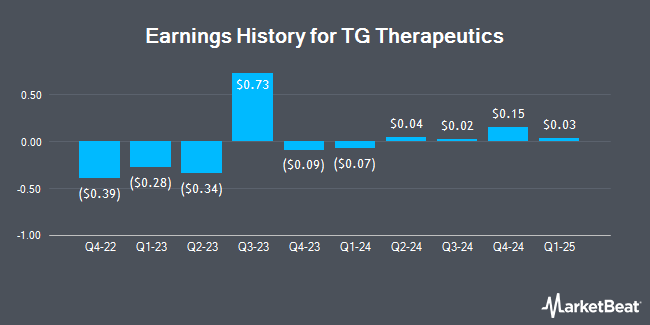

TG Therapeutics (NASDAQ:TGTX - Get Free Report) posted its quarterly earnings data on Monday. The biopharmaceutical company reported $0.15 earnings per share for the quarter, beating the consensus estimate of $0.09 by $0.06, Zacks reports. TG Therapeutics had a negative return on equity of 8.32% and a negative net margin of 5.42%.

TG Therapeutics Stock Up 14.4 %

TG Therapeutics stock traded up $4.33 during trading hours on Monday, hitting $34.42. The stock had a trading volume of 13,494,362 shares, compared to its average volume of 2,441,278. The company has a quick ratio of 3.91, a current ratio of 4.59 and a debt-to-equity ratio of 1.27. The stock has a market capitalization of $5.36 billion, a P/E ratio of -344.17 and a beta of 2.26. TG Therapeutics has a 12-month low of $12.93 and a 12-month high of $36.84. The stock's 50-day moving average price is $30.79 and its 200-day moving average price is $28.24.

Analysts Set New Price Targets

A number of research analysts have recently commented on TGTX shares. The Goldman Sachs Group raised their target price on TG Therapeutics from $20.00 to $22.00 and gave the company a "neutral" rating in a research note on Tuesday, November 5th. JPMorgan Chase & Co. raised their price objective on TG Therapeutics from $30.00 to $43.00 and gave the company an "overweight" rating in a research report on Monday, November 25th. HC Wainwright reaffirmed a "buy" rating and issued a $55.00 target price on shares of TG Therapeutics in a research report on Wednesday, January 15th. Finally, StockNews.com cut shares of TG Therapeutics from a "hold" rating to a "sell" rating in a research report on Friday, January 31st. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat, TG Therapeutics currently has an average rating of "Moderate Buy" and an average price target of $40.67.

Read Our Latest Stock Report on TG Therapeutics

Insider Transactions at TG Therapeutics

In related news, CFO Sean A. Power sold 10,021 shares of the business's stock in a transaction that occurred on Monday, January 6th. The shares were sold at an average price of $28.53, for a total value of $285,899.13. Following the completion of the transaction, the chief financial officer now directly owns 660,611 shares in the company, valued at $18,847,231.83. The trade was a 1.49 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 10.50% of the company's stock.

TG Therapeutics Company Profile

(

Get Free Report)

TG Therapeutics, Inc, a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. It provides BRIUMVI, an anti-CD20 monoclonal antibody for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease in adults.

Featured Articles

Before you consider TG Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TG Therapeutics wasn't on the list.

While TG Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.