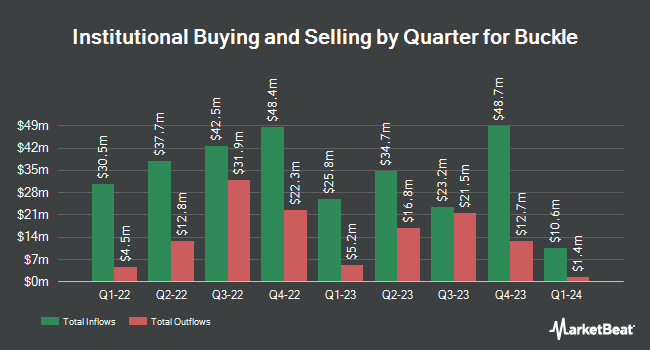

BNP Paribas Financial Markets lowered its position in The Buckle, Inc. (NYSE:BKE - Free Report) by 19.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 88,255 shares of the company's stock after selling 21,099 shares during the period. BNP Paribas Financial Markets owned about 0.17% of Buckle worth $3,881,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors also recently added to or reduced their stakes in BKE. Blue Trust Inc. increased its holdings in shares of Buckle by 52.0% in the 3rd quarter. Blue Trust Inc. now owns 789 shares of the company's stock valued at $35,000 after purchasing an additional 270 shares in the last quarter. Quest Partners LLC acquired a new stake in shares of Buckle during the 3rd quarter valued at approximately $86,000. CWM LLC lifted its position in shares of Buckle by 119.9% during the 2nd quarter. CWM LLC now owns 2,010 shares of the company's stock valued at $74,000 after acquiring an additional 1,096 shares during the period. Signaturefd LLC boosted its stake in shares of Buckle by 38.7% during the 3rd quarter. Signaturefd LLC now owns 2,236 shares of the company's stock worth $98,000 after acquiring an additional 624 shares in the last quarter. Finally, Gladius Capital Management LP grew its holdings in shares of Buckle by 217.4% in the 2nd quarter. Gladius Capital Management LP now owns 2,955 shares of the company's stock worth $109,000 after acquiring an additional 2,024 shares during the period. Hedge funds and other institutional investors own 53.93% of the company's stock.

Buckle Stock Down 2.3 %

Shares of Buckle stock traded down $1.25 during trading on Thursday, hitting $52.54. 506,143 shares of the company were exchanged, compared to its average volume of 404,487. The Buckle, Inc. has a fifty-two week low of $34.87 and a fifty-two week high of $54.25. The firm has a 50 day moving average price of $45.56 and a 200 day moving average price of $41.67. The stock has a market capitalization of $2.67 billion, a price-to-earnings ratio of 13.65 and a beta of 1.14.

Buckle (NYSE:BKE - Get Free Report) last released its quarterly earnings results on Friday, November 22nd. The company reported $0.88 earnings per share for the quarter, missing the consensus estimate of $0.89 by ($0.01). Buckle had a return on equity of 44.11% and a net margin of 16.21%. The company had revenue of $293.60 million for the quarter, compared to analysts' expectations of $293.60 million. During the same period in the previous year, the business posted $1.04 EPS. The business's quarterly revenue was down 3.3% on a year-over-year basis.

Buckle Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, October 25th. Shareholders of record on Friday, October 11th were issued a $0.35 dividend. The ex-dividend date of this dividend was Friday, October 11th. This represents a $1.40 dividend on an annualized basis and a yield of 2.66%. Buckle's dividend payout ratio (DPR) is 35.53%.

Insiders Place Their Bets

In related news, SVP Brett P. Milkie sold 16,000 shares of the stock in a transaction dated Friday, September 6th. The stock was sold at an average price of $41.35, for a total transaction of $661,600.00. Following the transaction, the senior vice president now directly owns 80,170 shares in the company, valued at approximately $3,315,029.50. This represents a 16.64 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director Karen B. Rhoads sold 9,500 shares of the firm's stock in a transaction dated Tuesday, November 26th. The stock was sold at an average price of $51.63, for a total value of $490,485.00. Following the completion of the sale, the director now directly owns 214,089 shares in the company, valued at approximately $11,053,415.07. The trade was a 4.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 148,218 shares of company stock valued at $6,611,809 in the last ninety days. Insiders own 39.80% of the company's stock.

Wall Street Analyst Weigh In

BKE has been the topic of a number of research analyst reports. UBS Group upgraded Buckle from a "sell" rating to a "neutral" rating and boosted their target price for the stock from $31.00 to $46.00 in a research report on Tuesday, November 12th. StockNews.com upgraded shares of Buckle from a "hold" rating to a "buy" rating in a research report on Monday, November 18th.

Get Our Latest Stock Report on BKE

About Buckle

(

Free Report)

The Buckle, Inc operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States. It markets a selection of brand name casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories, and footwear, as well as private label merchandise primarily comprising BKE, Buckle Black, Salvage, Red by BKE, Daytrip, Gimmicks, Gilded Intent, FITZ + EDDI, Willow & Root, Outpost Makers, Departwest, Sterling & Stitch, Reclaim, BKE Vintage, Nova Industries, J.B.

Featured Articles

Before you consider Buckle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Buckle wasn't on the list.

While Buckle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.