RBF Capital LLC raised its position in The GEO Group, Inc. (NYSE:GEO - Free Report) by 50.0% during the third quarter, according to its most recent 13F filing with the SEC. The fund owned 60,000 shares of the real estate investment trust's stock after buying an additional 20,000 shares during the period. RBF Capital LLC's holdings in The GEO Group were worth $771,000 as of its most recent filing with the SEC.

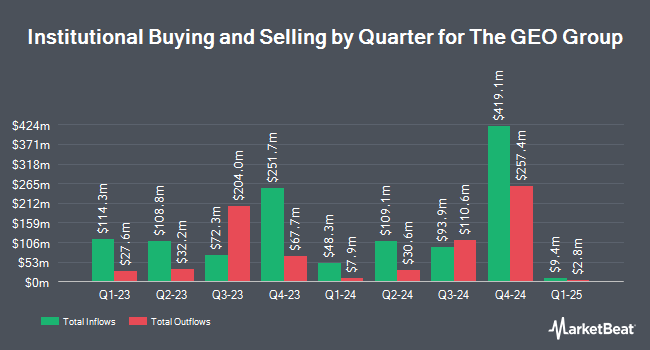

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Wedge Capital Management L L P NC increased its stake in shares of The GEO Group by 9.2% in the 2nd quarter. Wedge Capital Management L L P NC now owns 110,914 shares of the real estate investment trust's stock valued at $1,593,000 after acquiring an additional 9,313 shares during the last quarter. Nisa Investment Advisors LLC raised its holdings in shares of The GEO Group by 131.8% during the second quarter. Nisa Investment Advisors LLC now owns 1,037,881 shares of the real estate investment trust's stock worth $14,904,000 after acquiring an additional 590,099 shares during the period. SummerHaven Investment Management LLC lifted its position in The GEO Group by 1.1% in the 2nd quarter. SummerHaven Investment Management LLC now owns 100,735 shares of the real estate investment trust's stock valued at $1,447,000 after acquiring an additional 1,098 shares in the last quarter. Louisiana State Employees Retirement System boosted its stake in The GEO Group by 10.9% in the 2nd quarter. Louisiana State Employees Retirement System now owns 67,100 shares of the real estate investment trust's stock worth $964,000 after purchasing an additional 6,600 shares during the period. Finally, Bank of New York Mellon Corp grew its holdings in shares of The GEO Group by 4.6% during the second quarter. Bank of New York Mellon Corp now owns 1,114,771 shares of the real estate investment trust's stock worth $16,008,000 after buying an additional 49,134 shares in the last quarter. 76.10% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

GEO has been the subject of several recent research reports. Northland Securities increased their target price on shares of The GEO Group from $16.00 to $37.00 and gave the stock an "outperform" rating in a report on Friday, November 8th. Wedbush increased their price objective on shares of The GEO Group from $25.00 to $30.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th. StockNews.com downgraded The GEO Group from a "buy" rating to a "hold" rating in a research report on Wednesday, August 7th. Finally, Noble Financial cut The GEO Group from an "outperform" rating to a "market perform" rating in a research report on Monday, November 11th.

Get Our Latest Stock Report on GEO

The GEO Group Stock Performance

Shares of The GEO Group stock traded down $0.25 during trading on Thursday, hitting $28.95. 1,381,172 shares of the stock were exchanged, compared to its average volume of 2,718,480. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 1.25. The company has a fifty day moving average price of $19.70 and a 200-day moving average price of $15.92. The stock has a market capitalization of $4.05 billion, a price-to-earnings ratio of 99.52, a price-to-earnings-growth ratio of 3.26 and a beta of 0.88. The GEO Group, Inc. has a 1-year low of $9.85 and a 1-year high of $29.86.

The GEO Group Profile

(

Free Report)

The GEO Group, Inc NYSE: GEO engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities in the United States, Australia, the United Kingdom, and South Africa. The company also provides secure facility management services, including the provision of security, administrative, rehabilitation, education, and food services; reentry services, such as temporary housing, programming, employment assistance, and other services; electronic monitoring and supervision services; and transportation services; as well as designs, constructs, and finances new facilities through projects.

Recommended Stories

Before you consider The GEO Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The GEO Group wasn't on the list.

While The GEO Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.