Parnassus Investments LLC trimmed its holdings in The Bank of New York Mellon Co. (NYSE:BK - Free Report) by 13.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,202,990 shares of the bank's stock after selling 493,789 shares during the period. Parnassus Investments LLC owned 0.44% of Bank of New York Mellon worth $230,167,000 as of its most recent filing with the Securities and Exchange Commission.

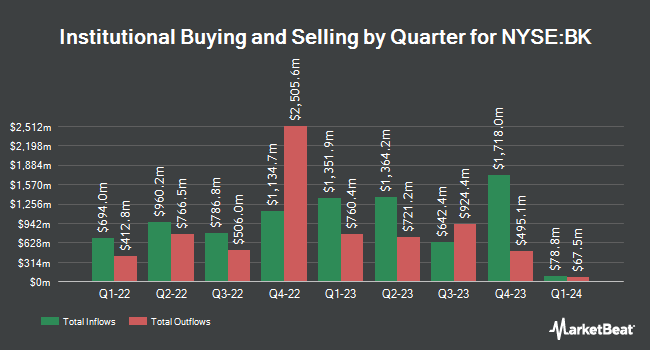

A number of other hedge funds and other institutional investors also recently made changes to their positions in BK. Stanley Laman Group Ltd. increased its stake in Bank of New York Mellon by 2.2% in the third quarter. Stanley Laman Group Ltd. now owns 6,198 shares of the bank's stock valued at $445,000 after acquiring an additional 135 shares during the last quarter. Avidian Wealth Enterprises LLC increased its stake in Bank of New York Mellon by 2.0% in the third quarter. Avidian Wealth Enterprises LLC now owns 7,024 shares of the bank's stock valued at $505,000 after acquiring an additional 137 shares during the last quarter. Frank Rimerman Advisors LLC increased its stake in Bank of New York Mellon by 1.1% in the third quarter. Frank Rimerman Advisors LLC now owns 12,908 shares of the bank's stock valued at $928,000 after acquiring an additional 142 shares during the last quarter. Sigma Planning Corp increased its stake in Bank of New York Mellon by 2.7% in the third quarter. Sigma Planning Corp now owns 5,470 shares of the bank's stock valued at $393,000 after acquiring an additional 143 shares during the last quarter. Finally, Grove Bank & Trust grew its stake in shares of Bank of New York Mellon by 28.8% during the third quarter. Grove Bank & Trust now owns 644 shares of the bank's stock worth $46,000 after buying an additional 144 shares during the last quarter. 85.31% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Bank of New York Mellon

In other news, EVP J Kevin Mccarthy sold 25,000 shares of the stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $76.31, for a total transaction of $1,907,750.00. Following the completion of the transaction, the executive vice president now directly owns 75,404 shares of the company's stock, valued at $5,754,079.24. This represents a 24.90 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Hanneke Smits sold 16,475 shares of the stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $76.47, for a total transaction of $1,259,843.25. Following the transaction, the vice president now directly owns 157,455 shares of the company's stock, valued at $12,040,583.85. This represents a 9.47 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.14% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of analysts have weighed in on the stock. Evercore ISI boosted their target price on shares of Bank of New York Mellon from $66.00 to $77.00 and gave the stock an "in-line" rating in a research note on Monday, October 14th. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $79.00 target price on shares of Bank of New York Mellon in a research note on Monday, October 14th. Wells Fargo & Company boosted their target price on shares of Bank of New York Mellon from $79.00 to $81.00 and gave the stock an "equal weight" rating in a research note on Friday. Deutsche Bank Aktiengesellschaft boosted their target price on shares of Bank of New York Mellon from $82.00 to $85.00 and gave the stock a "buy" rating in a research note on Monday, November 11th. Finally, UBS Group boosted their target price on shares of Bank of New York Mellon from $73.00 to $82.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Five analysts have rated the stock with a hold rating and nine have given a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $77.23.

View Our Latest Research Report on BK

Bank of New York Mellon Stock Down 1.3 %

Shares of NYSE:BK traded down $1.05 during midday trading on Tuesday, hitting $77.60. 2,168,312 shares of the company's stock were exchanged, compared to its average volume of 3,856,105. The company has a debt-to-equity ratio of 0.89, a current ratio of 0.70 and a quick ratio of 0.70. The stock has a 50 day moving average price of $74.21 and a 200-day moving average price of $66.17. The company has a market cap of $56.42 billion, a PE ratio of 16.95, a price-to-earnings-growth ratio of 0.89 and a beta of 1.07. The Bank of New York Mellon Co. has a 12 month low of $46.71 and a 12 month high of $80.29.

Bank of New York Mellon (NYSE:BK - Get Free Report) last posted its earnings results on Friday, October 11th. The bank reported $1.52 EPS for the quarter, topping the consensus estimate of $1.41 by $0.11. The company had revenue of $4.65 billion during the quarter, compared to the consensus estimate of $4.52 billion. Bank of New York Mellon had a net margin of 9.44% and a return on equity of 12.06%. On average, sell-side analysts anticipate that The Bank of New York Mellon Co. will post 5.82 EPS for the current fiscal year.

Bank of New York Mellon Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Monday, October 21st were given a dividend of $0.47 per share. This represents a $1.88 annualized dividend and a dividend yield of 2.42%. The ex-dividend date of this dividend was Monday, October 21st. Bank of New York Mellon's payout ratio is presently 40.87%.

About Bank of New York Mellon

(

Free Report)

The Bank of New York Mellon Corporation provides a range of financial products and services in the United States and internationally. The company operates through Securities Services, Market and Wealth Services, Investment and Wealth Management, and other segments. The Securities Services segment offers custody, trust and depositary, accounting, exchange-traded funds, middle-office solutions, transfer agency, services for private equity and real estate funds, foreign exchange, securities lending, liquidity/lending services, and data analytics.

Read More

Before you consider Bank of New York Mellon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of New York Mellon wasn't on the list.

While Bank of New York Mellon currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.