Tetra Tech (NASDAQ:TTEK - Get Free Report)'s stock had its "outperform" rating reaffirmed by equities research analysts at Royal Bank of Canada in a research note issued on Friday,Benzinga reports. They currently have a $52.00 price objective on the industrial products company's stock. Royal Bank of Canada's price target suggests a potential upside of 28.49% from the company's previous close.

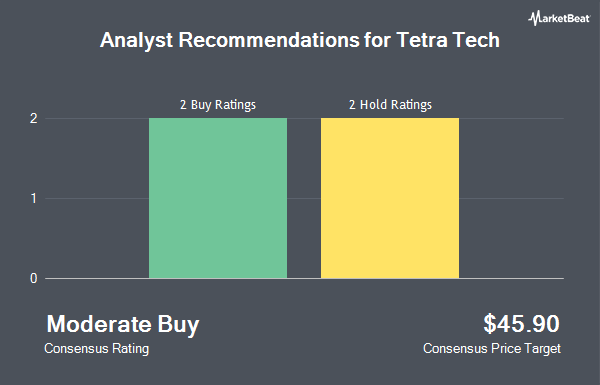

Several other equities research analysts also recently weighed in on the stock. Robert W. Baird upped their target price on shares of Tetra Tech from $46.00 to $47.00 and gave the stock a "neutral" rating in a research note on Thursday. KeyCorp reduced their target price on shares of Tetra Tech from $56.00 to $49.00 and set an "overweight" rating for the company in a report on Friday. Finally, StockNews.com raised shares of Tetra Tech from a "hold" rating to a "buy" rating in a research note on Tuesday, October 15th. One research analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $49.32.

Check Out Our Latest Analysis on TTEK

Tetra Tech Price Performance

Shares of TTEK stock traded down $0.49 during trading hours on Friday, reaching $40.47. The company had a trading volume of 1,834,099 shares, compared to its average volume of 1,446,471. The stock has a fifty day moving average of $47.82 and a 200-day moving average of $44.55. The company has a market capitalization of $10.83 billion, a price-to-earnings ratio of 32.87 and a beta of 0.94. The company has a debt-to-equity ratio of 0.52, a quick ratio of 1.21 and a current ratio of 1.21. Tetra Tech has a 12-month low of $30.92 and a 12-month high of $51.20.

Insider Transactions at Tetra Tech

In related news, CFO Steven M. Burdick sold 36,830 shares of the business's stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $46.57, for a total value of $1,715,173.10. Following the sale, the chief financial officer now directly owns 112,620 shares of the company's stock, valued at approximately $5,244,713.40. The trade was a 24.64 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, EVP Leslie L. Shoemaker sold 78,420 shares of the stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $46.11, for a total transaction of $3,615,946.20. Following the completion of the sale, the executive vice president now owns 296,015 shares of the company's stock, valued at approximately $13,649,251.65. This represents a 20.94 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 121,750 shares of company stock worth $5,633,239 in the last 90 days. 0.61% of the stock is owned by insiders.

Institutional Investors Weigh In On Tetra Tech

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Vanguard Group Inc. increased its stake in shares of Tetra Tech by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 5,168,554 shares of the industrial products company's stock worth $954,684,000 after purchasing an additional 14,701 shares during the last quarter. Sarasin & Partners LLP lifted its stake in Tetra Tech by 330.9% in the third quarter. Sarasin & Partners LLP now owns 4,950,383 shares of the industrial products company's stock worth $233,460,000 after purchasing an additional 3,801,435 shares during the last quarter. Allspring Global Investments Holdings LLC increased its position in shares of Tetra Tech by 387.3% in the third quarter. Allspring Global Investments Holdings LLC now owns 3,299,418 shares of the industrial products company's stock valued at $155,601,000 after acquiring an additional 2,622,288 shares during the period. abrdn plc boosted its holdings in Tetra Tech by 353.0% in the third quarter. abrdn plc now owns 2,110,076 shares of the industrial products company's stock valued at $98,477,000 after acquiring an additional 1,644,267 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its position in shares of Tetra Tech by 357.8% during the third quarter. Charles Schwab Investment Management Inc. now owns 2,070,483 shares of the industrial products company's stock valued at $97,644,000 after purchasing an additional 1,618,211 shares in the last quarter. 93.89% of the stock is owned by institutional investors.

Tetra Tech Company Profile

(

Get Free Report)

Tetra Tech, Inc provides consulting and engineering services in the United States and internationally. The company operates through two segments, Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG segment offers early data collection and monitoring, data analysis and information management, science and engineering applied research, engineering design, project management, and operations and maintenance services; and climate change and energy management consulting, as well as greenhouse gas inventory assessment, certification, reduction, and management services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tetra Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Tech wasn't on the list.

While Tetra Tech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.