Live Nation Entertainment (NYSE:LYV - Free Report) had its price objective hoisted by The Goldman Sachs Group from $148.00 to $166.00 in a report issued on Thursday morning,Benzinga reports. They currently have a buy rating on the stock.

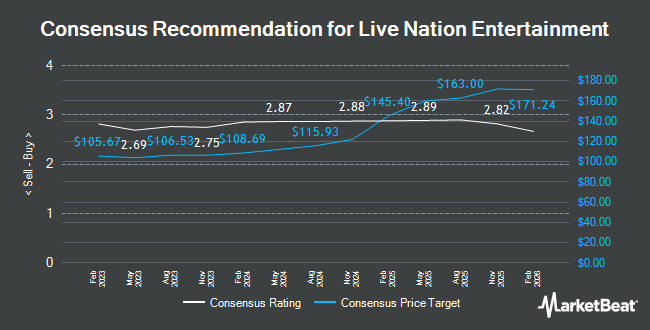

Several other analysts have also issued reports on LYV. JPMorgan Chase & Co. boosted their price objective on shares of Live Nation Entertainment from $137.00 to $150.00 and gave the company an "overweight" rating in a report on Thursday, December 12th. Deutsche Bank Aktiengesellschaft boosted their price objective on Live Nation Entertainment from $130.00 to $150.00 and gave the stock a "buy" rating in a research report on Tuesday, November 19th. Guggenheim boosted their price objective on Live Nation Entertainment from $146.00 to $155.00 and gave the stock a "buy" rating in a research report on Wednesday, December 4th. Evercore ISI upped their price target on Live Nation Entertainment from $110.00 to $150.00 and gave the company an "outperform" rating in a report on Tuesday, November 12th. Finally, Citigroup upped their price target on Live Nation Entertainment from $130.00 to $163.00 and gave the company a "buy" rating in a report on Wednesday, November 20th. Two investment analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $146.60.

View Our Latest Analysis on LYV

Live Nation Entertainment Trading Up 0.8 %

LYV traded up $1.22 on Thursday, hitting $153.80. The company had a trading volume of 1,461,285 shares, compared to its average volume of 1,732,927. The firm has a market cap of $35.73 billion, a P/E ratio of 163.61, a PEG ratio of 1.73 and a beta of 1.38. Live Nation Entertainment has a 1 year low of $86.81 and a 1 year high of $153.94. The company's fifty day moving average price is $137.45 and its 200 day moving average price is $120.56. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 6.10.

Institutional Investors Weigh In On Live Nation Entertainment

Large investors have recently modified their holdings of the stock. Measured Risk Portfolios Inc. purchased a new position in Live Nation Entertainment in the fourth quarter worth $29,000. Brooklyn Investment Group purchased a new position in Live Nation Entertainment in the third quarter worth $31,000. World Investment Advisors LLC purchased a new position in Live Nation Entertainment in the third quarter worth $38,000. Murphy & Mullick Capital Management Corp purchased a new position in Live Nation Entertainment in the fourth quarter worth $40,000. Finally, Reston Wealth Management LLC purchased a new position in Live Nation Entertainment in the third quarter worth $41,000. Hedge funds and other institutional investors own 74.52% of the company's stock.

About Live Nation Entertainment

(

Get Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

Recommended Stories

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.