Investment Management Corp of Ontario raised its position in shares of Texas Instruments Incorporated (NASDAQ:TXN - Free Report) by 48.6% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 30,260 shares of the semiconductor company's stock after acquiring an additional 9,900 shares during the period. Investment Management Corp of Ontario's holdings in Texas Instruments were worth $6,251,000 at the end of the most recent quarter.

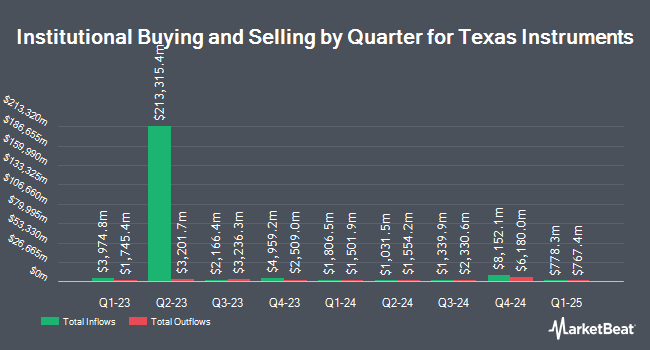

Other institutional investors have also made changes to their positions in the company. Charles Schwab Investment Management Inc. raised its position in Texas Instruments by 4.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 19,250,433 shares of the semiconductor company's stock valued at $3,976,562,000 after purchasing an additional 782,053 shares in the last quarter. Massachusetts Financial Services Co. MA raised its position in Texas Instruments by 0.5% during the third quarter. Massachusetts Financial Services Co. MA now owns 8,060,213 shares of the semiconductor company's stock valued at $1,664,998,000 after purchasing an additional 36,441 shares in the last quarter. Legal & General Group Plc raised its position in Texas Instruments by 0.8% during the second quarter. Legal & General Group Plc now owns 7,831,270 shares of the semiconductor company's stock valued at $1,523,415,000 after purchasing an additional 64,067 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in Texas Instruments by 1.6% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 7,773,932 shares of the semiconductor company's stock valued at $1,605,861,000 after purchasing an additional 124,712 shares in the last quarter. Finally, Van ECK Associates Corp raised its position in Texas Instruments by 3.6% during the third quarter. Van ECK Associates Corp now owns 6,168,241 shares of the semiconductor company's stock valued at $1,244,381,000 after purchasing an additional 212,888 shares in the last quarter. 84.99% of the stock is currently owned by institutional investors.

Insider Activity

In related news, Director Ronald Kirk sold 10,539 shares of Texas Instruments stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $203.33, for a total transaction of $2,142,894.87. Following the completion of the transaction, the director now directly owns 14,323 shares of the company's stock, valued at approximately $2,912,295.59. The trade was a 42.39 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Robert E. Sanchez sold 9,990 shares of Texas Instruments stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $208.80, for a total transaction of $2,085,912.00. Following the transaction, the director now directly owns 20,461 shares of the company's stock, valued at approximately $4,272,256.80. This represents a 32.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.68% of the company's stock.

Texas Instruments Stock Down 0.4 %

TXN traded down $0.84 during midday trading on Wednesday, reaching $196.39. The company's stock had a trading volume of 2,115,157 shares, compared to its average volume of 5,535,849. The firm has a market capitalization of $179.15 billion, a price-to-earnings ratio of 36.85, a PEG ratio of 4.41 and a beta of 0.97. The company has a current ratio of 4.31, a quick ratio of 3.14 and a debt-to-equity ratio of 0.74. Texas Instruments Incorporated has a 1 year low of $154.68 and a 1 year high of $220.38. The stock's 50-day moving average is $204.09 and its 200-day moving average is $200.95.

Texas Instruments (NASDAQ:TXN - Get Free Report) last posted its quarterly earnings results on Tuesday, October 22nd. The semiconductor company reported $1.47 EPS for the quarter, beating analysts' consensus estimates of $1.38 by $0.09. Texas Instruments had a net margin of 31.60% and a return on equity of 29.05%. The firm had revenue of $4.15 billion for the quarter, compared to analysts' expectations of $4.12 billion. During the same quarter in the prior year, the company posted $1.80 earnings per share. The business's revenue for the quarter was down 8.4% on a year-over-year basis. As a group, research analysts expect that Texas Instruments Incorporated will post 5.08 EPS for the current year.

Texas Instruments Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, November 12th. Stockholders of record on Thursday, October 31st were given a dividend of $1.36 per share. This represents a $5.44 annualized dividend and a dividend yield of 2.77%. This is an increase from Texas Instruments's previous quarterly dividend of $1.30. The ex-dividend date was Thursday, October 31st. Texas Instruments's dividend payout ratio (DPR) is presently 101.12%.

Analyst Upgrades and Downgrades

A number of analysts recently weighed in on TXN shares. Susquehanna decreased their price objective on Texas Instruments from $250.00 to $240.00 and set a "positive" rating for the company in a report on Monday, October 21st. Robert W. Baird lowered their target price on Texas Instruments from $200.00 to $175.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. Mizuho set a $200.00 target price on Texas Instruments in a research report on Friday, October 18th. Benchmark reaffirmed a "buy" rating and set a $230.00 target price on shares of Texas Instruments in a research report on Wednesday, October 23rd. Finally, Evercore ISI raised their target price on Texas Instruments from $268.00 to $298.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 23rd. Two investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and nine have assigned a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $210.05.

View Our Latest Research Report on Texas Instruments

Texas Instruments Company Profile

(

Free Report)

Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products.

Featured Articles

Before you consider Texas Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Instruments wasn't on the list.

While Texas Instruments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report