ON (NYSE:ONON - Get Free Report) had its price target increased by The Goldman Sachs Group from $50.00 to $57.00 in a research report issued on Wednesday,Benzinga reports. The firm currently has a "buy" rating on the stock. The Goldman Sachs Group's price objective would suggest a potential upside of 6.66% from the stock's previous close.

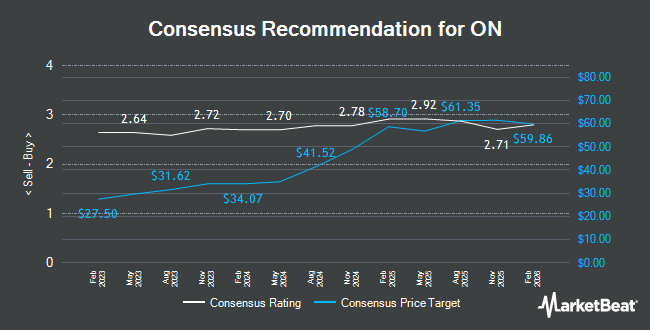

ONON has been the topic of several other reports. Stifel Nicolaus raised their price objective on ON from $45.00 to $59.00 and gave the stock a "buy" rating in a research note on Wednesday, September 18th. Robert W. Baird upped their price objective on ON from $55.00 to $63.00 and gave the company an "outperform" rating in a report on Wednesday. Raymond James started coverage on ON in a research note on Wednesday, July 31st. They set an "outperform" rating and a $46.00 price objective for the company. Truist Financial upped their price target on shares of ON from $51.00 to $58.00 and gave the company a "buy" rating in a research report on Thursday, October 3rd. Finally, HSBC began coverage on ON in a report on Thursday, September 5th. They issued a "hold" rating and a $52.00 target price on the stock. Four research analysts have rated the stock with a hold rating and twenty have issued a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $53.50.

Check Out Our Latest Stock Analysis on ON

ON Price Performance

ON stock traded up $0.82 during mid-day trading on Wednesday, hitting $53.44. 5,265,895 shares of the company were exchanged, compared to its average volume of 4,991,902. The business's 50 day simple moving average is $49.10 and its two-hundred day simple moving average is $42.90. The company has a market capitalization of $33.65 billion, a P/E ratio of 126.07 and a beta of 2.25. ON has a 12-month low of $24.15 and a 12-month high of $56.44.

ON (NYSE:ONON - Get Free Report) last issued its earnings results on Tuesday, August 13th. The company reported $0.10 earnings per share for the quarter, missing the consensus estimate of $0.14 by ($0.04). The firm had revenue of $627.66 million during the quarter, compared to analysts' expectations of $634.43 million. ON had a return on equity of 11.02% and a net margin of 5.87%. Equities research analysts predict that ON will post 0.75 earnings per share for the current year.

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the company. Private Trust Co. NA bought a new position in ON during the third quarter valued at about $26,000. Blue Trust Inc. grew its position in shares of ON by 319.8% during the 3rd quarter. Blue Trust Inc. now owns 529 shares of the company's stock valued at $27,000 after acquiring an additional 403 shares during the period. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA increased its stake in shares of ON by 210.5% during the 3rd quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 590 shares of the company's stock worth $28,000 after purchasing an additional 400 shares during the last quarter. MidAtlantic Capital Management Inc. bought a new stake in shares of ON in the 3rd quarter worth approximately $29,000. Finally, Quarry LP bought a new position in ON during the second quarter valued at $32,000. 33.11% of the stock is owned by institutional investors.

About ON

(

Get Free Report)

On Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

Read More

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.