TG Therapeutics (NASDAQ:TGTX - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "hold" rating to a "sell" rating in a report released on Friday.

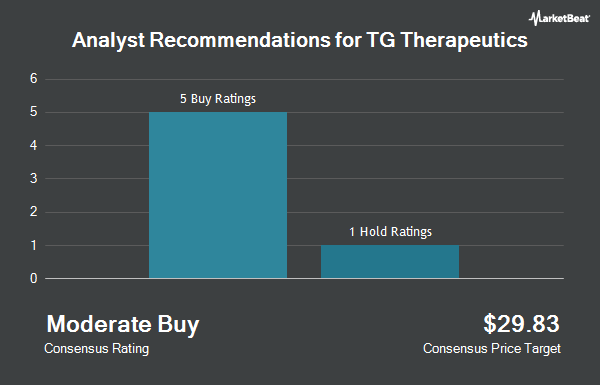

TGTX has been the subject of a number of other reports. JPMorgan Chase & Co. upped their price target on shares of TG Therapeutics from $30.00 to $43.00 and gave the stock an "overweight" rating in a research report on Monday, November 25th. HC Wainwright upped their target price on TG Therapeutics from $49.00 to $55.00 and gave the stock a "buy" rating in a research report on Tuesday, November 5th. The Goldman Sachs Group increased their target price on TG Therapeutics from $20.00 to $22.00 and gave the company a "neutral" rating in a research note on Tuesday, November 5th. Finally, TD Cowen began coverage on TG Therapeutics in a research report on Tuesday, October 29th. They set a "buy" rating and a $50.00 price target on the stock. One analyst has rated the stock with a sell rating, one has issued a hold rating and five have given a buy rating to the company. Based on data from MarketBeat.com, TG Therapeutics currently has a consensus rating of "Moderate Buy" and a consensus price target of $40.67.

View Our Latest Stock Analysis on TGTX

TG Therapeutics Price Performance

NASDAQ:TGTX traded up $0.28 during trading hours on Friday, hitting $33.93. The company's stock had a trading volume of 1,317,530 shares, compared to its average volume of 3,636,542. The company has a market capitalization of $5.28 billion, a PE ratio of -339.27 and a beta of 2.25. TG Therapeutics has a 52-week low of $12.84 and a 52-week high of $36.84. The business's 50-day moving average is $27.44 and its two-hundred day moving average is $22.72. The company has a debt-to-equity ratio of 1.27, a quick ratio of 3.91 and a current ratio of 4.59.

TG Therapeutics (NASDAQ:TGTX - Get Free Report) last posted its earnings results on Monday, November 4th. The biopharmaceutical company reported $0.02 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.03 by ($0.01). TG Therapeutics had a negative net margin of 5.42% and a negative return on equity of 8.32%. The company had revenue of $83.90 million during the quarter, compared to analysts' expectations of $81.68 million. During the same period in the previous year, the company posted $0.73 EPS. TG Therapeutics's quarterly revenue was down 49.4% compared to the same quarter last year. As a group, research analysts anticipate that TG Therapeutics will post 0.17 EPS for the current fiscal year.

Insider Buying and Selling at TG Therapeutics

In other TG Therapeutics news, Director Sagar Lonial sold 5,000 shares of the business's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $30.44, for a total value of $152,200.00. Following the completion of the transaction, the director now directly owns 100,195 shares of the company's stock, valued at approximately $3,049,935.80. The trade was a 4.75 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Insiders own 10.50% of the company's stock.

Institutional Trading of TG Therapeutics

A number of institutional investors and hedge funds have recently modified their holdings of TGTX. NBC Securities Inc. lifted its holdings in shares of TG Therapeutics by 58.9% during the 3rd quarter. NBC Securities Inc. now owns 1,309 shares of the biopharmaceutical company's stock valued at $30,000 after purchasing an additional 485 shares in the last quarter. Blue Trust Inc. lifted its stake in TG Therapeutics by 127.3% in the third quarter. Blue Trust Inc. now owns 1,516 shares of the biopharmaceutical company's stock valued at $35,000 after buying an additional 849 shares in the last quarter. Ashton Thomas Private Wealth LLC acquired a new position in shares of TG Therapeutics in the second quarter valued at approximately $35,000. ORG Wealth Partners LLC bought a new stake in shares of TG Therapeutics during the third quarter worth $53,000. Finally, Values First Advisors Inc. acquired a new stake in shares of TG Therapeutics during the third quarter worth $58,000. 58.58% of the stock is owned by institutional investors.

About TG Therapeutics

(

Get Free Report)

TG Therapeutics, Inc, a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. It provides BRIUMVI, an anti-CD20 monoclonal antibody for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease in adults.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TG Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TG Therapeutics wasn't on the list.

While TG Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.