Geneva Capital Management LLC lifted its stake in Texas Roadhouse, Inc. (NASDAQ:TXRH - Free Report) by 0.4% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 922,405 shares of the restaurant operator's stock after buying an additional 3,584 shares during the period. Texas Roadhouse makes up 2.7% of Geneva Capital Management LLC's investment portfolio, making the stock its 8th largest holding. Geneva Capital Management LLC owned about 1.38% of Texas Roadhouse worth $162,897,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

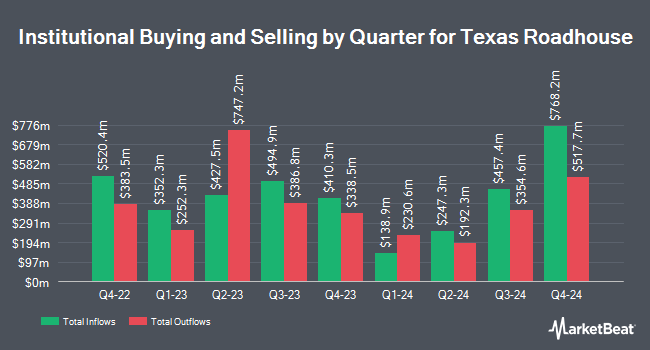

Other hedge funds and other institutional investors also recently bought and sold shares of the company. LRI Investments LLC acquired a new position in Texas Roadhouse during the first quarter valued at approximately $25,000. Thurston Springer Miller Herd & Titak Inc. acquired a new position in shares of Texas Roadhouse in the 2nd quarter valued at about $25,000. Hollencrest Capital Management acquired a new position in Texas Roadhouse in the second quarter worth approximately $25,000. McClarren Financial Advisors Inc. grew its holdings in Texas Roadhouse by 4,175.0% during the second quarter. McClarren Financial Advisors Inc. now owns 171 shares of the restaurant operator's stock valued at $29,000 after purchasing an additional 167 shares during the last quarter. Finally, PSI Advisors LLC lifted its position in Texas Roadhouse by 70.8% in the third quarter. PSI Advisors LLC now owns 181 shares of the restaurant operator's stock worth $32,000 after purchasing an additional 75 shares during the period. 94.82% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts have recently commented on TXRH shares. UBS Group boosted their target price on shares of Texas Roadhouse from $200.00 to $210.00 and gave the company a "buy" rating in a research note on Friday, October 25th. Royal Bank of Canada boosted their price objective on Texas Roadhouse from $175.00 to $185.00 and gave the stock a "sector perform" rating in a report on Friday, October 25th. Bank of America upped their price target on Texas Roadhouse from $206.00 to $234.00 and gave the company a "buy" rating in a research note on Tuesday, October 22nd. Guggenheim boosted their price objective on Texas Roadhouse from $190.00 to $195.00 and gave the company a "buy" rating in a research report on Wednesday, September 25th. Finally, BTIG Research boosted their price objective on Texas Roadhouse from $175.00 to $190.00 and gave the company a "buy" rating in a research report on Friday, July 26th. Twelve research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $189.00.

Get Our Latest Stock Analysis on TXRH

Texas Roadhouse Trading Up 0.9 %

Shares of NASDAQ:TXRH traded up $1.75 during mid-day trading on Tuesday, hitting $196.23. 202,797 shares of the company traded hands, compared to its average volume of 771,830. The stock has a market cap of $13.09 billion, a P/E ratio of 33.42, a P/E/G ratio of 1.68 and a beta of 0.98. Texas Roadhouse, Inc. has a 12-month low of $103.27 and a 12-month high of $201.24. The stock has a 50-day moving average price of $177.63 and a two-hundred day moving average price of $171.71.

Texas Roadhouse (NASDAQ:TXRH - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The restaurant operator reported $1.26 earnings per share for the quarter, missing the consensus estimate of $1.32 by ($0.06). The business had revenue of $1.27 billion during the quarter, compared to analysts' expectations of $1.27 billion. Texas Roadhouse had a return on equity of 31.33% and a net margin of 7.65%. The firm's revenue for the quarter was up 13.5% on a year-over-year basis. During the same period in the prior year, the firm posted $0.95 EPS. As a group, analysts expect that Texas Roadhouse, Inc. will post 6.39 earnings per share for the current year.

Texas Roadhouse Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Tuesday, December 10th will be paid a $0.61 dividend. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $2.44 dividend on an annualized basis and a yield of 1.24%. Texas Roadhouse's dividend payout ratio is currently 41.92%.

Texas Roadhouse Profile

(

Free Report)

Texas Roadhouse, Inc, together with its subsidiaries, operates casual dining restaurants in the United States and internationally. It also operates and franchises restaurants under the Texas Roadhouse, Bubba's 33, and Jaggers names in 49 states and ten internationally. Texas Roadhouse, Inc was founded in 1993 and is based in Louisville, Kentucky.

See Also

Want to see what other hedge funds are holding TXRH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Texas Roadhouse, Inc. (NASDAQ:TXRH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.