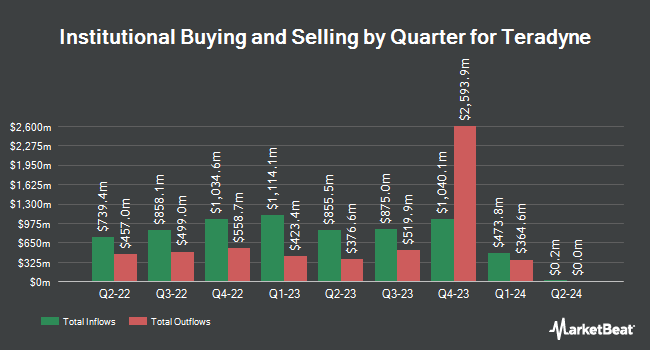

Alkeon Capital Management LLC increased its position in shares of Teradyne, Inc. (NASDAQ:TER - Free Report) by 189.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 1,144,017 shares of the company's stock after buying an additional 749,003 shares during the period. Alkeon Capital Management LLC owned about 0.70% of Teradyne worth $153,218,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently made changes to their positions in the company. Kayne Anderson Rudnick Investment Management LLC raised its holdings in shares of Teradyne by 1.3% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 4,603,123 shares of the company's stock valued at $682,597,000 after purchasing an additional 57,989 shares in the last quarter. Van ECK Associates Corp increased its holdings in Teradyne by 6.3% during the third quarter. Van ECK Associates Corp now owns 3,082,064 shares of the company's stock valued at $383,501,000 after buying an additional 183,721 shares during the period. Sumitomo Mitsui Trust Group Inc. raised its stake in Teradyne by 18.2% in the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,432,722 shares of the company's stock worth $325,814,000 after buying an additional 374,522 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its holdings in Teradyne by 2.2% during the third quarter. Allspring Global Investments Holdings LLC now owns 2,233,058 shares of the company's stock worth $299,073,000 after buying an additional 47,157 shares during the period. Finally, Charles Schwab Investment Management Inc. boosted its position in Teradyne by 5.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 968,841 shares of the company's stock valued at $129,757,000 after acquiring an additional 49,115 shares in the last quarter. 99.77% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research firms have recently commented on TER. Cantor Fitzgerald raised Teradyne from a "neutral" rating to an "overweight" rating and set a $160.00 price target for the company in a research report on Friday, August 16th. Craig Hallum cut their price objective on shares of Teradyne from $124.00 to $111.00 and set a "hold" rating on the stock in a research report on Friday, October 25th. Northland Securities decreased their target price on shares of Teradyne from $126.00 to $117.00 and set a "market perform" rating for the company in a research report on Friday, October 25th. StockNews.com raised shares of Teradyne from a "sell" rating to a "hold" rating in a report on Sunday, October 27th. Finally, Robert W. Baird decreased their price objective on Teradyne from $140.00 to $133.00 and set an "outperform" rating for the company in a report on Friday, October 25th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $142.62.

Read Our Latest Analysis on Teradyne

Teradyne Price Performance

Teradyne stock traded up $1.91 during trading hours on Friday, hitting $110.00. 1,437,423 shares of the stock traded hands, compared to its average volume of 2,041,438. Teradyne, Inc. has a 1 year low of $90.24 and a 1 year high of $163.21. The stock has a market capitalization of $17.91 billion, a price-to-earnings ratio of 34.92, a P/E/G ratio of 2.34 and a beta of 1.52. The firm's 50 day moving average price is $117.95 and its 200-day moving average price is $131.10.

Teradyne (NASDAQ:TER - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The company reported $0.90 earnings per share for the quarter, topping the consensus estimate of $0.78 by $0.12. Teradyne had a net margin of 18.75% and a return on equity of 18.56%. The company had revenue of $737.30 million for the quarter, compared to the consensus estimate of $716.40 million. During the same quarter in the prior year, the company earned $0.80 EPS. Teradyne's quarterly revenue was up 4.8% on a year-over-year basis. Research analysts forecast that Teradyne, Inc. will post 3.17 earnings per share for the current fiscal year.

Teradyne Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Monday, November 25th will be given a dividend of $0.12 per share. The ex-dividend date is Monday, November 25th. This represents a $0.48 dividend on an annualized basis and a yield of 0.44%. Teradyne's dividend payout ratio is presently 15.24%.

Teradyne declared that its board has authorized a share repurchase program on Monday, November 11th that allows the company to repurchase $100.00 million in shares. This repurchase authorization allows the company to reacquire up to 0.6% of its shares through open market purchases. Shares repurchase programs are often a sign that the company's management believes its stock is undervalued.

Insider Activity at Teradyne

In related news, insider Richard John Burns sold 789 shares of the firm's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total transaction of $104,779.20. Following the sale, the insider now owns 21,864 shares in the company, valued at approximately $2,903,539.20. This trade represents a 3.48 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Mercedes Johnson sold 625 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $133.49, for a total transaction of $83,431.25. Following the completion of the transaction, the director now owns 16,518 shares of the company's stock, valued at approximately $2,204,987.82. This trade represents a 3.65 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 8,199 shares of company stock worth $1,080,634 over the last three months. Company insiders own 0.36% of the company's stock.

Teradyne Company Profile

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Further Reading

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report