Pathstone Holdings LLC lifted its stake in The Bancorp, Inc. (NASDAQ:TBBK - Free Report) by 53.5% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 32,126 shares of the bank's stock after buying an additional 11,197 shares during the period. Pathstone Holdings LLC owned approximately 0.07% of Bancorp worth $1,719,000 as of its most recent SEC filing.

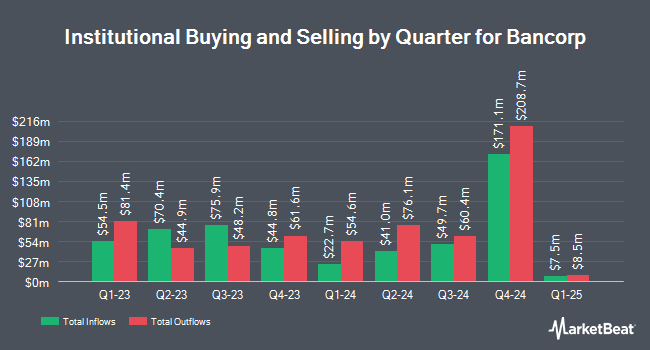

A number of other large investors have also modified their holdings of the stock. Blue Trust Inc. boosted its stake in shares of Bancorp by 72.3% during the 3rd quarter. Blue Trust Inc. now owns 627 shares of the bank's stock valued at $34,000 after buying an additional 263 shares during the last quarter. GAMMA Investing LLC boosted its stake in Bancorp by 60.5% during the 2nd quarter. GAMMA Investing LLC now owns 772 shares of the bank's stock valued at $29,000 after acquiring an additional 291 shares during the last quarter. US Bancorp DE bought a new position in Bancorp during the 3rd quarter valued at $83,000. EverSource Wealth Advisors LLC grew its holdings in Bancorp by 345.7% during the 1st quarter. EverSource Wealth Advisors LLC now owns 1,640 shares of the bank's stock worth $55,000 after acquiring an additional 1,272 shares in the last quarter. Finally, Summit Asset Management LLC bought a new stake in shares of Bancorp in the 3rd quarter worth about $281,000. Institutional investors and hedge funds own 96.22% of the company's stock.

Insider Transactions at Bancorp

In related news, Director Matthew Cohn acquired 545 shares of the business's stock in a transaction dated Tuesday, October 29th. The stock was bought at an average price of $50.11 per share, for a total transaction of $27,309.95. Following the transaction, the director now owns 56,636 shares of the company's stock, valued at approximately $2,838,029.96. The trade was a 0.97 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CMO Maria Wainwright sold 11,357 shares of the firm's stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $50.08, for a total value of $568,758.56. Following the sale, the chief marketing officer now directly owns 23,291 shares of the company's stock, valued at approximately $1,166,413.28. This represents a 32.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 26,983 shares of company stock valued at $1,345,366 in the last quarter. Insiders own 5.20% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded Bancorp from a "sell" rating to a "hold" rating in a research note on Monday.

Check Out Our Latest Report on Bancorp

Bancorp Price Performance

NASDAQ TBBK traded up $0.22 on Thursday, reaching $59.05. 380,977 shares of the stock traded hands, compared to its average volume of 626,463. The Bancorp, Inc. has a 12 month low of $29.92 and a 12 month high of $61.17. The company has a market cap of $2.83 billion, a price-to-earnings ratio of 14.91 and a beta of 1.46. The firm's fifty day simple moving average is $54.14 and its 200 day simple moving average is $46.46. The company has a quick ratio of 0.85, a current ratio of 0.88 and a debt-to-equity ratio of 0.18.

Bancorp (NASDAQ:TBBK - Get Free Report) last announced its earnings results on Thursday, October 24th. The bank reported $1.04 earnings per share for the quarter, missing the consensus estimate of $1.12 by ($0.08). Bancorp had a net margin of 30.97% and a return on equity of 26.63%. The firm had revenue of $125.84 million for the quarter, compared to the consensus estimate of $131.34 million. During the same period in the prior year, the business earned $0.92 EPS. As a group, research analysts predict that The Bancorp, Inc. will post 4.3 EPS for the current fiscal year.

Bancorp Profile

(

Free Report)

The Bancorp, Inc operates as the bank holding company for The Bancorp Bank, National Association that provides banking products and services in the United States. It offers a range of deposit products and services, including checking, savings, time, money market, and commercial accounts; overdrafts; and certificates of deposit.

Further Reading

Before you consider Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bancorp wasn't on the list.

While Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.