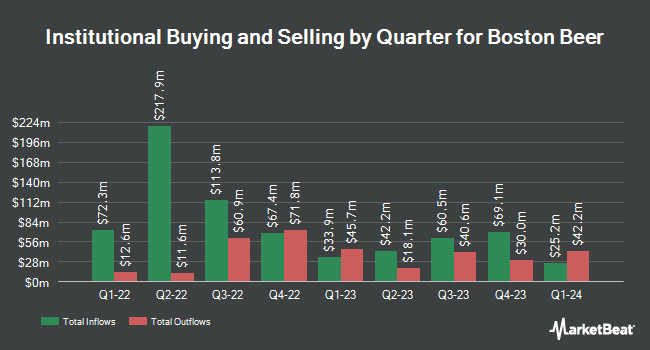

Charles Schwab Investment Management Inc. trimmed its position in shares of The Boston Beer Company, Inc. (NYSE:SAM - Free Report) by 19.3% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 89,681 shares of the company's stock after selling 21,512 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.78% of Boston Beer worth $25,930,000 at the end of the most recent quarter.

Several other large investors have also recently added to or reduced their stakes in SAM. First Horizon Advisors Inc. lifted its holdings in shares of Boston Beer by 105.1% in the 3rd quarter. First Horizon Advisors Inc. now owns 121 shares of the company's stock valued at $35,000 after buying an additional 62 shares during the period. Covestor Ltd grew its stake in shares of Boston Beer by 36.6% during the 3rd quarter. Covestor Ltd now owns 127 shares of the company's stock worth $37,000 after purchasing an additional 34 shares during the period. ORG Partners LLC acquired a new stake in shares of Boston Beer in the second quarter valued at about $48,000. Sachetta LLC boosted its holdings in Boston Beer by 1,533.3% during the second quarter. Sachetta LLC now owns 245 shares of the company's stock worth $68,000 after buying an additional 230 shares in the last quarter. Finally, DekaBank Deutsche Girozentrale grew its position in Boston Beer by 61.3% during the second quarter. DekaBank Deutsche Girozentrale now owns 250 shares of the company's stock worth $75,000 after buying an additional 95 shares during the period. 81.13% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts have recently issued reports on SAM shares. UBS Group lifted their price target on shares of Boston Beer from $300.00 to $309.00 in a research report on Thursday, October 24th. Roth Mkm reiterated a "buy" rating and set a $389.00 target price on shares of Boston Beer in a research report on Wednesday, October 23rd. Royal Bank of Canada restated a "sector perform" rating and issued a $318.00 price target on shares of Boston Beer in a research report on Friday, October 25th. Piper Sandler increased their price objective on shares of Boston Beer from $325.00 to $330.00 and gave the company an "overweight" rating in a research note on Friday, October 25th. Finally, Jefferies Financial Group downgraded shares of Boston Beer from a "buy" rating to a "hold" rating and reduced their price target for the company from $355.00 to $325.00 in a report on Friday, October 25th. One investment analyst has rated the stock with a sell rating, nine have given a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat, Boston Beer presently has a consensus rating of "Hold" and a consensus target price of $314.82.

Get Our Latest Analysis on SAM

Boston Beer Trading Up 0.3 %

Shares of Boston Beer stock traded up $0.94 during trading hours on Thursday, reaching $316.09. 105,381 shares of the company's stock were exchanged, compared to its average volume of 154,130. The firm has a market capitalization of $3.63 billion, a price-to-earnings ratio of 46.28, a price-to-earnings-growth ratio of 1.20 and a beta of 1.07. The Boston Beer Company, Inc. has a 52-week low of $254.40 and a 52-week high of $371.65. The company has a fifty day moving average of $298.71 and a 200-day moving average of $287.41.

Boston Beer Company Profile

(

Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

Featured Stories

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.