Parsons (NYSE:PSN - Get Free Report) had its target price cut by stock analysts at The Goldman Sachs Group from $109.00 to $98.00 in a research report issued on Tuesday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. The Goldman Sachs Group's price objective would suggest a potential upside of 68.31% from the stock's previous close.

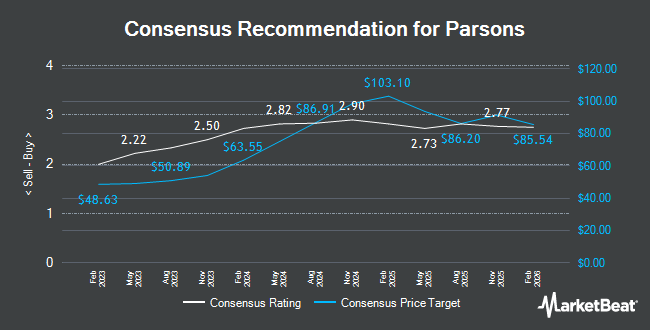

Other equities analysts have also recently issued research reports about the company. William Blair raised Parsons from a "market perform" rating to an "outperform" rating in a research note on Tuesday, February 18th. TD Cowen downgraded shares of Parsons from a "buy" rating to a "hold" rating and set a $105.00 price objective on the stock. in a research report on Friday, February 21st. Truist Financial cut their target price on shares of Parsons from $130.00 to $110.00 and set a "buy" rating for the company in a research report on Friday, November 22nd. Raymond James cut shares of Parsons from an "outperform" rating to a "market perform" rating in a report on Thursday, January 2nd. Finally, Robert W. Baird dropped their price objective on Parsons from $125.00 to $78.00 and set an "outperform" rating on the stock in a report on Thursday, February 20th. Two research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $99.44.

Check Out Our Latest Analysis on Parsons

Parsons Stock Down 1.2 %

Shares of Parsons stock traded down $0.71 during midday trading on Tuesday, hitting $58.23. The company's stock had a trading volume of 1,323,212 shares, compared to its average volume of 1,593,588. Parsons has a 1-year low of $56.87 and a 1-year high of $114.68. The company has a quick ratio of 1.55, a current ratio of 1.29 and a debt-to-equity ratio of 0.31. The firm has a market capitalization of $6.22 billion, a P/E ratio of 76.61, a PEG ratio of 0.93 and a beta of 0.73. The stock has a 50-day simple moving average of $82.21 and a 200-day simple moving average of $94.09.

Institutional Trading of Parsons

Several institutional investors have recently modified their holdings of the company. CIBC Private Wealth Group LLC acquired a new position in shares of Parsons in the fourth quarter valued at $25,000. Aster Capital Management DIFC Ltd bought a new stake in Parsons in the 4th quarter valued at $25,000. ORG Wealth Partners LLC bought a new stake in Parsons in the 4th quarter valued at $26,000. Huntington National Bank raised its stake in shares of Parsons by 28,900.0% in the 4th quarter. Huntington National Bank now owns 290 shares of the company's stock valued at $27,000 after buying an additional 289 shares in the last quarter. Finally, GAMMA Investing LLC lifted its holdings in shares of Parsons by 224.7% during the 4th quarter. GAMMA Investing LLC now owns 315 shares of the company's stock worth $29,000 after acquiring an additional 218 shares during the period. Institutional investors and hedge funds own 98.02% of the company's stock.

Parsons Company Profile

(

Get Free Report)

Parsons Corporation provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally. The company operates through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment provides critical technologies, such as cybersecurity; missile defense; intelligence; space launch and ground systems; space and weapon system resiliency; geospatial intelligence; signals intelligence; environmental remediation; border security, critical infrastructure protection; counter unmanned air systems; biometrics and bio surveillance solutions to U.S.

Featured Articles

Before you consider Parsons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parsons wasn't on the list.

While Parsons currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.