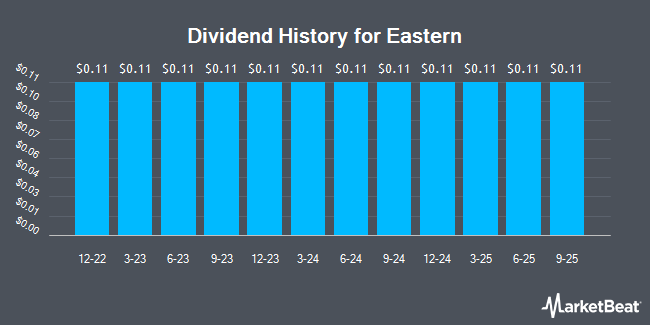

The Eastern Company (NASDAQ:EML - Get Free Report) announced a quarterly dividend on Monday, February 3rd,Wall Street Journal reports. Stockholders of record on Friday, February 14th will be paid a dividend of 0.11 per share by the industrial products company on Friday, March 14th. This represents a $0.44 dividend on an annualized basis and a dividend yield of 1.67%. The ex-dividend date of this dividend is Friday, February 14th.

Eastern Trading Down 3.6 %

Eastern stock traded down $0.99 during mid-day trading on Friday, hitting $26.31. The company's stock had a trading volume of 5,558 shares, compared to its average volume of 9,373. The business has a 50 day moving average price of $27.69 and a 200-day moving average price of $29.28. The company has a debt-to-equity ratio of 0.37, a current ratio of 2.64 and a quick ratio of 1.42. Eastern has a 12 month low of $22.63 and a 12 month high of $35.78. The stock has a market cap of $162.60 million, a price-to-earnings ratio of -25.54 and a beta of 0.98.

Eastern (NASDAQ:EML - Get Free Report) last issued its earnings results on Tuesday, November 5th. The industrial products company reported $0.75 earnings per share for the quarter. The company had revenue of $71.27 million during the quarter. Eastern had a positive return on equity of 10.44% and a negative net margin of 2.26%.

Analysts Set New Price Targets

Separately, StockNews.com cut shares of Eastern from a "strong-buy" rating to a "buy" rating in a research report on Saturday.

Get Our Latest Research Report on Eastern

Eastern Company Profile

(

Get Free Report)

The Eastern Company designs, manufactures, and sells engineered solutions to industrial markets in the United States and internationally. The company offers turnkey returnable packaging solutions, which are used in the assembly processes of vehicles, aircraft, and durable goods, as well as in production processes of plastic packaging products, packaged consumer goods, and pharmaceuticals; designs and manufactures blow mold tools and injection blow mold tooling products, and 2-step stretch blow molds and related components for the stretch blow molding industry; and supplies blow molds and change parts to the food, beverage, healthcare, and chemical industries.

Featured Articles

Before you consider Eastern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eastern wasn't on the list.

While Eastern currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.