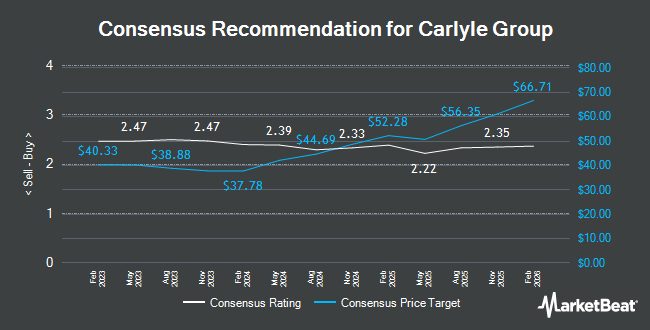

The Carlyle Group (NASDAQ:CG - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "hold" rating to a "sell" rating in a research report issued on Friday.

Several other equities analysts also recently commented on CG. UBS Group upped their price target on shares of The Carlyle Group from $43.00 to $54.00 and gave the company a "neutral" rating in a research note on Tuesday, October 22nd. Evercore ISI lifted their price target on shares of The Carlyle Group from $45.00 to $47.00 and gave the company an "in-line" rating in a research report on Monday, October 14th. JMP Securities restated a "market outperform" rating and issued a $60.00 price target on shares of The Carlyle Group in a research report on Wednesday, October 9th. Morgan Stanley upped their price objective on shares of The Carlyle Group from $46.00 to $50.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 10th. Finally, Deutsche Bank Aktiengesellschaft dropped their target price on shares of The Carlyle Group from $55.00 to $53.00 and set a "buy" rating for the company in a research report on Thursday, August 15th. One investment analyst has rated the stock with a sell rating, nine have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $53.33.

View Our Latest Report on The Carlyle Group

The Carlyle Group Stock Performance

NASDAQ CG traded up $0.86 on Friday, hitting $53.65. 2,523,834 shares of the stock were exchanged, compared to its average volume of 2,355,727. The business's fifty day moving average is $48.30 and its 200 day moving average is $44.00. The Carlyle Group has a 52 week low of $32.09 and a 52 week high of $54.52. The company has a market capitalization of $19.19 billion, a PE ratio of 185.00, a P/E/G ratio of 1.35 and a beta of 1.70. The company has a debt-to-equity ratio of 1.38, a current ratio of 2.32 and a quick ratio of 2.32.

The Carlyle Group (NASDAQ:CG - Get Free Report) last issued its earnings results on Wednesday, November 6th. The financial services provider reported $0.95 EPS for the quarter, topping the consensus estimate of $0.87 by $0.08. The Carlyle Group had a return on equity of 24.91% and a net margin of 2.21%. The company had revenue of $895.00 million during the quarter, compared to the consensus estimate of $908.17 million. During the same period in the previous year, the company posted $0.87 EPS. The firm's revenue for the quarter was up 15.2% compared to the same quarter last year. Research analysts anticipate that The Carlyle Group will post 3.77 EPS for the current fiscal year.

Insiders Place Their Bets

In other The Carlyle Group news, major shareholder Carlyle Group Inc. sold 133,643 shares of the firm's stock in a transaction on Monday, October 7th. The stock was sold at an average price of $2.51, for a total value of $335,443.93. Following the completion of the sale, the insider now directly owns 4,767,697 shares of the company's stock, valued at $11,966,919.47. This trade represents a 2.73 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Daniel A. D'aniello sold 495,542 shares of the company's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $51.53, for a total value of $25,535,279.26. Following the transaction, the director now directly owns 32,504,102 shares in the company, valued at $1,674,936,376.06. This represents a 1.50 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 2,171,556 shares of company stock valued at $29,222,475 in the last 90 days. 27.20% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On The Carlyle Group

Hedge funds have recently made changes to their positions in the stock. Westbourne Investment Advisors Inc. raised its holdings in shares of The Carlyle Group by 3.6% in the 3rd quarter. Westbourne Investment Advisors Inc. now owns 5,700 shares of the financial services provider's stock valued at $245,000 after acquiring an additional 200 shares in the last quarter. Bleakley Financial Group LLC raised its stake in The Carlyle Group by 0.5% in the third quarter. Bleakley Financial Group LLC now owns 41,742 shares of the financial services provider's stock valued at $1,797,000 after purchasing an additional 208 shares in the last quarter. Tobam grew its stake in The Carlyle Group by 32.8% in the 3rd quarter. Tobam now owns 890 shares of the financial services provider's stock worth $38,000 after buying an additional 220 shares in the last quarter. Western Pacific Wealth Management LP raised its position in shares of The Carlyle Group by 14.7% during the 1st quarter. Western Pacific Wealth Management LP now owns 2,447 shares of the financial services provider's stock valued at $115,000 after buying an additional 313 shares in the last quarter. Finally, Mercer Global Advisors Inc. ADV grew its position in The Carlyle Group by 0.5% in the second quarter. Mercer Global Advisors Inc. ADV now owns 61,684 shares of the financial services provider's stock worth $2,484,000 after acquiring an additional 318 shares in the last quarter. 55.88% of the stock is currently owned by hedge funds and other institutional investors.

The Carlyle Group Company Profile

(

Get Free Report)

The Carlyle Group Inc is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider The Carlyle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Carlyle Group wasn't on the list.

While The Carlyle Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.