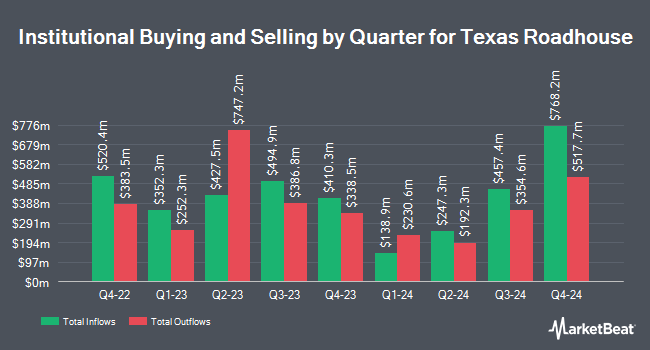

Quadrature Capital Ltd reduced its stake in Texas Roadhouse, Inc. (NASDAQ:TXRH - Free Report) by 52.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 6,511 shares of the restaurant operator's stock after selling 7,230 shares during the period. Quadrature Capital Ltd's holdings in Texas Roadhouse were worth $1,149,000 at the end of the most recent reporting period.

Other institutional investors have also recently made changes to their positions in the company. Kingsview Wealth Management LLC increased its position in Texas Roadhouse by 3.1% during the 3rd quarter. Kingsview Wealth Management LLC now owns 1,771 shares of the restaurant operator's stock valued at $313,000 after purchasing an additional 54 shares during the period. CIBC Asset Management Inc raised its stake in Texas Roadhouse by 3.3% in the third quarter. CIBC Asset Management Inc now owns 1,952 shares of the restaurant operator's stock worth $345,000 after buying an additional 62 shares in the last quarter. Insight Wealth Partners LLC raised its position in shares of Texas Roadhouse by 3.9% in the 3rd quarter. Insight Wealth Partners LLC now owns 1,818 shares of the restaurant operator's stock worth $321,000 after acquiring an additional 68 shares in the last quarter. PSI Advisors LLC grew its stake in Texas Roadhouse by 70.8% in the third quarter. PSI Advisors LLC now owns 181 shares of the restaurant operator's stock worth $32,000 after purchasing an additional 75 shares during the period. Finally, Angeles Wealth Management LLC grew its position in shares of Texas Roadhouse by 5.4% in the 3rd quarter. Angeles Wealth Management LLC now owns 1,469 shares of the restaurant operator's stock worth $259,000 after buying an additional 75 shares during the period. Hedge funds and other institutional investors own 94.82% of the company's stock.

Insider Activity

In related news, CTO Hernan E. Mujica sold 1,500 shares of the business's stock in a transaction dated Thursday, November 14th. The stock was sold at an average price of $202.26, for a total value of $303,390.00. Following the sale, the chief technology officer now directly owns 16,342 shares in the company, valued at approximately $3,305,332.92. The trade was a 8.41 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Donna E. Epps sold 610 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $195.66, for a total value of $119,352.60. Following the transaction, the director now directly owns 3,532 shares of the company's stock, valued at approximately $691,071.12. The trade was a 14.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.50% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on the company. Loop Capital cut their price target on Texas Roadhouse from $215.00 to $209.00 and set a "buy" rating on the stock in a research note on Monday, October 28th. Royal Bank of Canada increased their target price on Texas Roadhouse from $175.00 to $185.00 and gave the stock a "sector perform" rating in a research note on Friday, October 25th. Guggenheim lifted their price target on Texas Roadhouse from $190.00 to $195.00 and gave the stock a "buy" rating in a research report on Wednesday, September 25th. Evercore ISI increased their price objective on shares of Texas Roadhouse from $195.00 to $200.00 and gave the company an "outperform" rating in a research report on Tuesday, October 15th. Finally, Stifel Nicolaus raised their price objective on shares of Texas Roadhouse from $180.00 to $195.00 and gave the company a "hold" rating in a research note on Friday, October 25th. Thirteen analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company. According to MarketBeat.com, Texas Roadhouse has a consensus rating of "Hold" and an average price target of $190.09.

Read Our Latest Stock Analysis on Texas Roadhouse

Texas Roadhouse Stock Up 0.1 %

NASDAQ:TXRH traded up $0.25 during mid-day trading on Friday, hitting $196.56. 570,621 shares of the company traded hands, compared to its average volume of 637,930. The stock's fifty day moving average price is $189.31 and its 200-day moving average price is $176.14. The firm has a market cap of $13.11 billion, a price-to-earnings ratio of 33.77, a price-to-earnings-growth ratio of 1.67 and a beta of 0.98. Texas Roadhouse, Inc. has a one year low of $112.87 and a one year high of $206.04.

Texas Roadhouse (NASDAQ:TXRH - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The restaurant operator reported $1.26 earnings per share for the quarter, missing analysts' consensus estimates of $1.32 by ($0.06). The firm had revenue of $1.27 billion during the quarter, compared to the consensus estimate of $1.27 billion. Texas Roadhouse had a return on equity of 31.33% and a net margin of 7.65%. During the same quarter in the previous year, the company earned $0.95 earnings per share. The business's revenue for the quarter was up 13.5% compared to the same quarter last year. Equities analysts predict that Texas Roadhouse, Inc. will post 6.39 EPS for the current year.

Texas Roadhouse Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Tuesday, December 10th will be issued a dividend of $0.61 per share. This represents a $2.44 dividend on an annualized basis and a yield of 1.24%. The ex-dividend date of this dividend is Tuesday, December 10th. Texas Roadhouse's dividend payout ratio (DPR) is currently 41.92%.

Texas Roadhouse Profile

(

Free Report)

Texas Roadhouse, Inc, together with its subsidiaries, operates casual dining restaurants in the United States and internationally. It also operates and franchises restaurants under the Texas Roadhouse, Bubba's 33, and Jaggers names in 49 states and ten internationally. Texas Roadhouse, Inc was founded in 1993 and is based in Louisville, Kentucky.

Featured Stories

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.