Tetra Tech (NASDAQ:TTEK - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "buy" rating to a "hold" rating in a research report issued to clients and investors on Friday.

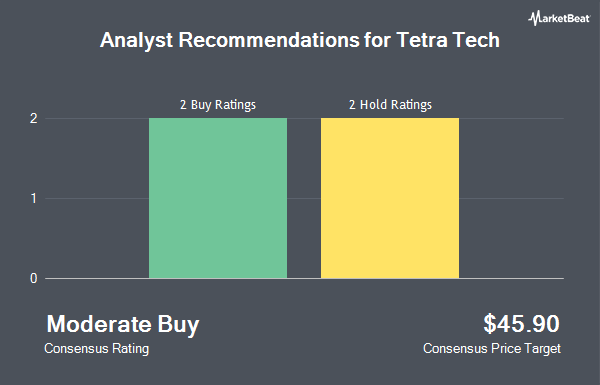

Other analysts have also issued reports about the company. KeyCorp dropped their target price on Tetra Tech from $56.00 to $49.00 and set an "overweight" rating on the stock in a report on Friday. Robert W. Baird raised their price objective on shares of Tetra Tech from $46.00 to $47.00 and gave the stock a "neutral" rating in a research note on Thursday. Finally, Royal Bank of Canada reiterated an "outperform" rating and issued a $52.00 target price on shares of Tetra Tech in a research note on Friday. Two equities research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, Tetra Tech has a consensus rating of "Moderate Buy" and an average price target of $49.32.

Read Our Latest Report on TTEK

Tetra Tech Stock Performance

NASDAQ:TTEK traded up $0.31 during mid-day trading on Friday, hitting $41.27. The company's stock had a trading volume of 4,176,183 shares, compared to its average volume of 1,457,021. The business's fifty day moving average is $47.60 and its two-hundred day moving average is $44.58. The stock has a market cap of $11.05 billion, a price-to-earnings ratio of 33.50 and a beta of 0.94. Tetra Tech has a 1 year low of $30.92 and a 1 year high of $51.20. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.21 and a quick ratio of 1.21.

Insider Buying and Selling at Tetra Tech

In other news, CFO Steven M. Burdick sold 36,830 shares of the firm's stock in a transaction that occurred on Wednesday, September 11th. The shares were sold at an average price of $46.57, for a total value of $1,715,173.10. Following the completion of the transaction, the chief financial officer now owns 112,620 shares of the company's stock, valued at approximately $5,244,713.40. This trade represents a 24.64 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, EVP Leslie L. Shoemaker sold 78,420 shares of the company's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $46.11, for a total transaction of $3,615,946.20. Following the sale, the executive vice president now directly owns 296,015 shares in the company, valued at approximately $13,649,251.65. The trade was a 20.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 121,750 shares of company stock worth $5,633,239. Corporate insiders own 0.61% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the company. US Bancorp DE boosted its holdings in Tetra Tech by 43.3% in the first quarter. US Bancorp DE now owns 3,270 shares of the industrial products company's stock valued at $604,000 after purchasing an additional 988 shares in the last quarter. Vanguard Group Inc. grew its position in shares of Tetra Tech by 0.3% in the 1st quarter. Vanguard Group Inc. now owns 5,168,554 shares of the industrial products company's stock valued at $954,684,000 after buying an additional 14,701 shares during the last quarter. Edgestream Partners L.P. raised its stake in Tetra Tech by 355.8% during the 1st quarter. Edgestream Partners L.P. now owns 9,302 shares of the industrial products company's stock worth $1,718,000 after acquiring an additional 7,261 shares in the last quarter. Covestor Ltd lifted its position in Tetra Tech by 421.1% in the first quarter. Covestor Ltd now owns 495 shares of the industrial products company's stock valued at $92,000 after acquiring an additional 400 shares during the last quarter. Finally, Bahl & Gaynor Inc. boosted its stake in Tetra Tech by 8.3% in the first quarter. Bahl & Gaynor Inc. now owns 41,546 shares of the industrial products company's stock valued at $7,674,000 after acquiring an additional 3,200 shares in the last quarter. Hedge funds and other institutional investors own 93.89% of the company's stock.

Tetra Tech Company Profile

(

Get Free Report)

Tetra Tech, Inc provides consulting and engineering services in the United States and internationally. The company operates through two segments, Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG segment offers early data collection and monitoring, data analysis and information management, science and engineering applied research, engineering design, project management, and operations and maintenance services; and climate change and energy management consulting, as well as greenhouse gas inventory assessment, certification, reduction, and management services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tetra Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Tech wasn't on the list.

While Tetra Tech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.