Neo Ivy Capital Management grew its position in shares of The Estée Lauder Companies Inc. (NYSE:EL - Free Report) by 767.1% in the third quarter, according to its most recent filing with the SEC. The fund owned 10,474 shares of the company's stock after acquiring an additional 9,266 shares during the quarter. Neo Ivy Capital Management's holdings in Estée Lauder Companies were worth $1,044,000 at the end of the most recent reporting period.

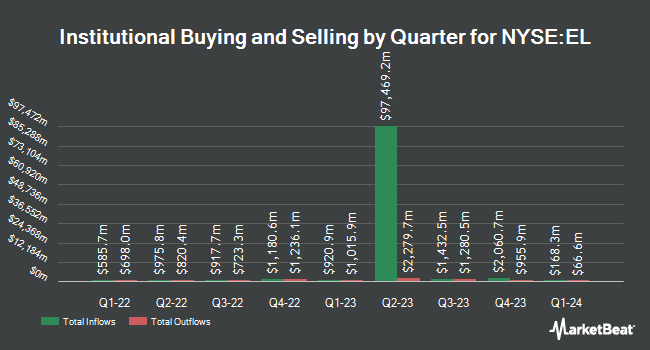

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. State Street Corp lifted its stake in shares of Estée Lauder Companies by 9.5% in the 3rd quarter. State Street Corp now owns 10,575,926 shares of the company's stock valued at $1,054,314,000 after purchasing an additional 913,470 shares during the last quarter. Massachusetts Financial Services Co. MA raised its holdings in Estée Lauder Companies by 79.4% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 5,723,746 shares of the company's stock valued at $570,600,000 after buying an additional 2,533,006 shares during the period. Geode Capital Management LLC lifted its position in Estée Lauder Companies by 1.5% in the third quarter. Geode Capital Management LLC now owns 4,679,154 shares of the company's stock worth $464,587,000 after buying an additional 70,307 shares during the last quarter. Van ECK Associates Corp boosted its stake in Estée Lauder Companies by 36.4% during the third quarter. Van ECK Associates Corp now owns 4,041,911 shares of the company's stock worth $402,938,000 after buying an additional 1,078,926 shares during the period. Finally, Independent Franchise Partners LLP increased its position in Estée Lauder Companies by 44.4% during the second quarter. Independent Franchise Partners LLP now owns 3,466,048 shares of the company's stock valued at $368,788,000 after acquiring an additional 1,066,320 shares during the last quarter. 55.15% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on the stock. Stifel Nicolaus lowered shares of Estée Lauder Companies from a "buy" rating to a "hold" rating and set a $125.00 target price for the company. in a report on Thursday, October 31st. UBS Group decreased their price objective on shares of Estée Lauder Companies from $115.00 to $104.00 and set a "neutral" rating for the company in a research note on Tuesday, August 20th. Evercore ISI cut their target price on Estée Lauder Companies from $180.00 to $130.00 and set an "outperform" rating on the stock in a research note on Tuesday, August 20th. Royal Bank of Canada decreased their price target on Estée Lauder Companies from $131.00 to $100.00 and set an "outperform" rating for the company in a research note on Friday, November 1st. Finally, Bank of America cut their price objective on Estée Lauder Companies from $100.00 to $75.00 and set a "neutral" rating on the stock in a research report on Friday, November 1st. Nineteen investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $98.57.

Read Our Latest Stock Report on EL

Estée Lauder Companies Stock Down 0.3 %

Shares of NYSE:EL traded down $0.21 during trading on Thursday, reaching $81.01. The stock had a trading volume of 3,392,524 shares, compared to its average volume of 3,583,491. The firm's 50-day simple moving average is $78.85 and its 200 day simple moving average is $93.26. The company has a current ratio of 1.32, a quick ratio of 0.90 and a debt-to-equity ratio of 1.44. The Estée Lauder Companies Inc. has a one year low of $62.29 and a one year high of $159.75. The company has a market capitalization of $29.08 billion, a P/E ratio of 145.04, a PEG ratio of 5.14 and a beta of 1.05.

Estée Lauder Companies (NYSE:EL - Get Free Report) last announced its earnings results on Thursday, October 31st. The company reported $0.14 earnings per share for the quarter, topping the consensus estimate of $0.09 by $0.05. Estée Lauder Companies had a return on equity of 17.31% and a net margin of 1.31%. The firm had revenue of $3.36 billion for the quarter, compared to the consensus estimate of $3.37 billion. During the same period in the previous year, the business earned $0.11 EPS. The firm's revenue for the quarter was down 4.5% on a year-over-year basis. As a group, research analysts expect that The Estée Lauder Companies Inc. will post 1.48 EPS for the current fiscal year.

Estée Lauder Companies Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be paid a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a yield of 1.73%. The ex-dividend date is Friday, November 29th. Estée Lauder Companies's dividend payout ratio (DPR) is presently 250.00%.

Insiders Place Their Bets

In other news, CEO Fabrizio Freda sold 10,969 shares of the company's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $67.76, for a total value of $743,259.44. Following the sale, the chief executive officer now directly owns 295,838 shares of the company's stock, valued at $20,045,982.88. This represents a 3.58 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Paul J. Fribourg bought 75,500 shares of Estée Lauder Companies stock in a transaction that occurred on Monday, November 18th. The shares were acquired at an average cost of $64.93 per share, with a total value of $4,902,215.00. Following the acquisition, the director now owns 310,000 shares of the company's stock, valued at $20,128,300. The trade was a 32.20 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 12.78% of the stock is owned by insiders.

Estée Lauder Companies Profile

(

Free Report)

The Estée Lauder Companies Inc manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers skin care products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products; and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, and powders, as well as compacts, brushes, and other makeup tools.

Featured Articles

Before you consider Estée Lauder Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Estée Lauder Companies wasn't on the list.

While Estée Lauder Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report