Fomento Económico Mexicano (NYSE:FMX - Free Report) had its price objective reduced by The Goldman Sachs Group from $109.00 to $97.80 in a research report report published on Tuesday,Benzinga reports. They currently have a buy rating on the stock.

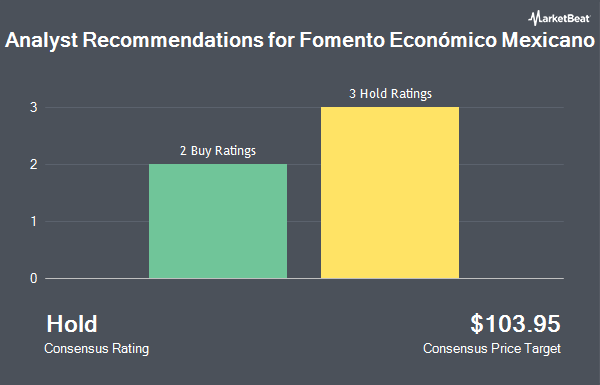

Other analysts also recently issued research reports about the company. Barclays downgraded Fomento Económico Mexicano from an "overweight" rating to an "equal weight" rating in a research note on Tuesday, January 21st. StockNews.com raised Fomento Económico Mexicano from a "hold" rating to a "buy" rating in a research report on Wednesday, November 6th. Three investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $119.20.

Read Our Latest Research Report on FMX

Fomento Económico Mexicano Stock Performance

Shares of FMX stock traded down $1.99 on Tuesday, reaching $85.29. The stock had a trading volume of 273,523 shares, compared to its average volume of 449,447. The company has a debt-to-equity ratio of 0.37, a quick ratio of 1.32 and a current ratio of 1.62. Fomento Económico Mexicano has a 1 year low of $81.07 and a 1 year high of $143.43. The stock has a market cap of $30.52 billion, a P/E ratio of 21.87, a price-to-earnings-growth ratio of 5.00 and a beta of 0.90. The company has a 50 day simple moving average of $86.29 and a 200 day simple moving average of $97.00.

Fomento Económico Mexicano Increases Dividend

The firm also recently disclosed a dividend, which was paid on Friday, January 17th. Investors of record on Friday, January 17th were given a $0.9201 dividend. This is a positive change from Fomento Económico Mexicano's previous dividend of $0.74. The ex-dividend date was Friday, January 17th. Fomento Económico Mexicano's dividend payout ratio is presently 11.79%.

Hedge Funds Weigh In On Fomento Económico Mexicano

Several large investors have recently made changes to their positions in FMX. Brooklyn Investment Group increased its stake in Fomento Económico Mexicano by 82.8% during the fourth quarter. Brooklyn Investment Group now owns 340 shares of the company's stock worth $29,000 after purchasing an additional 154 shares during the period. Banque Cantonale Vaudoise purchased a new position in Fomento Económico Mexicano in the 3rd quarter valued at approximately $55,000. Mather Group LLC. increased its position in shares of Fomento Económico Mexicano by 179.1% during the fourth quarter. Mather Group LLC. now owns 575 shares of the company's stock worth $49,000 after acquiring an additional 369 shares during the period. Exchange Traded Concepts LLC acquired a new stake in shares of Fomento Económico Mexicano in the fourth quarter valued at $51,000. Finally, Rosenberg Matthew Hamilton boosted its holdings in Fomento Económico Mexicano by 30.2% in the fourth quarter. Rosenberg Matthew Hamilton now owns 758 shares of the company's stock valued at $65,000 after purchasing an additional 176 shares during the period. 61.00% of the stock is currently owned by institutional investors and hedge funds.

Fomento Económico Mexicano Company Profile

(

Get Free Report)

Fomento Económico Mexicano, SAB. de C.V., through its subsidiaries, operates as a bottler of Coca-Cola trademark beverages. The company produces, markets, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and Uruguay.

Featured Stories

Before you consider Fomento Económico Mexicano, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fomento Económico Mexicano wasn't on the list.

While Fomento Económico Mexicano currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.