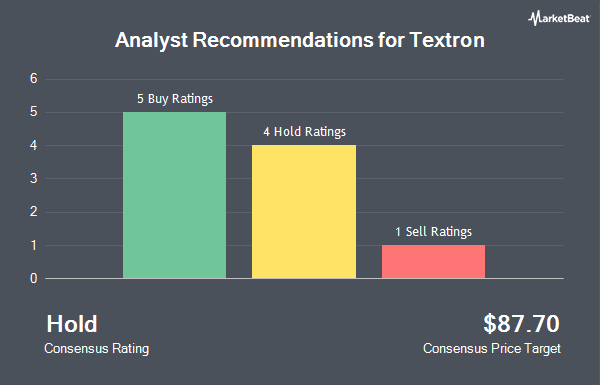

Textron Inc. (NYSE:TXT - Get Free Report) has been assigned a consensus recommendation of "Hold" from the nine research firms that are covering the firm, MarketBeat.com reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and five have issued a buy recommendation on the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $101.56.

Several analysts have recently weighed in on the stock. JPMorgan Chase & Co. dropped their price objective on shares of Textron from $100.00 to $95.00 and set a "neutral" rating for the company in a report on Monday, October 14th. UBS Group lowered their price target on shares of Textron from $87.00 to $79.00 and set a "sell" rating for the company in a report on Friday, October 25th. StockNews.com lowered shares of Textron from a "strong-buy" rating to a "buy" rating in a report on Thursday, September 12th. Robert W. Baird lowered their price target on shares of Textron from $109.00 to $100.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Finally, TD Cowen lowered shares of Textron from a "buy" rating to a "hold" rating and lowered their price target for the company from $103.00 to $95.00 in a report on Wednesday, September 25th.

Read Our Latest Analysis on TXT

Institutional Investors Weigh In On Textron

Several large investors have recently modified their holdings of TXT. Innealta Capital LLC acquired a new position in shares of Textron in the 2nd quarter valued at approximately $25,000. True Wealth Design LLC bought a new position in Textron in the third quarter valued at approximately $26,000. Harel Insurance Investments & Financial Services Ltd. bought a new position in Textron in the second quarter valued at approximately $30,000. Oakworth Capital Inc. bought a new position in Textron in the second quarter valued at approximately $31,000. Finally, Family Firm Inc. bought a new position in Textron in the second quarter valued at approximately $40,000. 86.03% of the stock is currently owned by institutional investors.

Textron Price Performance

TXT traded down $0.23 during midday trading on Monday, reaching $82.43. 1,112,588 shares of the company's stock were exchanged, compared to its average volume of 1,081,224. The firm has a market capitalization of $15.29 billion, a price-to-earnings ratio of 18.17, a price-to-earnings-growth ratio of 1.49 and a beta of 1.25. The company has a quick ratio of 0.82, a current ratio of 1.83 and a debt-to-equity ratio of 0.46. Textron has a one year low of $75.81 and a one year high of $97.33. The business has a 50-day simple moving average of $85.49 and a two-hundred day simple moving average of $86.96.

Textron (NYSE:TXT - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The aerospace company reported $1.40 earnings per share for the quarter, missing the consensus estimate of $1.49 by ($0.09). The firm had revenue of $3.43 billion for the quarter, compared to analyst estimates of $3.50 billion. Textron had a return on equity of 16.02% and a net margin of 6.30%. The business's quarterly revenue was up 2.5% on a year-over-year basis. During the same period in the previous year, the business posted $1.49 EPS. As a group, research analysts predict that Textron will post 5.52 EPS for the current year.

Textron Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Shareholders of record on Friday, December 13th will be issued a dividend of $0.02 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.08 annualized dividend and a yield of 0.10%. Textron's dividend payout ratio is presently 1.76%.

Textron Company Profile

(

Get Free ReportTextron Inc operates in the aircraft, defense, industrial, and finance businesses worldwide. It operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. The Textron Aviation segment manufactures, sells, and services business jets, turboprop and piston engine aircraft, and military trainer and defense aircraft; and offers maintenance, inspection, and repair services, as well as sells commercial parts.

Further Reading

Before you consider Textron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Textron wasn't on the list.

While Textron currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.