Kerrisdale Advisers LLC lifted its position in shares of The Boeing Company (NYSE:BA - Free Report) by 16.0% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 14,855 shares of the aircraft producer's stock after acquiring an additional 2,050 shares during the quarter. Boeing accounts for approximately 0.9% of Kerrisdale Advisers LLC's portfolio, making the stock its 27th largest holding. Kerrisdale Advisers LLC's holdings in Boeing were worth $2,629,000 at the end of the most recent quarter.

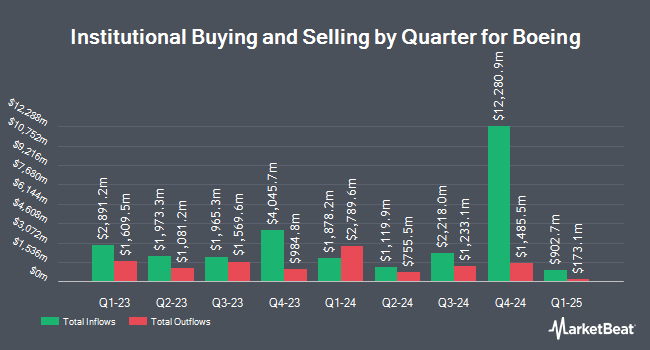

Other large investors have also recently added to or reduced their stakes in the company. Keynote Financial Services LLC grew its holdings in shares of Boeing by 3.8% in the 4th quarter. Keynote Financial Services LLC now owns 1,542 shares of the aircraft producer's stock worth $273,000 after acquiring an additional 57 shares during the last quarter. Chaney Capital Management Inc. increased its stake in Boeing by 2.1% in the 4th quarter. Chaney Capital Management Inc. now owns 2,870 shares of the aircraft producer's stock worth $508,000 after purchasing an additional 58 shares in the last quarter. Farmers & Merchants Investments Inc. raised its holdings in Boeing by 0.6% during the 4th quarter. Farmers & Merchants Investments Inc. now owns 10,608 shares of the aircraft producer's stock worth $1,878,000 after buying an additional 59 shares during the period. Center for Financial Planning Inc. lifted its stake in Boeing by 12.0% during the fourth quarter. Center for Financial Planning Inc. now owns 562 shares of the aircraft producer's stock valued at $99,000 after buying an additional 60 shares in the last quarter. Finally, Trek Financial LLC boosted its holdings in shares of Boeing by 2.7% in the fourth quarter. Trek Financial LLC now owns 2,307 shares of the aircraft producer's stock worth $408,000 after buying an additional 60 shares during the period. 64.82% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Boeing

In other news, EVP Uma M. Amuluru sold 3,159 shares of the company's stock in a transaction dated Thursday, February 20th. The shares were sold at an average price of $180.69, for a total transaction of $570,799.71. Following the completion of the transaction, the executive vice president now owns 19,213 shares of the company's stock, valued at approximately $3,471,596.97. This represents a 14.12 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 0.09% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have weighed in on BA shares. Royal Bank of Canada reaffirmed an "outperform" rating on shares of Boeing in a research note on Wednesday. UBS Group boosted their price objective on shares of Boeing from $208.00 to $217.00 and gave the company a "buy" rating in a research report on Wednesday, January 29th. Deutsche Bank Aktiengesellschaft increased their target price on shares of Boeing from $184.00 to $215.00 and gave the stock a "buy" rating in a research report on Thursday, January 2nd. Melius upgraded shares of Boeing from a "hold" rating to a "buy" rating in a report on Monday, March 24th. Finally, StockNews.com upgraded Boeing to a "sell" rating in a report on Saturday, April 5th. Two investment analysts have rated the stock with a sell rating, six have assigned a hold rating, fourteen have given a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, Boeing currently has a consensus rating of "Moderate Buy" and a consensus price target of $197.11.

Check Out Our Latest Research Report on Boeing

Boeing Stock Up 6.1 %

Shares of BA stock opened at $172.47 on Thursday. The Boeing Company has a 12 month low of $128.88 and a 12 month high of $196.95. The company has a market cap of $129.37 billion, a PE ratio of -9.41 and a beta of 1.24. The business's 50 day moving average is $165.18 and its two-hundred day moving average is $164.29.

Boeing (NYSE:BA - Get Free Report) last posted its quarterly earnings data on Wednesday, April 23rd. The aircraft producer reported ($0.49) EPS for the quarter, topping analysts' consensus estimates of ($1.39) by $0.90. The business had revenue of $19.50 billion during the quarter, compared to the consensus estimate of $19.57 billion. As a group, equities analysts expect that The Boeing Company will post -2.58 EPS for the current fiscal year.

Boeing Company Profile

(

Free Report)

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.