIA in a research report on Monday, October 14th. They set a "buy" rating and a $276.00 target price for the company. Finally, Barclays reduced their price target on IQVIA from $260.00 to $255.00 and set an "overweight" rating on the stock in a research report on Friday, November 1st. Five investment analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, IQVIA currently has a consensus rating of "Moderate Buy" and a consensus target price of $256.50.

Read Our Latest Stock Report on IQV

IQVIA Price Performance

Shares of NYSE:IQV traded up $2.70 during trading on Friday, hitting $202.63. 1,388,125 shares of the company's stock were exchanged, compared to its average volume of 2,002,141. The company has a debt-to-equity ratio of 1.76, a current ratio of 0.81 and a quick ratio of 0.81. IQVIA Holdings Inc. has a 52-week low of $187.62 and a 52-week high of $261.73. The business's 50-day simple moving average is $215.18 and its 200 day simple moving average is $225.10. The company has a market cap of $36.78 billion, a price-to-earnings ratio of 26.59, a PEG ratio of 2.09 and a beta of 1.49.

IQVIA Company Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.