Bank of New York Mellon Corp lifted its stake in TFI International Inc. (NYSE:TFII - Free Report) by 6.4% during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 78,621 shares of the company's stock after purchasing an additional 4,763 shares during the period. Bank of New York Mellon Corp owned 0.09% of TFI International worth $10,621,000 at the end of the most recent quarter.

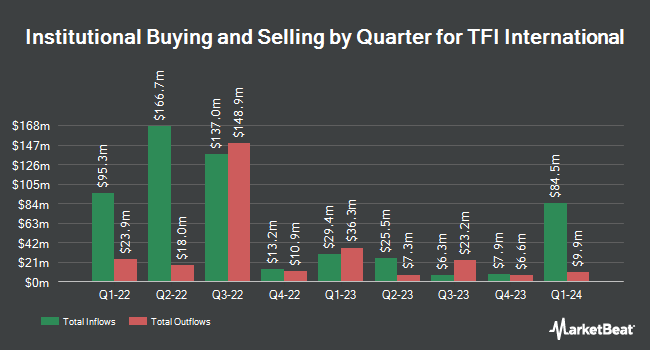

Several other large investors have also recently bought and sold shares of the company. Baillie Gifford & Co. bought a new stake in shares of TFI International in the fourth quarter worth $148,623,000. Legato Capital Management LLC boosted its holdings in shares of TFI International by 8.9% during the fourth quarter. Legato Capital Management LLC now owns 10,468 shares of the company's stock worth $1,414,000 after acquiring an additional 859 shares during the period. Entropy Technologies LP grew its holdings in TFI International by 97.8% in the 4th quarter. Entropy Technologies LP now owns 9,295 shares of the company's stock valued at $1,256,000 after buying an additional 4,595 shares in the last quarter. Canoe Financial LP bought a new stake in TFI International in the 4th quarter valued at about $1,853,000. Finally, Toronto Dominion Bank raised its holdings in TFI International by 37.9% in the 3rd quarter. Toronto Dominion Bank now owns 60,112 shares of the company's stock valued at $8,229,000 after acquiring an additional 16,510 shares in the last quarter. Institutional investors own 73.30% of the company's stock.

Analysts Set New Price Targets

TFII has been the topic of several research reports. Veritas lowered shares of TFI International from a "strong-buy" rating to a "hold" rating in a report on Friday, February 21st. Royal Bank of Canada dropped their target price on TFI International from $156.00 to $127.00 and set an "outperform" rating for the company in a research report on Friday, February 21st. Susquehanna reduced their price target on TFI International from $170.00 to $135.00 and set a "positive" rating on the stock in a report on Monday, March 3rd. Bank of America cut shares of TFI International from a "neutral" rating to an "underperform" rating in a research report on Thursday, February 20th. Finally, Stephens decreased their price objective on TFI International from $138.00 to $110.00 and set an "equal weight" rating for the company in a report on Tuesday, February 25th. One research analyst has rated the stock with a sell rating, six have assigned a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $148.93.

Read Our Latest Report on TFII

TFI International Price Performance

Shares of NYSE:TFII traded up $0.63 on Friday, hitting $82.52. The company's stock had a trading volume of 344,175 shares, compared to its average volume of 420,709. The company has a 50-day simple moving average of $117.33 and a 200 day simple moving average of $133.89. TFI International Inc. has a 1 year low of $80.19 and a 1 year high of $162.13. The company has a debt-to-equity ratio of 0.86, a current ratio of 1.03 and a quick ratio of 0.96. The company has a market capitalization of $6.95 billion, a PE ratio of 16.50, a PEG ratio of 1.11 and a beta of 1.62.

TFI International (NYSE:TFII - Get Free Report) last posted its earnings results on Wednesday, February 19th. The company reported $1.19 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.59 by ($0.40). TFI International had a return on equity of 18.40% and a net margin of 5.08%. The business had revenue of $2.08 billion during the quarter, compared to the consensus estimate of $1.54 billion. Sell-side analysts forecast that TFI International Inc. will post 7.76 EPS for the current fiscal year.

TFI International Profile

(

Free Report)

TFI International Inc, together with its subsidiaries, provides transportation and logistics services in the United States and Canada. The company operates through Package and Courier, Less-Than-Truckload (LTL), Truckload (TL), and Logistics segments. The Package and Courier segment engages in the pickup, transport, and delivery of items in North America.

Featured Articles

Before you consider TFI International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TFI International wasn't on the list.

While TFI International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.