Luminar Technologies (NASDAQ:LAZR - Free Report) had its price target reduced by The Goldman Sachs Group from $0.75 to $0.50 in a research note released on Thursday,Benzinga reports. They currently have a sell rating on the stock.

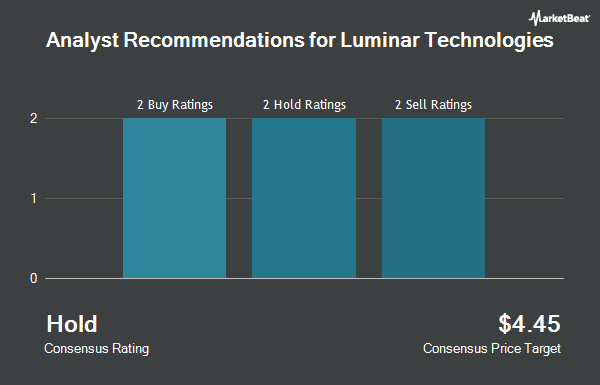

Several other research firms have also recently commented on LAZR. Citigroup reduced their price target on Luminar Technologies from $9.00 to $6.00 and set a "buy" rating for the company in a report on Friday, August 16th. Craig Hallum decreased their target price on shares of Luminar Technologies from $1.50 to $1.00 and set a "hold" rating on the stock in a research report on Tuesday. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating and set a $1.00 price target on shares of Luminar Technologies in a research note on Tuesday, September 10th. JPMorgan Chase & Co. lowered their price target on shares of Luminar Technologies from $8.00 to $6.00 and set an "overweight" rating on the stock in a research note on Monday, August 19th. Finally, Westpark Capital reaffirmed a "buy" rating and set a $9.00 price target on shares of Luminar Technologies in a research note on Tuesday, August 6th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $3.34.

Get Our Latest Report on Luminar Technologies

Luminar Technologies Price Performance

Shares of NASDAQ:LAZR traded down $0.02 during trading on Thursday, hitting $1.03. 12,094,040 shares of the company were exchanged, compared to its average volume of 15,403,785. The stock has a market capitalization of $508.57 million, a P/E ratio of -1.16 and a beta of 1.61. Luminar Technologies has a 12-month low of $0.73 and a 12-month high of $3.69. The firm's 50 day moving average price is $0.86 and its 200-day moving average price is $1.25.

Luminar Technologies (NASDAQ:LAZR - Get Free Report) last released its quarterly earnings results on Monday, November 11th. The company reported ($0.16) EPS for the quarter, beating the consensus estimate of ($0.22) by $0.06. The business had revenue of $15.49 million during the quarter, compared to analysts' expectations of $17.70 million. During the same quarter last year, the company earned ($0.33) EPS. The firm's revenue for the quarter was down 8.6% compared to the same quarter last year. As a group, equities research analysts anticipate that Luminar Technologies will post -0.97 EPS for the current year.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the stock. Vanguard Group Inc. boosted its holdings in Luminar Technologies by 5.1% in the first quarter. Vanguard Group Inc. now owns 27,024,843 shares of the company's stock worth $53,239,000 after purchasing an additional 1,319,480 shares during the period. Price T Rowe Associates Inc. MD boosted its holdings in Luminar Technologies by 30.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 149,030 shares of the company's stock worth $294,000 after purchasing an additional 34,566 shares during the period. Virtu Financial LLC acquired a new position in Luminar Technologies in the first quarter worth $163,000. American International Group Inc. boosted its holdings in Luminar Technologies by 6.0% in the first quarter. American International Group Inc. now owns 143,517 shares of the company's stock worth $283,000 after purchasing an additional 8,089 shares during the period. Finally, Headlands Technologies LLC bought a new stake in Luminar Technologies in the second quarter valued at $55,000. 30.99% of the stock is currently owned by hedge funds and other institutional investors.

About Luminar Technologies

(

Get Free Report)

Luminar Technologies, Inc, an automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East. It operates in two segments, Autonomy Solutions and Advanced Technologies and Services. The Autonomy Solutions segment designs, manufactures, and sells laser imaging, detection, and ranging sensors or lidars, as well as related perception and autonomy software solutions primarily for original equipment manufacturers in the automobile, commercial vehicle, robo-taxi, and adjacent industries.

Featured Articles

Before you consider Luminar Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Luminar Technologies wasn't on the list.

While Luminar Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.