Teradata (NYSE:TDC - Get Free Report) was downgraded by research analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a research report issued to clients and investors on Tuesday.

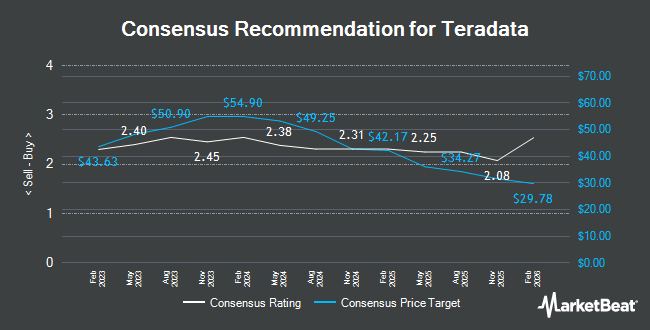

Several other brokerages have also issued reports on TDC. Morgan Stanley set a $29.00 target price on shares of Teradata in a research report on Monday, March 24th. Barclays dropped their price objective on shares of Teradata from $30.00 to $25.00 and set an "underweight" rating for the company in a report on Wednesday, February 12th. Guggenheim reduced their target price on Teradata from $42.00 to $37.00 and set a "buy" rating on the stock in a research note on Wednesday, February 12th. Evercore ISI dropped their price target on Teradata from $37.00 to $32.00 and set an "outperform" rating for the company in a research note on Wednesday, February 12th. Finally, Royal Bank of Canada cut their price objective on Teradata from $32.00 to $29.00 and set a "sector perform" rating for the company in a report on Wednesday, February 12th. Three analysts have rated the stock with a sell rating, three have issued a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, Teradata currently has an average rating of "Hold" and an average target price of $34.00.

Get Our Latest Analysis on TDC

Teradata Price Performance

Shares of TDC stock traded down $0.18 on Tuesday, reaching $20.44. The company's stock had a trading volume of 1,036,145 shares, compared to its average volume of 1,040,620. The company has a market capitalization of $1.96 billion, a P/E ratio of 17.47, a PEG ratio of 6.23 and a beta of 0.87. Teradata has a 12-month low of $18.43 and a 12-month high of $38.45. The stock's 50 day simple moving average is $23.67 and its 200-day simple moving average is $28.65. The company has a quick ratio of 0.79, a current ratio of 0.81 and a debt-to-equity ratio of 3.65.

Teradata (NYSE:TDC - Get Free Report) last announced its earnings results on Tuesday, February 11th. The technology company reported $0.30 earnings per share for the quarter, missing analysts' consensus estimates of $0.44 by ($0.14). Teradata had a return on equity of 149.16% and a net margin of 6.51%. As a group, equities analysts predict that Teradata will post 1.31 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Teradata

Several institutional investors have recently bought and sold shares of the stock. Point72 Asset Management L.P. purchased a new stake in shares of Teradata during the third quarter valued at approximately $27,000. Independence Bank of Kentucky purchased a new stake in Teradata during the 4th quarter valued at $37,000. Aster Capital Management DIFC Ltd grew its holdings in Teradata by 53.0% in the 4th quarter. Aster Capital Management DIFC Ltd now owns 1,567 shares of the technology company's stock worth $49,000 after acquiring an additional 543 shares during the last quarter. Groupama Asset Managment purchased a new position in shares of Teradata in the third quarter valued at about $50,000. Finally, GAMMA Investing LLC raised its stake in shares of Teradata by 91.5% during the fourth quarter. GAMMA Investing LLC now owns 1,829 shares of the technology company's stock valued at $57,000 after acquiring an additional 874 shares during the last quarter. 90.31% of the stock is currently owned by hedge funds and other institutional investors.

About Teradata

(

Get Free Report)

Teradata Corporation, together with its subsidiaries, provides a connected multi-cloud data platform for enterprise analytics. The company offers Teradata Vantage, an open and connected platform designed to leverage data across an enterprise. Its business consulting services include support services for organizations to establish a data and analytic vision, enable a multi-cloud ecosystem architecture, and identify and operationalize analytical opportunities, as well as to ensure the analytical infrastructure delivers value.

See Also

Before you consider Teradata, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradata wasn't on the list.

While Teradata currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.